Buy Ambuja Cements Ltd for the Target Rs. 740 by Motilal Oswal Financial Services Ltd

Beat earnings; resilient EBITDA/t led by operational efficiency

Debottlenecking to unlock 15mtpa capacity at lower capex

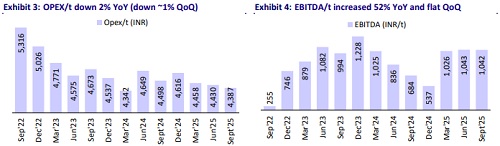

* Ambuja Cements (ACEM) reported strong growth of ~81% YoY in EBITDA to INR17.6b (~28% beat, led by lower-than-estimated opex/t). EBITDA/t grew ~52% YoY to INR1,042 (vs. estimate INR847) and OPM was up 6pp at ~19% (+3.7pp vs. our estimates). Adjusted profit (after MI) was up ~14% YoY at INR5.6b (+35% vs. our estimate).

* Management highlighted that ongoing efficiency measures and group synergies have helped it to lower total opex/t. It targets to bring costs down from INR4,200/t currently to INR3,650/t by FY28 through optimized fuel mix, higher green power use, and logistics improvements. Further, it announced debottlenecking initiatives across plants with grinding capacity addition of 15mtpa at a capex of USD48/t. It also clarified that the capex cost under this new initiative is on an integrated plant basis. Hence, the company has raised its capacity target to 155mtpa by FY28 (vs. 140mtpa earlier).

* We raise our EBITDA estimate by 10% for FY26, considering outperformance in 2Q, and ~3% for FY27/28E (each). The stock is currently trading at 16x/14x FY27E/FY28E EV/EBITDA. We value the stock at 20x Sep’27E EV/EBITDA to arrive at our TP of INR740. Reiterate BUY.

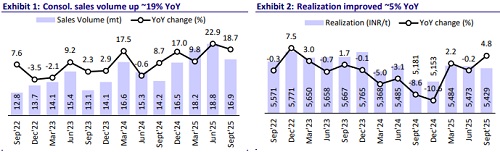

Consolidated volume up ~19% YoY; blended realization/t up ~5% YoY

* Consol. revenue/EBITDA/adj. PAT stood at INR91.7b/INR17.6b/INR5.6b (up 24%/81%/14% YoY, and +4%/+28%/+35% vs. estimates) in 2QFY26. Consol. volume rose ~19% YoY to 16.9mt (+4% vs. estimate). Blended realization/t increased ~5% YoY but declined ~1% QoQ (~1% below estimates).

* Opex/t was down ~2% YoY/1% QoQ (~5% below our estimate), led by ~7%/ 5% decline in variable/freight cost/t. Other expenses/t increased ~15% YoY partly due to the integration of recently acquired assets. EBITDA/t grew ~52% YoY to INR1,042, and OPM surged 6pp YoY to ~19%. Depreciation increased ~70% YoY, driven by inorganic expansion. Other income declined ~31% YoY. ETR stood at 29.3% vs. 33.3% in 2QFY25.

* In 1HFY26, revenue/EBITDA/adj. PAT stood at INR194.6b/INR37.2b/INR13.4b (up ~23%/65%/18% YoY). OPM surged 4.8pp YoY to ~19%. OCF at INR14.4b vs. operating cash outflow of INR18.8b in 1HFY25. Capex stood at INR35.6b vs. INR45.5b in 1HFY25. Net cash outflow stood at INR21.2b vs. INR64.3b in 1HFY25.

Highlights from the management commentary

* Cement demand was tepid at ~4% YoY in 2Q due to early monsoon, though management remains bullish with ~7-8% demand growth guidance in FY26, supported by GST cuts and higher rural/infra project demand.

* Share of premium products increased to ~35% vs. ~33% in 1QFY26, driven by strong consumer acceptance of Adani Cement branding and the introduction of value-added variants across key markets.

* Green power contributed to ~33% of total power requirement vs. ~16%/28% in 2QFY25/1QFY26. ACEM is targeting to increase this to ~60% by FY28.

Valuation and view

* ACEM has reported steady improvements in profitability, with EBITDA/t of +INR1,000/t in the third consecutive quarter. Resilient performance was led by steady realization and QoQ reduction in opex/t. Further, the integration of Orient Cement/Penna/Sanghi brands with ACC and ACEM was encouraging. The company raised its capacity target to 155mtpa by FY28, as it is adding additional 15mtpa through debottlenecking at various plants. Execution remains a key thing to watch out for given the delay in few ongoing projects.

* We estimate a CAGR of ~14%/29%/30% in consolidated revenue/EBITDA/PAT over FY25-28E, led by volume growth of ~11% and profitability improvement. We estimate its EBITDA/t to increase to INR1,154/INR1,230 in FY27/FY28 vs. INR1,043 in FY26E. ACEM (consol.) trades at 16x/14x FY27E/FY28E EV/EBITDA and USD138/USD128 EV/t. We value the stock at 20x Sep’27E EV/EBITDA to arrive at our TP of INR740. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412