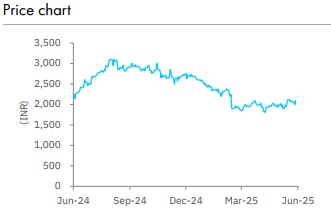

Buy Deepak Nitrite Ltd for Target Rs. 2,390 by Elara Capitals

Investment to yield returns

The stock price of Deepak Nitrite (DN IN) has run-up 8% in the past three months but has underperformed the benchmark Nifty Mid-Cap Index (up 16%). This was because of a delay in commissioning of upcoming projects and weak revenue YoY from Advanced Intermediates (AI) (on weaker prices/gross-margin of agrochem products - tri-fluoromethyl-aceto-phenone). Per DN, agrochem demand will continue to be subdued for two more quarters. We are bullish on overall demand from AI, as indicated by global players (BASF, Bayer, Corteva, Sumitomo, Nippon Soda) in their strong revenue growth guidance for respective segments related to DN’s AI domain (13% growth guidance in CY25 versus 1% dip in CY24). Also, stable median EBITDA margin guidance of 14% YoY in CY25 by global majors will aid related demand. However, anticipated recovery in global AI demand would be offset by a likely drop in revenue from the phenolic segment of global chemical players (Mitsui, LG Chem, Solvay) – CY25 revenue guidance has 11% drop versus a 9% growth in CY24.

Based on Q4FY25 earnings call and outlook of global chemical players, we cut FY26E and FY27E EPS estimates by 13% and 18%, respectively and reduce TP to INR 2,390 from INR 2,515. We are positive on DN in the long-term as ongoing capex is estimated to add INR 20bn to revenue (~25% of FY25) and INR 4bn to EBITDA (~40% of FY25) by FY28E. It would be EBITDA margin-accretive due to import replacement opportunity and forward integration strategy. We reiterate BUY.

Export incentives by government drives PAT: Q4 EBITDA and PAT stood at INR 3.2bn and INR 2.0bn, versus our estimates of INR 2.5bn and INR 1.6bn, led by export incentives of INR 1- 1.1bn by the government. Q4 PAT was down 20% YoY but recovered QoQ, with volume recovery in phenolics and AI. Q4 revenue was up 3% YoY. YoY, revenue from the phenolics business grew 5% (aided by the government’s export incentives) even as AI declined 3%.

Ongoing capex to spur growth in next three years: Ongoing capex of INR 140bn in polycarbonate (PC) compounding, phenol derivatives and specialty chemicals would add 25% to revenue by FY28E versus FY25 levels. Nitric acid capacity will come online in H1 and MIBK/MIBC may be commissioned in H2FY26. All the future projects are expected to be completed by end-FY28. DN has recently announced a capex of INR 35bn for manufacturing 300KTA of Phenol, 185KTA of Acetone and 100KTA of Iso-propyl Alcohol.

Reiterate Buy with a lower TP of INR 2,390: We cut our FY26E and FY27E EPS estimates by 13% and 18% respectively, due to slower recovery in agrochem demand. Consequently, we lower our TP to INR 2,390 (from INR 2,515). We introduce FY28E EPS at INR 94.5, ascribing 10% YoY growth. Our DCF-based TP assumes a 5% (unchanged) terminal growth, an 11.0% (unchanged) WACC and an EBITDA CAGR of 22% in FY25-28E (from 35%).

We reiterate Buy, led by benefits from the commissioning of new projects (that would offer import replacement opportunity) and forward integration strategy. These would likely yield a 14% revenue CAGR in FY25-28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933