Buy JSW Energy Ltd For Target Rs.810 By Motilal Oswal Financial Services Ltd

O2 Power acquisition unlocks value

* JSW Energy (JSWE) announced a definitive agreement to acquire O2 Power Midco Holdings Pte. Limited, O2 Energy SG Pte. Limited, and their subsidiaries (O2 Power) for a total cash consideration of INR124.68b. We view this move positively, and following are the key implications according to us:

* Up to INR57/share value unlocking upon deal completion: With listed Renewable Energy (RE) generation companies currently trading at ~15x EV/EBITDA, the acquisition of 4.7GW high-quality renewable assets at ~7x EV/EBITDA unlocks ~INR57 in value, we estimate.

* High-quality assets: We like the overall quality of assets. Key highlights include: 1) interest cost for O2 Power at 8.8% is competitive and at par with JSWE itself; 2) receivable days at 43 for the asset portfolio are in fact lower than JSWE’s receivable days at 68 (FY24); 3) 87% of the portfolio is backed by utilities such as SECI/NTPC/SJVN, while the 13% C&I portfolio largely comprises AA or higher rated issuers; 4) we like the diverse nature of the asset portfolio encompassing solar, wind, and niche segments such as FDRE.

* High transmission and land visibility: O2 Power has full transmission connectivity for its entire 4.7GW portfolio, and the entire under-construction pipeline is backed by Power Purchase Agreements (PPAs). We believe this is crucial in providing confidence to the market about the timely execution of the project pipeline.

* Savings from in-house EPC/O&M: Lastly, while the steady-state EBITDA from the 4.7GW portfolio is guided at INR37.5b, we believe there is potential for further upside due to JSWE carrying out the EPC/O&M of assets in-house.

* Transitory rise in leverage: Should both the KSK Mahanadi and O2 Power deals be consummated by the end of FY25, we estimate JSWE’s net debt/EBITDA for FY26 to rise to 5.4x (current estimate: 4.7x). However, given the strong operating cash flow generation and the company’s ability to raise funds, we believe the transitory rise in leverage should not be a major concern.

* We have a buy rating on JSWE with an SOTP-based TP of INR810/share.

Valuation and view

* We value JSWE's core business at 15x FY27 EBITDA, reflecting its strong operational performance and market position. The stake in JSW Steel is valued at a 25% discount to the current market price.

* The total equity value of JSWE was determined by aggregating the values from these different components, leading to a TP of INR810/share.

* Additionally, note that we see an option value of INR60/share from KSK Mahanadi, which should materialize once the deal is approved.

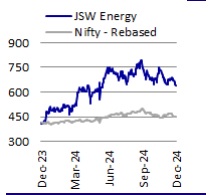

Stock Performance (one-year)

https://www.research360.in/?utm_source=InvestmentGuru+&utm_medium=ResearchArticle

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412