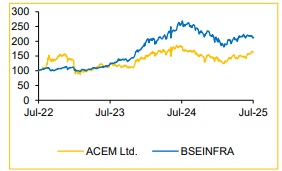

Buy Ambuja Cement Ltd For Target Rs. 700 By Choice Broking Ltd

Focus on Long Term Transformation Plan

We maintain our BUY rating on ACEM with a TP of INR 700/sh. We continue to be constructive on ACEM due to: 1) INR300/t cost reduction benefit over FY25-28E; out of INR300/t, INR 150/t is expected from logistics side by reducing lead distance and increasing the share of sea and rail, 2) Increasing premium product share that drives better realization, and 3) Ambitious capacity expansion to reach 118 Mnt by FY26 end and 140 Mnt by FY28 end. We incorporate a robust EV to CE (Enterprise Value to Capital Employed) valuation framework (Exhibit 3), which allows us a rational basis to assign a valuation multiple that captures improving fundamentals (ROCE expansion by 488bps over FY25-28E).

We forecast ACEM EBITDA to grow at a CAGR of 26.4% over FY25–28E, supported by our assumptions of volume growth at 12.0%/10.0%/10.0% and realisation growth of 3.5%/0.5%/0.0% in FY26E/FY27E/FY28E, respectively. We remain positive on ACEM, supported by the group’s strong presence in the cement sector and synergies benefits.

We arrive at a 1-year forward TP of INR 700/share for ACEM. We now value ACEM on our EV/CE framework – we assign an EV/CE multiple of 4.5x/4.5x for FY27E/28E, which we believe is conservative given the increase of RoCE from 8.0% in FY25 to ~12.9% in FY28E under reasonable operational assumptions. Management has indicated the cement industry is expected to grow by 7-8% in FY26.

Q1FY26: EBITDA hit by elevated operating costs

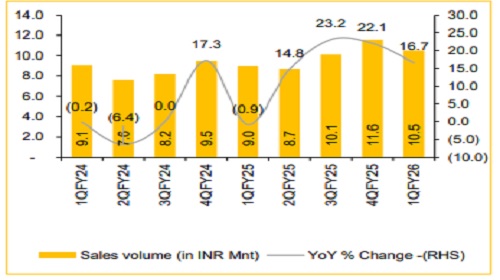

ACEM reported Q1FY26 Revenue and EBITDA of INR 55,147 Mn (+21.1% YoY, -3.7% QoQ) and INR 8,718Mn (+35.0% YoY, -16.0% QoQ) vs Choice Institutional Equities (CIE) estimates of INR 54,882Mn and INR 9,854Mn, respectively. Volume for Q1 stood at 10.5 Mnt (vs CIE est. 10.7 Mnt), up 16.7% YoY, and down 9.5% QoQ

Realization/t came in at INR 5,252/t (+3.8% YoY, +6.4% QoQ), which is higher than CIE's est. of INR 5,143/t. Total cost/t came in at INR 4,422/t (+1.9% YoY, +9.4% QoQ). As a result, EBITDA/t came in at INR 830/t (vs CIE est. of INR923/t), up 15.7% YoY and down 7.2% QoQ.

Cost optimization on track; INR300/t reduction target by FY28:

ACEM’s management appears well-positioned to achieve its targeted total cost of INR 3,983/t by FY28, having already achieved a cost reduction of approximately INR 175/t. We anticipate a further ~INR100/t decline in Power & Fuel costs, supported by the company’s goal to scale WHRS capacity to 30% by FY28. In parallel, long-term supply agreements are expected to lower raw material costs by 8–10%. With sustained cost-efficiency initiatives, we project ACEM’s EBITDA/t to grow at a CAGR of 22.1%, reaching INR 1,114/t by FY28.

Key Risks:

• Integration of acquired assets like Orient Cement poses short-term cost pressures and operational adjustments, impacting power and fuel, logistics, and other expenses, as seen in Q1 FY26 consolidated results.

• Ambitious capacity expansion targets, aiming for 140 Mnt by FY28, carry inherent execution risks such as potential delays or unforeseen operational hurdles, despite current progress on groundwork and approvals.

Impressive volume growth in Q1

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131