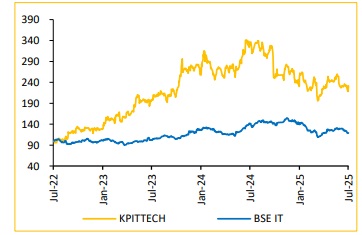

Add KPIT Technologies Ltd For Target Rs. 1,400 By Choice Broking Ltd

New Products & Platform models thrust to drive productivity led growth

KPITTECH’s strong deal wins & pipeline indicate sustainable long-term growth prospects. However, near term growth might get impacted by macro uncertainties. Growth momentum is expected to rebound in H2FY26 with Automotive OEMs spends firming up in next couple of quarters. Despite the current OEM cost pressures, delays in SDV programs & EV timelines outside China, the company foresees margin expansion from medium to long-term perspective This expansion will be driven by a strategic shift to fixed-price projects delivery thereby improving profitability from long-term basis. KPITTECH is leveraging AI to build validation solutions, meeting client demand for costeffective, faster delivery. It will be focused in improving productivity, expanding product and solutions offerings, & revamping HR with variable pay tied to AI adoption. Given this outlook, we expect Revenue/ EBITDA/ PAT to grow at CAGR of 13.1%/ 14.3%/ 12.1% over FY25–28E and maintain our rating to ADD. We roll forward to FY28 estimates & consider average of FY27E & FY28E EPS of INR 40, implying a PE multiple of 35x (maintained) to arrive at our Target Price of INR 1,400.

Strong execution amidst weak macros faced by Automotive Industry

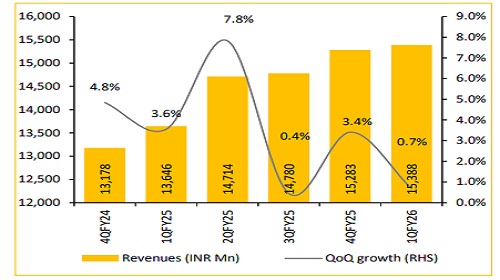

* Reported Revenue for Q1FY26 stood at USD 178Mn up 0.3% Q0Q (vs CIE est. at USD 179Mn). In CC terms the revenues de-grew by 3.2% QoQ. In INR terms, revenue stood at INR 15,390Mn, up 0.7% QoQ.

* EBITDA for Q1FY26 came at INR 3,239Mn up 0.3% QoQ (vs CIE est. at INR 3,174Mn). EBITDA margin was flat QoQ at 21.1% (vs CIE est. at 20.7%).

* PAT for Q1FY26 came at INR 1,719Mn, down 29.8% QoQ (vs CIE est. at INR 2,116Mn) led by loss on Forward contracts of INR 81Mn.

KPITTECH secures deals worth USD 241Mn in Q1FY26 despite weak

macros: KPITTECH reported Q1FY26 deal wins totalling USD 241Mn, primarily in Powertrain & Connected solutions for passenger vehicles across US & Europe. Commercial vehicles remained soft in Q1FY26 but expected to rebound. Although the deal pipeline has increased 20% YoY, the revenue conversion has slowed due to client reprioritization & a shift towards efficient, solution-based delivery models & at time cannibalizing the existing business. In the near term, we believe the demand landscape remains challenged by cost pressures faced by OEMs aggravated by geopolitical uncertainties. OEMs focus stays on smart cockpits, Level 2+ autonomy, cybersecurity, & validation related spends. EV delays outside China shift attention to hybrids; SDV rollouts are postponed. The company aims triple-digit growth from India & China via strong pipelines and programs like JSW Motors EV. Europe to lead future growth, while US & Japan to eye segment-specific recovery. Overall, we anticipate H2FY26 to be stronger than H1, with growth momentum returning as market uncertainties settle.

Q1 EBITDAM steady at 21%; Product-led model to drive margins in long-run:

KPITTECH reported a steady QoQ EBITDAM of 21%, with management optimistic about sustaining margins barring major currency shifts. While revenue from India and China is set to rise, the company aims to maintain margins through diversified models and platform-based offerings, moving away from time and material billing thereby strategically shifting to fixed-price billing (stood at 62.5%), to counter margin pressures. The company’s focus on enhancing productivity & shifting towards product & solution-based business model is expected to support efficiency gains and good margin improvement in long run. However, considering the near term macro concerns, we expect conservative margin of 20.8% in FY26E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131