Buy RR Kabel Ltd For Target Rs. 1,820 By Choice Broking Ltd

Power Cables Segment to be the Game Changer

RRKABEL launched a major capacity expansion beginning in FY24, totalling INR 17Bn (5 Bn incurred so far + 12Bn to be incurred till FY27) with 80% allocated to Power Cables. We believe this shall generate additional revenue potential of INR 48- 54Bn at optimal capacity utilization; considering 3.5-4x fixed asset turnover. Power Cables segment contributes ~27% (INR 18.4Bn) to C&W (Cables and Wires) revenue which is estimated to increase to 36% (INR 35.9Bn) by FY28E, with 25% CAGR fuelled by structural tailwinds such as renewable energy, data centres and exportoriented tailwinds like the China+1 shift. We believe that to gain sizeable share in domestic Power Cable segment, the management has been cross subsidising profitability of wire segment in domestic market since last few years. Thus, RRKABEL has been an underperformer in terms of EBIT margins compared to peers. But now, due to improving product mix such as adding MV/HV Power Cables capacity and operating leverage coming into play, we expect the EBIT Margins to expand massively by 370bps to 9.8% (and reach INR 3.5Bn) indicating the highest margin expansion among peers.

Wires Segment Regaining Momentum

RRKABEL’s Wires segment (domestic + export) contributes 73% to C&W revenue and has been hit by low margins (9%) due to volatility in raw material (copper) prices. Housing Wires segment is poised for revival, and we believe Wires segment growth will compound at ~10% annually from FY26-28E to INR 64Bn driven by increasing per distributor productivity and strengthening engagement through a comprehensive loyalty program for electricians and retailers.

Fast Moving Electrical Goods (FMEG) Segment turning profitable

FMEG segment accounts for 12% of total revenue, comprising fans, LED lighting, switches, MCBs, and appliances, complements its core C&W business, leveraging its 4,000+ dealer network. Although the FMEG sector is slow, RRKABEL is expected to outperform via its focus on premiumization of FMEG products, leveraging its brand and penetrating Tier 2/3 markets. We estimate the segment to turn profitable from FY26E with revenue projected to grow at a 25% CAGR & EBIT margin to reach ~4% by FY28E. In FY25, FMEG EBIT margins narrowed by 400 bps to (5%) & Q4 FY25 witnessed 400 bps YoY improvement in EBIT margin to (3%).

Investment View

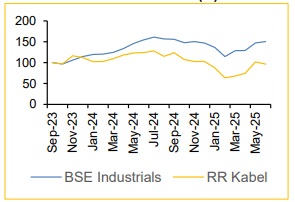

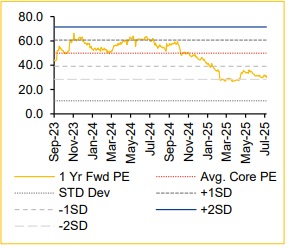

We expect RRKABEL to deliver strong financial performance, with Revenue/EBITDA/PAT projected to grow at a CAGR of 16%/33%/32%, respectively, over FY25–FY28E. Supported by robust growth in the Power Cables and FMEG segments, we initiate BUY with a TP of INR 1,820, based on DCF (31% upside), implying a PE multiple of 44.0/28.4 at FY27E EPS/FY28E EPS.

Key Risk

Volatility in raw material prices, particularly copper:

Peers pass on upside/downside of copper to customers with lag effect on 1 st day of next month based on average LME prices & average FOREX rate in USD terms for previous month. However, RRKABEL’s policy is to pass on upside/downside beyond +3%/-3% to customers & being net forex earner with 25%+ of revenues contributed by export (doesn’t hedge for imported copper costs).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131