Insurance Sector Update: Insurance Amendment Bill 2025 – On expected by Emkay Global Financial Services Ltd

On Tuesday, 16-Dec-25, the Union Government introduced ‘Sabka Bima Sabki Suraksha (Amendment of Insurance Laws) Bill, 2025’, which aims to overhaul 3 existing laws—the Insurance Act, 1938; the IRDA Act, 1999; and the LIC Act, 1956. The proposed amendments are broadly in line with our expectations, with 4 key changes to the Dec-22 draft not finding place in these amendments which are 1) composite licensing, 2) opening up of Individual Agents to tie up with more than one life, one General, and one health insurer, 3) reduction in capital requirements for Primary insurers, and 4) allowing ancillary-services offering and distribution of financial products. On the draft Insurance Laws (Amendment) Bill, 2022—refer to ‘The Insurance Laws (Amendment) Bill, 2022: Aiming for growth and disruption, by empowering the Regulator’, we had argued that the aforementioned changes are not desirable. The key changes that have found place in the final bill include i) permitting 100% FDI in the insurance sector; ii) the amendment to Section 35, permitting merger of an insurance company with a non-insurance company; iii) insertion of sub-section 2A of Section 40, empowering regulator IRDA to specify the limits of commission, and other matters related to insurance agents or intermediaries; iv) omission of Sections 27A, 27B, 27C, and 27D, empowering the regulator to specify investment-related regulations. Overall, from the perspective of listed insurers, Brand, Distribution, and Cost efficiency remain key to success. With capping commissions finding explicit mention in Section 40, we expect the regulator to bring down commissions and opex, and a likely focus on reducing high upfront commission to move toward the trail commission model.

Plethora of amendments to recast the Insurance Act, 1938 and IRDA Act, 1999

The Union Government introduced the Sabka Bima Sabki Suraksha (Insurance Laws amendment) Bill, 2025, aimed at fostering growth, increasing insurance penetration, improving efficiency, and increasing regulatory flexibility. Key amendments introduced in the bill include a) permitting 100% FDI in insurance, b) amendment to Section 35, permitting the merger of an insurance company with a non-insurance company, c) easing net owned fund requirements for foreign re-insurance branches to Rs10bn from Rs50bn, d) empowering the IRDA to regulate intermediary commission and regulations, e) increased flexibility on investment norms by delegating power to the IRDA to specify conditions of the investments by insurers.

Key draft proposals omitted in the final bill – A relief for certain players Several key changes proposed in the draft Insurance Amendment Bill, 2022 did not find place in the final Sabka Bima Sabki Suraksha Bill, 2025. These include omission of the proposals related to 1) composite license and captive insurer, 2) open architecture in the individual agency channel, 3) providing ancillary services and distribution of other financial products, 4) empowering the regulator to specify the minimum capital requirement for the insurance and re-insurance businesses. While we argued earlier that the above-mentioned draft changes would not be desirable, the omission of composite license and open architecture of the agency channel in the final bill brings relief for STARHEAL, as these two concerns have weighed on the stock price since long. Further, LICI should see some relief from the absence of open architecture for Individual agents

Amendment to Section 40 – A step toward reducing commission and opex The insertion of sub-section 2A to Section 40 of the Insurance Act empowers the regulator to specify the limits of commission, remuneration, or reward paid to a distributor, the manner of such payment, the manner of disclosures required, and other matters related to insurance agents and intermediaries. While Section 40 (2A) of the Act explicitly states that the regulator has the power to limit commissions, we expect the regulator to work toward bringing down commissions and opex across the sector by introducing a cap on commissions or transitioning from a high upfront commission structure to a trail-based commission model. While distributors may contend that insurance continues to be a push product, the maturation of the industry over the past two decades and its increasing scale should, in principle, lead to a sustained reduction in distribution and operating costs.

What does the allowance of 100% FDI in Insurance mean for the industry? The move to permit 100% foreign investment in insurance is constructive, as it is likely to facilitate sector consolidation and help resolve ownership constraints in several insurance joint ventures. While insurance remains a business driven by brand strength, distribution reach, and product innovation, we do not expect many changes in the sectoral competitive landscape as it is extremely difficult for a 100% foreign-owned Life Insurance entity to make meaningful inroads in a sector driven by Brand, Distribution, and Cost Efficiency. The 100% FDI could see some foreign promoters increasing their stake in GI and SAHI entities like Zurich in Zurich-Kotak or Bupa in Niva Bupa.

What does the amendment to Section 35 of the Insurance Act, 1938 mean for MAXF? The amendment to Section 35 of the Insurance Act, 1938 permits an insurance company, with regulatory approval, to enter a scheme of arrangement—including mergers, demergers, or reverse mergers—with entities not engaged in insurance business. This enables the proposed reverse merger of Max Financial with Axis Max Life and, over time, the listing of Axis Max Life. While this amendment has long been a prerequisite for such a transaction, expectations of its inclusion in the final Bill have already led to a narrowing of the holding company discount in MAXF’s share price, resulting in multiple re-rating. Consequently, we believe this outcome is largely priced into MAXF share price and remains our base-case scenario.

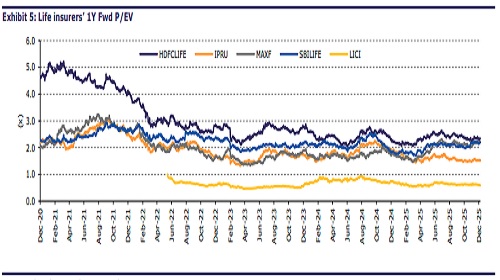

Brand, Distribution, and Cost Efficiency remain the key to success The omission of composite license and open-architecture proposals is a positive for STARHEAL, while exclusion of the open-architecture proposal also provides relief to LICI. The amendment to Section 35 enables the proposed reverse merger of MAXF with Axis Max Life. Separately, expectations of regulatory action to cap commissions in the life and general insurance sectors, along with a potential shift from high upfront commissions to a trail-based structure, are likely to affect insurance intermediaries’ share price in the near term. Supported by brand strength, distribution reach, and scale, listed insurers have consistently demonstrated their ability to defend profitability across regulatory and macroeconomic cycles. We believe large listed incumbents retain durable advantages in brand and distribution that are difficult to replicate. Based on the risk-reward, SBILIFE and IPRU look attractive in Life Insurance, while STARHEAL and ICICIGI in General Insurance/SAHI seem well-positioned.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)