Buy State Bank of India Ltd for the Target Rs. 915 by Motilal Oswal Financial Services Ltd

Earnings in line; Treasury gains offset high opex, provisions

Reduction in repo rate to keep margins under check

* State Bank of India (SBIN) reported a 4QFY25 PAT of INR186.4b (in line) with robust treasury gains offsetting higher opex and provisions.

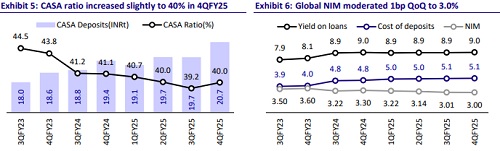

* NII grew 3% YoY to INR427.7b (in line). NIM stood at 3.0% (1bp QoQ dip) with domestic NIM holding stable at 3.15%.

* Opex grew 18% YoY to INR357b (19% higher than MOFSLe). This was led by a spike in overhead expenses, which stood at INR176.9b (vs. INR128.6b in 3Q).

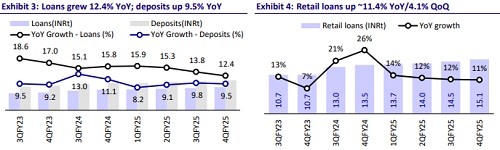

* SBIN’s loan book grew 12% YoY / 4% QoQ while deposits grew 9% YoY / 3% QoQ. CASA ratio increased 77bp QoQ to ~40%.

* Slippages during 4QFY25 stood at INR42.2b (0.42% annualized). The GNPA ratio improved 25bp QoQ to 1.82%, while NNPA improved 6bp QoQ to 0.47%. The PCR ratio stood broadly stable at 74.2%.

* We cut our earnings estimates by 4.6%/5.0% for FY26/FY27 due to higher provisions and NIM pressures. We expect FY27 RoA/RoE at 1.0%/16.1%. Reiterate BUY with a TP of INR915 (based on 1.2x FY27E ABV).

Loan growth guidance at 12-13%; asset quality ratios improve

* SBIN reported a 4QFY25 PAT of INR186.4b (in line) with robust treasury gains offsetting higher opex and provisions. In FY25, earnings grew 16% YoY to INR709b.

* NII grew 3% YoY to INR427.7b (in line). NIM stood at 3.0% (1bp QoQ decline). Provisions surged 300% YoY to INR64.4b.

* Other income grew 39% YoY to INR 242.1b (64% beat). This was led by robust treasury income of INR68.8b aided by provisioning write-backs of INR38.75b on SRs issued by NARCL.

* Opex grew 18% YoY to INR357b (19% higher than MOFSLe), resulting in 9% YoY growth in PPoP to INR312.9b. C/I ratio declined 184bp QoQ to 53.3%.

* Advances grew 12.4% YoY/4% QoQ. Of this, Retail grew 11.4% YoY, Corporate rose 9% YoY, and Agri/SME increased by 14.3%/16.9% YoY. Within Retail, Xpress credit saw a flattish growth of 0.5% QoQ (1.5% YoY).

* Deposits grew 9.5% YoY/2.9% QoQ, with the CASA ratio increasing 77bp QoQ to 40%. The domestic CD ratio was up 77bp QoQ to 69.7%.

* Slippages during 4QFY25 stood at INR42.2b (0.42% annualized). The GNPA ratio improved 25bp QoQ to 1.82%, while NNPA improved 6bp QoQ to 0.47%. The PCR ratio stood broadly stable at 74.2%. Credit costs for FY25 stood at 0.38%. SMA book stood at 8bp vs. 24bp in 3QFY25.

* Subsidiaries: SBICARD clocked a PAT of INR5.3b (down 19% YoY). SBILIFE’s PAT remained flat YoY to INR8.1b. PAT of the AMC business grew 6% YoY to INR6.1b, while SBI General reported a profit of INR50m.

Highlights from the management commentary

* Factoring in another ~50bp rate cut and with certain levers on the cost front, SBIN expects to maintain NIM around ~3% levels on a full-year basis with some quarterly variations.

* The bank aims to maintain an RoA at ~1% levels on an annual basis (with some quarterly variances).

* SBIN has three performance-linked payments: 1) industry agreed upon incentive – part of staff expenses, 2) 1% of profit allocated to performance-linked incentive based on grid – part of staff expenses, and 3) SBIN has for the first time introduced PLI scheme for the chief manager and above level – which is a part of overheads and is subject to government approval.

Valuation and view

SBIN reported in-line earnings as higher provisions and opex were offset by higher other income, while margins held broadly stable (1bp QoQ decline). Management expects NIM to remain under pressure due to the rate cuts; however, the bank has some offsetting levers like an increase in CD ratio, a higher MCLR-linked book, and yield benefits from the recent increase in MCLR rates. Credit grew 12% YoY, while the unsecured book (Xpress Credit) saw a flat trend. SBIN expects credit growth to remain ~12-13% in FY26. The deposit book grew 9.5% YoY, while the CASA ratio remained at 40%. The bank has seen an increase in its domestic CD ratio to ~69.7%. Fresh slippages were contained, which underscores improvements in underwriting standards. The restructured book was well under control at 0.31% of advances. We cut our earnings estimate by 4.6%/5.0% for FY26/FY27 due to NIM and provisioning pressures and expect FY27E RoA/RoE at 1.0%/16.1%. We reiterate our BUY rating with a TP of INR915 (premised on 1.2x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Bank of India, Mumbai North Zone Hosts ``Pravasi Sampark`` ? NRI Meet