Add AAVAS Financier Ltd For Target Rs. 2,021 - Centrum Broking Ltd

Aavas reported its Q4FY25 results, which came in below our estimates, with disbursement in HL declining YoY for the first time since Covid. Overall disbursements for the quarter increased by 7% YoY, driving an 18% YoY expansion in AUM to Rs204bn (lower than our estimate). Notably, reported spreads dropped by 5bps QoQ to 4.89%. The compression in spreads in Q4FY25 can be attributed to lower yields as the CoB remained stable at 8.24%. As a result, NII growth of 15% YoY and 9.5% QoQ trailed AUM growth. Further, the CTI came in higher at 46.1% (PY: 44.1%, PQ: 42.7%) due to the opening of 24 branches during the quarter, which spiked manpower costs and led to higher expenses. Consequently, operating profit increased by 10.4% YoY and 3.2% QoQ. Credit costs (cal.) rose to 19bps from 16bps PQ. Net profit for Q4FY25 came in at Rs1.6bn, up 12% YoY/7% QoQ. Looking ahead, given the moderation in disbursement trends—particularly within the Housing segment—and the significant stock price appreciation (~25% rise) since the previous quarter, we believe the scope for further upside is limited. Relative to peers, Aavas offers lower growth and inferior return profile. Accordingly, we continue to assign a relatively lower valuation multiple to the company and prefer to wait for a sustained improvement in disbursements and spreads before considering an upgrade from ADD to BUY. We are building in AUM/NII/PAT CAGR at 19%/20%/20% over FY25-FY27E and expect RoA/RoE of 3.3%/15.0% in FY27E. Aavas is currently trading at 3.4x/2.9x FY25E/FY26E ABV, which captures all growth parameters and offers limited upside from our target price of Rs2,021 (2.8x FY27E P/ABV). We maintain ADD on Aavas given our positive outlook on the sector.

FY25 growth guidance missed but re-iterated for FY26

Aavas reported AUM of Rs204bn, up ~18% YoY and 6% QoQ. However, disbursement growth was subdued at 9.7% for FY25. Home Loan AUM grew ~16% YoY and 4.6% QoQ while Non-HL AUM grew 23% YoY and 9.6% QoQ. Disbursements growth for the quarter in HL/Non HL portfolio was -3%/27% YoY. The management attributed the subdued performance in the HL segment to cautious underwriting approach, with the conventional login-to-sanction conversion rate declining from 42% to 38%. We are baking in miss on growth guidance similar to FY25 given its inconsistent delivery on the disbursement front.

Spread inches down as yields decline

Aavas reported spreads of 4.89%, down 5bps QoQ, driven by a 5bps QoQ fall in yields to 13.13%. However, the CoB remained stable at 8.24%. Notably, in a rate-cut scenario, 36% of bank borrowings are linked to EBLR (T-bill, Repo & MIBOR) and 23% to a 3m MCLR, which should help mitigate pressure on CoB in the medium term.

Opex/AAUM decline QoQ

Aavas improved its opex-to-assets ratio by 11bps in FY25 to 3.32% and aims to reduce it by 20bps annually, targeting sub-3% levels through cost optimization. Operating leverage will be driven by tech integration, reduced manpower for sourcing and collections, and enhanced productivity, where Aavas currently lags peers.

Asset quality remains pristine

1+dpd declined 46bps QoQ to 3.39% while Stage 2/3 assets stood at 1.47%/1.08% (vs. 1.54%/1.14% in Q3FY25). Asset quality remains pristine and best in the industry. Stage 3 PCR increased to 32.4% due to a shift in new system (PQ: 29.8%, PY: 28.8%), with total asset provisions inching up by 4bps to 0.66%.

Valuation

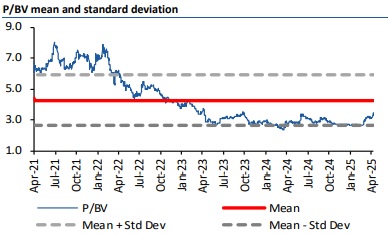

We are buildin in AUM/NII/PAT CAGR at 19%/20%/20% over FY25-FY27E and expect RoA/RoE of 3.3%/15.0% for FY27E. Aavas is currently trading at 3.4x/2.9x FY25E/FY26E ABV, which captures all growth parameters and offers limited upside from our target of Rs2,021 (2.8x FY27E P/ABV). We maintain ADD on Aavas given our positive outlook on the Housing sector

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331