Buy Oil & Natural Gas Corporation Ltd For Target Rs.292 by Prabhudas Liladhar Capital Ltd

Steady volume trajectory

Quick Pointers:

* Production guidance of 21mmt and 21.5bcm standalone in FY27.

* ONGC expects share of NWG in total production to increase to 30%-35% in 3-4 years.

ONGC reported a steady sales volume inc JV of oil (+2.7% QoQ) and gas (flat QoQ) combined with an oil price realization of USD67.4/bbl in Q2FY26 vs USD66.1/bbl in Q1FY26 and USD78.3/bbl in Q2FY25. This led to a revenue of Rs330.3bn, +3.2% QoQ and -2.5% YoY (Ple Rs318.6bn, BBGe Rs323.9bn). Reported EBITDA of Rs177.0bn (-5.1%/-1.4% QoQ/YoY) was in-line with our estimate (Ple: Rs179.6bn & BBGe: Rs180.9bn). Sequentially lower DDA/writeoffs of Rs74.7bn vs Rs80.0bn in Q1FY26, coupled with increase in other income of Rs34.2bn (Ple Rs26.7bn) due to addition of dividend income of Rs19.7bn this quarter vs Rs12.1bn in Q1FY26, resulted in PBT of Rs125.4bn (PLe Rs120.1bn), rising by 16.8% QoQ. PAT stood at Rs98.5bn, beating our estimates by 9.6% (Ple Rs89.9bn, BBGe Rs92.3bn, +22.7% QoQ). Going ahead, we build in 4-5% volume growth in oil and gas production in FY27/FY28E over FY25 driven by upcoming projects and well optimization plans. The stock is currently trading at 8.1x Sept FY27E SA EPS. Maintain ‘Buy’ rating with a target price of Rs292 (earlier Rs278), valuing standalone segment at 9x FY27/28E adj EPS and adding the value of investments. Key risk to our recommendation is further decline in oil prices and inability to ramp-up volumes. With every USD5/bbl change in oil price realization, conso EPS is impacted by 8-9%.

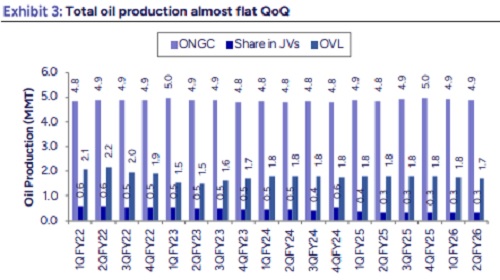

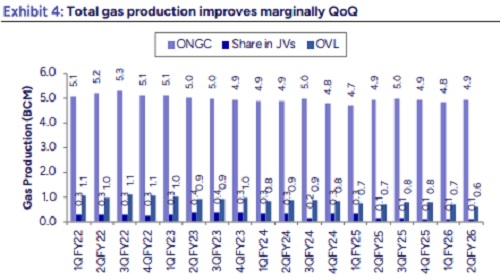

Steady Production: Standalone oil production in Q2FY26 stood at 4.88mmt from own fields and the share of JVs stood at 0.31mmt. On a combined basis, it fell slightly by 1.0% QoQ and a slight increase of 0.6% YoY. Standalone gas production for the quarter stood at 4.92bcm from own fields and 0.11bcm from JVs, leading to a combined growth of +1.4% QoQ and a miniscule decline of -0.6% YoY. For OVL, oil & gas production in Q2FY26 stood at 1.72mmt (-2.2% QoQ, -5.7% YoY) and 0.61bcm (-12.8% QoQ, -13.8% YoY). Oil and gas production inc. JV’s stayed flat YoY in H1FY26, while OVL volumes fell -4.0% and -8.5% YoY.

Price realization - Crude oil realization from own fields stood at USD67.3/bbl, up 1.8% QoQ, while it declined 14.0% YoY. Gas price realization for own fields stood at USD6.75/mmbtu, flat QoQ and up 3.8% YoY.

NWG: The share of new well gas (NWG) in total gas revenue from nomination fields crossed 21% during H1 FY26, contributing Rs33.5bn, an additional Rs6.5bn over the administered price mechanism (APM) gas rate. Company expects the share of NWG in total production to increase from current 13%-14% to 30%-35% over the next 3-4 years.

Concall highlights: 1) SA Production Guidance: Oil: FY26: 19.8mmt; FY27 at 21mmt. Gas: FY26 at ~20bcm, rising to 21.5bcm in FY27, and increasing thereafter driven by expected improved output from MH field following BP’s TSP engagement and upcoming Daman project enhancing gas volumes 2) The current run-rate of oil and gas production is below expectations, with management now guiding for FY26 oil output of ~20mmt (vs 21mmt earlier) and gas production slightly below 21.5bcm, as part of the volumes are expected to shift into early FY27, preferably in Q1FY27. 3) In KG-98/2 basin, gas production rate at ~3mmscmd due to constraints from the living quarters compression package, expected to be installed by Dec’25-Jan’26; post-installation, gas output is projected to ramp up to ~10mmscmd by Jun-Jul’26. Oil production remains low at ~28kbpd, but as per management, ongoing well intervention and additional planned works aim to lift output, supporting gradual improvement ahead. 4) OPAL’s plant capacity utilization to improve above +90% for H2FY26, leading to positive EBITDA. 5) NWG currently contributes ~13–14% of total production, Co. expects it to rise to ~30–35% over the next 3-4 years as Daman and other project’s ramp-up. 5) Daman Field/DSF II: Expected to add 9mmscmd of gas in FY26 (5 mmscmd from Daman and 4mmscmd from DSF-II), helping achieve total production of 24-25mmscmd by FY28. 6) Capex: E&P capex to remain steady at Rs300-350bn in FY26, with no cut in E&P spending. Similar capex planned for FY27. 7) Cost Optimization: Targeting Rs50bn reduction in opex through logistics efficiencies, dual-fuel rig conversion, green energy, and efficient rig deployment to lower fuel & power costs. 8) Mozambique: Force majeure lifted, aiming for project resumption, 9) OPAL net debt stood at Rs251.9bn as of this quarter, with interest costs (~8.5%) expected to decline by over 100 bps, reducing finance expenses going forward.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271