Buy Kalpataru Projects Ltd For Target Rs. 1,450 By Emkay Global Financial Services Ltd

Order inflow momentum to sustain; reiterate BUY

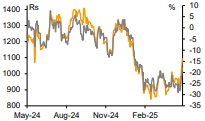

We maintain BUY on Kalpataru Projects International Ltd (KPIL) with a TP of Rs1,450 (implying 30% upside). Standalone revenue/EBITDA/PAT grew by 21%/31%/48% YoY, led by strong order book, improved execution, and operating efficiencies. The T&D and Building and Factories segments were the primary growth contributors, while the railways and water segments faced execution challenges due to a weak order book, intense competition, and delays in cash flows. For FY25, order inflows stood at Rs255bn, taking the order backlog to an all-time high of Rs645bn (~3x), which provides strong revenue visibility. For FY26, the management has guided for Rs260-280bn in order inflows and 20% revenue growth, which we believe is achievable, given the strong order book and promising tender pipeline. Despite strong revenue growth, NWC was well under control at 94 days (well within management’s guidance of below 100 days), which is commendable. Securing large highmargin orders, improving execution, maintaining effective working capital control, and exiting non-core businesses are the management’s key focus areas.

T&D and B&F to drive order inflow momentum

KPIL’s FY25 order inflow was at Rs255bn, led by T&D/B&F segments registering 30%/26% YoY growth. This resulted in 10% YoY growth in the order backlog, which touched Rs645bn (BB ratio: ~3x). The current L1 position stands at ~Rs25bn. Strong base in T&D and HVDC segments (with limited competition), along with growth in B&F segment on the back of commercial, residential and infrastructure projects, is expected to sustain the order inflow momentum. Order inflows and execution are expected to remain weak for water and railways segments. The management expects a swift recovery in the water segment, provided collections continue to improve in FY26. The railway business continues to see headwinds amid increased competition.

NWC well under control; net debt lower by 40% YoY

Net working capital days were at 94 days, compared to 99 days at the end of FY24, aligning with the management's target of maintaining NWC below 100 days. This improvement was led by better execution control and a strong focus on cash collections, with Rs5.75bn received from Jal Jeevan Mission-related payments in Q4FY25. Standalone net debt decreased by Rs7.3bn (40% YoY) to Rs11bn, supported by better working capital management, prudent capital allocation, and funds raised through QIP.

View and valuation

KPIL remains one of our top picks in the T&D EPC space. We remain constructive on the company, given its robust order book, strong revenue visibility, disciplined bidding approach, and focus on efficient NWC management. We introduce FY28 and bake in FY26- 28E earnings CAGR of ~26%. We maintain BUY with an upside of ~30%, arriving at a TP of Rs1,450 (20x 1Y forward PER on March 2027).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354