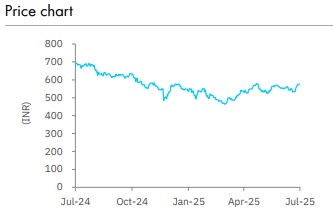

Accumulate Ambuja Cements Ltd For Target Rs. 616 By Elara Capital

Reaffirming FY28 growth roadmap

We attended Ambuja Cements’ (ACEM IN) capital market day recently. Key takeaways are: 1) reiteration of its ambition of expanding cement capacity to 140mn tonne by FY28, 2) continued focus on cost reduction, with a targeted cost savings of INR 550/tonne, and 3) longterm vision of consolidation of all businesses into a single entity through the “One business, One Company” strategy. We reiterate Accumulate with a TP of INR 616.

Targeting 140mn tonne capacity by FY28: ACEM has reiterated aggressive growth strategy, targeting a ~36% increase in cement capacity from the current ~102mn tonne to 140mn tonne by FY28. Clinker capacity is also expected to rise from ~62mn tonne to ~107mn tonne during the same period. Currently, ~17mn tonne of capacity is under execution, with plans for an additional 21mn tonne. The expansion is projected at a competitive capital cost of USD 70– 80/tonne. Currently, ACEM holds ~9bn tonne of low-premium limestone reserves. It aims to expand its domestic market share from the current 14.5% to 17–18% by FY28, with an aim to surpass 20% by FY30.

Aims INR 550/tonne cost savings: ACEM has reiterated its cost optimization roadmap with a targeted cost reduction of INR 550/tonne, with most benefits likely to materialize from FY27. Key levers include: 1) power and fuel cost savings of INR 280-300/tonne, driven by scaling up of green power capacity from 375MW to 1,000MW by June 2026 and targeting 60% of power from renewable sources, 2) raw material cost reduction of INR 100/tonne through long-term fly ash tie-ups (covering currently ~40% of requirement for the next decade) and securing 10mn tonne of slag supply in East India, 3) logistics savings of INR 100/tonne through network optimization & structural reorganization, and 4) overhead savings of INR 50/tonne from administrative efficiency, including workforce rejuvenation -- average employee age has dropped from 41 years to 37, with plans to reduce it further to 35. ACEM is actively pursuing premiumization with select premium brands, earning an EBITDA premium of INR 400/tonne. At a steady state, ACEM targets an EBITDA/tonne of INR 1,500.

Consolidation strategy -- “One Business, One Company”: The Adani Group is pursuing a “One Business, One Company” approach across its cement verticals. In line with this, ACEM is in the process of merging Sanghi Industries and Penna Cement with itself, which is likely to be completed in the next two quarters. A merger between ACC with ACEM is also on the cards. The recent acquisition of Orient Cement (ORCMNT IN, Sell, CMP: INR 242, TP; INR 225) has been executed smoothly with no volume disruption, despite brand and pricing differences. Notably, 60% of ORCMNT dealers have already started stocking ACC and ACEM products. ORCMNT is likely to operate only as a manufacturing entity.

Reiterate Accumulate with a TP of INR 616: We believe ACEM is well-positioned to deliver healthy volume growth, led by better demand, ramp-up in acquired assets, and completion of ongoing capacity expansions. Also, its continued focus on cost saving initiatives should help it to keep a check on margin in the long term. Thus, we reiterate Accumulate with a TP of INR 616 based on 18x FY27E EV/EBITDA. Sub-par demand, weak cement price, and a sharp rise in fuel price are key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)