Buy Dabur Ltd for the Target Rs. 575 by Motilal Oswal Financial Services Ltd

Weak quarter; banking on consumption recovery

* Dabur’s 4QFY25 performance was weak but largely in line with our estimate. Consolidated revenue marginally inched up ~1% YoY, while constant currency (cc) growth was ~4%. India volume/value declined 5.0%/5.2% YoY. Dabur took a 3.5% price hike to offset inflation, but it was neutralized by trade schemes and promotions.

* Home & Personal Care revenue fell 3% and oral care declined 5% YoY (base 22%). Healthcare revenue fell 5% YoY due to the delayed winter. Beverages declined 9% YoY due to higher competitive intensity and muted urban consumption. Foods posted 14% growth, led by Hommade coconut milk, Lemoneez etc. Badshah saw 6% growth YoY, with volume up 11% YoY. The international business grew 19% YoY in cc terms and 13% in INR terms.

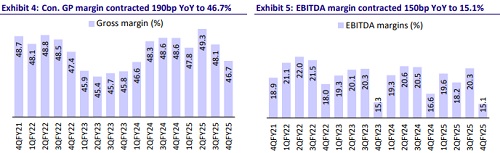

* GM contracted 190bp YoY to 46.7% (est. 49%), while EBITDA margin contracted by 150bp to 15.1% (in line). EBITDA declined 8% YoY.

* Dabur’s growth trajectory is trending below its potential and historical delivery. Most of its initiatives are delivering limited outcomes, which are marred by a high base, seasonality, weak consumption and high competitive intensity. With most of its categories reporting a decline in revenue, the upcoming season will be critical to track. Near-term growth worries persist amid weak summer season demand and slow power brands’ performance. The stock has corrected ~30% in the last nine months owing to sluggish performance compared to peers. However, with a positive outlook on consumption for FY26, we expect that a gradual performance recovery for Dabur will reflect in the stock price accordingly. We reiterate our BUY rating on the stock with a TP of INR575 (premised on 45x FY27E EPS)..

In-line performance; domestic volume down ~5%

* Weak but in-line performance: Dabur’s 4QFY25 consolidated sales grew ~1% YoY (in line) to INR28.3b (est. INR27.8b) and ~4% in CC terms. India revenue declined 5% and volume fell 5% (est. -4%). EBITDA and adj. PAT fell 8% YoY to INR4.3b and INR3.3b (est.INR4.2b/INR3.1b), respectively.

* HPC business down 3% YoY: Oral Care declined 5% YoY, impacted by a higher base (22% growth in 4QFY24). Meswak and Dabur Herbal performed well. Hair Care declined ~5% YoY. Home care was up 1% YoY, while Skin care grew 8% YoY, led by double-digit growth in Gulabari franchise.

* Healthcare portfolio declined 5% YoY: Health Supplements fell ~4% YoY as delayed and contracted winters impacted Chyawanprash and Honey. The OTC & Ethicals segment declined 8% YoY, as winter-centric products reported a muted performance. Digestives declined 2% YoY.

* Beverages facing high competitive intensity: The foods business delivered 14% growth, while beverages posted a 9% YoY revenue decline, impacted by high competitive intensity and slowdown in urban consumption. Badshah delivered 6% growth YoY with volume growth of 11% YoY.

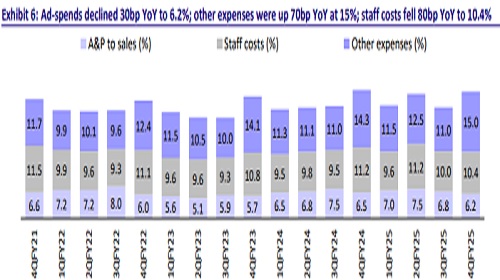

* RM inflation leads to margin pressure: Gross margin contracted 190bp YoY to 46.7% (est. 49%). As a percentage of sales, ad spends declined 30bp YoY to 6.2%, other expenses were up 70bp YoY to 15%, and staff costs fell 80bp YoY to 10.4%. EBITDA margin contracted by 150bp to 15.1% (est. 15%).

* International growth was at 19% in CC terms and 13% in INR terms, led by Egypt, MENA, Turkey and Bangladesh. ? In FY25, net sales grew 1%, whereas EBITDA/APAT declined 4% each.

Highlights from the management commentary

* FMCG demand trends remained subdued amid high food inflation and a surge in the cost of living, which limited urban spending during 4QFY25.

* Emerging channels, comprising Modern Trade, E-Commerce and Quick Commerce, grew in double digits, although general trade in urban markets remained under pressure.

* Most of the price increases by Dabur were largely negated by certain trade promotions; hence, gross margin was impacted. Inflation was ~5%, while price hike was ~3.5% by Dabur in 4Q. This price hike will flow into 1QFY26 as well.

* For FY26, Dabur aspires to post high-single-digit value growth and increase its operating margin.

* Dabur plans to achieve a sustainable double-digit CAGR by FY28 in revenue and profit. To achieve this, it has mentioned seven parameters: 1) it will continue to invest in core brands as they contribute ~70% of sales; 2) premiumization across categories; 3) bold bets across Health & Wellness spaces; 4) streamlined portfolio - Rationalization of underperforming products/SKUs; 5) GTM 2.0 – Distributor consolidation, optimizing cost to serve, double down on emerging channels and coverage expansion; 6) strategic M&A; 7) operating model refinement – optimize for cost, efficiency, agility and digitization across value chain.

Valuation and view

* We cut our EPS estimates by 3% for FY26 and 4% for FY27 given the weak operational performance.

* Despite taking price hikes, Dabur is unable to offset the impact of inflationary pressures. However, backed by disciplined cost control, operational efficiencies, and improving macro scenario, we expect its growth outlook to improve gradually. With a broader distribution reach (to ~0.13m villages and ~7.9m outlets), increased direct penetration (~1.4m outlets), and extensive presence/categorical leadership in the rural market, DABUR is better positioned to capitalize on the rural consumption trend compared to its peers.

* Operating margin, which has been hovering around 20% over the last 8-9 years (unlike its peers that have experienced expansions), has room for expansion in the medium term.

* We reiterate our BUY rating on the stock with a TP of INR575 (premised on 45x P/E on FY27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412