Buy Crompton Greaves Consumer Ltd for Target Rs.490 by Elara Capitals

Eyeing the future with premiumization, capex

Crompton Greaves Consumer Electricals (CROMPTON IN) saw a quarter of muted growth as delayed Summer and early rains dragged fans demand, and overall consumer demand remains subdued. CROMPTON however continues to expand its premium portfolio, which is driving margin improvement despite higher ad spend. It has also announced a capex of INR 3.5bn and foray into rooftop solar scheme offering. We retain Buy with a higher TP of INR 490 on 36x March FY27E P/E based on premiumization-led margin improvement potential, Butterfly Gandhimati (BGAM) recovery, Union Budget-led ramping up of consumer demand, and the stock having underperformed the Nifty by 12% in the past six months.

Focus on premiumization to improve margin: CROMPTON has been focused on growing its premium portfolio for the past few quarters, which has been showing results in the form of continued margin improvement every quarter in the past year. FY25 EBITDA margin has grown 150bp YoY to 11.3% despite a large increase in ad spend to expand reach. Amid a muted demand scenario, premiumization has helped offset lack of volume with an increase in average selling price. The company’s new premium Brushless Direct Current (BLDC) fans, premium air coolers, and new innovative platform-based Nucleoid & Niteo fans have seen robust demand.

Greenfield capex of INR 3.5bn announced along with foray into rooftop solar: The company has announced a large Greenfield capex plan of INR 3.5bn for the next 1-2 years, wherein phase 1 will focus on fans, with future expansion in other product categories, to sustain growth run-rate. It has also announced entry in the rooftop solar segment, with CROMPTON’s product offerings having a total addressable market of INR 200bn as per management. The company looks to grow this category similar to its growth in solar pumps, supported by strong sectoral tailwinds.

Butterfly sees profitability rebound: After a series of negative quarters wherein muted kitchen demand dragged sales and profitability, Butterfly saw a rebound in Q4FY25, with topline- growth of 11% YoY along with a profit of INR 123mn vs a loss of INR 261mn in the base quarter. This was led by double-digit growth in mixer grinders, cookers, wet grinders along with price action implemented across retail, modern trade and export channels. The company also saw sequential growth in market share in mixer grinders & pressure cookers.

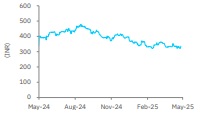

Retain Buy with a higher TP of INR 490: We have incorporated BGAM’s financials into CROMPTON. We lower our FY26E and FY27E EPS by 4% each on early rains impacting fans demand, along with persistent weakness in overall demand. We introduce FY28E. However, we retain Buy with a higher TP of INR 490 from INR 475 on 36x (unchanged) March FY27E P/E, led by continued margin improvement, a recovery at BGAM and the Union Budget focusing on revamping consumption demand, along with strong growth potential in pumps, appliances and rooftop solar. The stock has underperformed the Nifty by 12% in the past six months. We expect an earnings CAGR of 22% during FY25-28E with an average ROE of 34% during FY26-28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933