Buy Vimta Labs Ltd For Target Rs. 743 By Sushil Finance

Moving up the value chain

Vimta Labs Ltd (VLL) management articulates a clear vision to evolve from a traditional testing lab into a comprehensive Contract Research and Testing Organization (CRTO) with end-to-end capabilities. The long-term strategy revolves around expanding service offerings, deepening technical expertise, and extending market reach. The company is positioning itself to capture more high-value research work (hence the entry into biologics and clinical trial management) while consolidating its leadership in routine testing

Robust fundamentals & superior financial position make a good base for growth, going forward

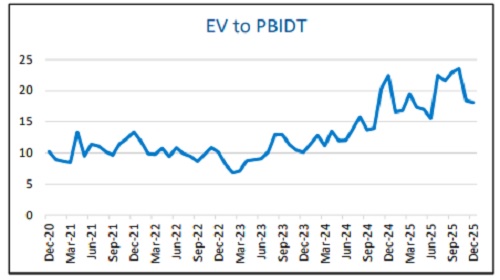

Apart from leading market share, VLL also enjoys superior profitability; it is net debt free with a gross debt-equity ratio of 0.02x; Furthermore, VLL has witnessed strong cash generation over the years resulting into strong balance sheet. Lower debt-equity & healthy profits have resulted in comfortable interest coverage and robust return ratios. We expect rerating to happen, as the company expands into the biologics and clinical testing space, albeit gradually. The underlying industries have positive growth momentum, pharma outsourcing is a innovation driven space, where VLL is gaining market share, while food testing is a burgeoning compliance-driven market with consolidation opportunities for leaders

OUTLOOK & VALUATION

With capacity expansion to be completed in FY26, we expect the company’s topline to grow at a CAGR of ~17.7% to Rs. 471 cr in FY24-27E. EBITDA margin is likely to remain at healthy level, 35%, on exit of low margin diagnostic business. Hence, with an expected PAT margin of 19% in FY27E, we expect the PAT and EPS to be at Rs. 90 Cr and Rs. 20.1 respectively. We have assigned a P/E multiple of 38x to arrive at a price target of Rs. 743 which provides an upside of ~26% within 18 to 24 months from the current market price of Rs.592.

Please refer disclaimer at https://www.sushilfinance.com/Disclamier/disclaimer

Member : BSE/ NSE/ MSEI. SEBI Registration No.-INZ000165135.