Buy AU Small Finance Bank Ltd for the Target Rs. 755 by Axis Securities Ltd

Recommendation Rationale

* Credit costs pressure to ease from H2FY26: AUSFB’s credit costs stood at 1.3% (on total assets), primarily owing to elevated stress in the unsecured portfolios, mainly MFI and Credit cards. However, the bank has seen an improvement in collection efficiency (CE) in the MFI portfolio and expects the trend to continue into FY26. However, near-term headwinds owing to the implementation of the MFIN guardrails 2.0 could keep credit costs higher in H1FY26, while gradually trending downwards from H2FY26. Similarly, gauging the stress in the credit card portfolio, AUSFB tightened the underwriting and credit filters in the portfolio, thereby limiting the credit card issuance. With respite on asset quality stress expected in both the portfolio, the management expects credit costs to improve meaningfully in FY26 to 85-90bps (on total assets), with MFI credit costs declining to 3.5% in FY26 (vs 7.7% in FY25) and Credit Card credit costs declining to 7-8% in FY26 and further normalising at 5-6% from FY27 onwards (vs 11% in FY25). The secured book continues to behave well, and slippages in this portfolio are expected to remain under control in FY26. Credit costs trending downwards (expected at 75-80bps in FY27E) would be a key RoA improvement driver.

* NIMs to remain under pressure in the near-term: Post the repo-rate cut, AUSFB has reduced its peak TD rates by 25bps and also rationalised its SA rates by 25bps. However, owing to intense competition from peer banks on rates, the bank does not intend to tinker with rates further. That said, the bank intends to build a strong deposit franchise focusing on building customer relationships and cross-selling rather than purely on deposit pricing. With ~30% of the portfolio being floating rate, the bank expects yields to reprice downwards in Q1FY26. However, CoF will taper with a lag, resulting in near-term pressures on margins. However, we believe AUSFB’s margins would find support from (i) fixed rate portfolio (~70%) as CoF trend downwards and (ii) pick-up in the growth in the higher-yielding unsecured portfolios. Thus, we expect NIMs to range between 5.7 and 5.8% over FY26-27E.

Sector Outlook: Positive

Company Outlook: The bank is marching towards achieving its FY27E RoA target of 1.8%, with tight control on costs and focused efforts on improving asset quality to drive meaningful improvement in credit costs. While near-term headwinds on NIMs are likely to persist owing to immediate repricing in floating-rate book and higher slippages in the unsecured portfolio, we expect some support for margins over the medium-term, driven by a ~70% fixed-rate book and growth resumption in the higher-yielding unsecured products. The bank awaits the granting of the universal banking license (expected in the current calendar year), which would help AUSFB strengthen its market positioning and enable better deposit mobilisation at a more favourable cost. The management is confident of no adverse impact on the new LCR norms. Supported by healthy business growth, maintained margins in a tight range, and gradually moderating credit costs, AUSFB is expected to deliver RoA/RoE of 1.6-1.8%/16-18% over FY26-27E.

Financial Performance:

? Operational Performance: YoY numbers would not be comparable. Advances grew by 47/8% YoY/QoQ, with healthy growth across secured segments. The secured loans grew by 24/6% YoY/QoQ, Unsecured businesses de-grew by 18/10% YoY/QoQ driven by industry-wide deleverage in MFI and corrective actions taken in Credit Cards. Deposit growth was strong at 43/11% YoY/QoQ, primarily led by TDs (52/13% YoY/QoQ). CASA deposits grew by 24/5% YoY/QoQ. CASA Ratio stood at 29.2% vs 30.6% QoQ. LDR stood at 87.5% vs 90% QoQ

? Financial Performance: NII grew by 57/4% YoY/QoQ, with NIMs contracting by ~6bps QoQ (marginally lower contraction than expected). NIMs (reported) stood at 5.8% vs 5.9% QoQ and were impacted due to portfolio mix shift. Non-interest income grew by 37/23% YoY/QoQ. Opex grew by 27/9% YoY/QoQ. C-I Ratio declined to 54.7% vs 54.4% QoQ. PPOP grew by 95/7% YoY/QoQ. Credit costs inched up (higher than estimates) to 2.42% vs 2.04% QoQ as the bank made an accelerated provision of Rs 150 Cr to strengthen provision coverage, which improved to 84%. PAT grew by 36% YoY and was down 5% QoQ.

? Asset Quality remained broadly steady with GNPA/NNPA at 2.28/0.74% vs 2.31/0.91% QoQ. Slippages moderated sequentially, with the slippage ratio at 3.5% vs 3.9% QoQ, led by improved secured assets and MFI.

Outlook

We revise our NII estimates downwards by ~1-3% over FY26-27E to reflect the lag in the transmission of a rate cut on CoF even as yields (on 30% floating book) are expected to reprice downwards immediately. However, on expectations of controlled Opex growth and moderating credit costs, we revise our earnings estimates marginally upwards by 1-4% over FY26-27E. We believe AUSFB remains well placed to deliver a strong Credit/Deposit/NII/Earnings growth of 21/23/26/35% CAGR over FY25-27E. We expect the bank to deliver RoA/RoE of 1.6-1.8%/16-18% over FY26-27E.

Valuation & Recommendation

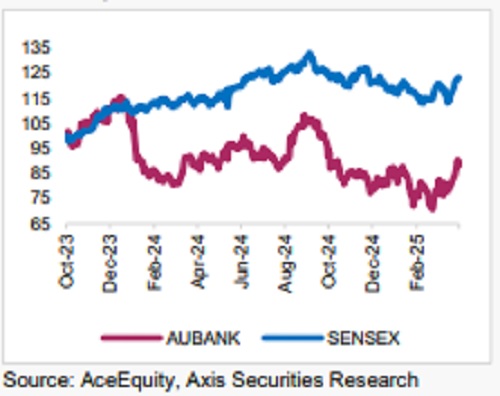

The stock currently trades at 2.0x FY27E ABV. We value the stock at 2.5x FY27E to arrive at a target price of Rs 755/share, implying an upside of 23% from the CMP. We maintain our BUY recommendation on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)