Buy IndusInd Bank Ltd For Target Rs.1,100 by Motilal Oswal Financial Services Ltd

RBI approves re-appointment of MD and CEO for one year

* Leadership uncertainty remains; maintain BUY with reduced TP of INR1,100

* The RBI has approved the reappointment of Mr. Sumant Kathpalia as MD & CEO of the bank for a one-year term, effective 24th Mar’25, following the conclusion of his current term. This marks the second instance when the MD’s term extension has been shorter than the board’s proposal.

* The extension has come amid heightened speculation, and a one-year term will keep uncertainties lingering around the potential leadership transition at the bank. On the other hand, this also gives the bank adequate time to regain normalcy in operations, work on management succession, and address the gaps with the regulator in a planned manner.

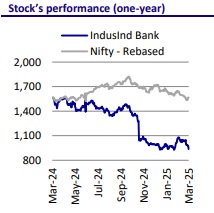

* IIB has reported a muted performance over the past few quarters, led by a combination of factors, including a slowdown in loan growth, asset quality stress and subdued margin performance, all of which have resulted in a ~40% correction in the bank’s stock price over FY25YTD. Additionally, the speculation regarding the MD’s term extension has contributed to further de-rating in the stock price.

* We cut our FY26E/FY27E earnings by 9%/10% and estimate IIB to deliver RoA of 1.3%/1.4% in FY26/FY27. We believe that at the current valuations IIB is already pricing in most of these uncertainties, and notwithstanding near-term negativity, we find the current valuations inexpensive, particularly as operating performance starts to recover in FY26. Maintain BUY with a revised TP of INR1,100.

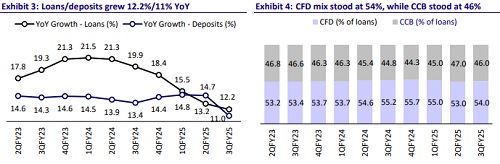

Estimate loan growth to sustain at ~13% CAGR over FY25-27E

* While the bank had seen healthy growth in the past two years (FY22-24) at ~19% CAGR, the stress build-up in MFI (~9% of loans) and the slowdown in CV business (~25% of loans) have resulted in slower growth in FY25E at ~10%. We estimate a gradual recovery over FY26 as stress in the MFI segment subsides, along with a recovery in the CV cycle. With corporate and commercial banking business well under control and market share stable at 46%, we expect the bank to clock a 13% CAGR over FY25-27E.

Asset quality to remain under stress; expect recovery in 2QFY26

* IIB has been navigating through the stress over the recent period amid stress in the MFI/Card businesses and a slowdown in the vehicle segment. While some early relieving signs are visible in DPD 0+ bucket, slippages are likely to remain elevated in the near term, led by the forward flows witnessed in the prior quarters. As a result, we expect slippages to show an improving trend over FY26, with much more clarity from 2H onward. We are factoring in a credit cost of 1.4% in FY26E (vs. 1.8% in FY25). IIB has a contingency buffer of INR13.2b, which corresponds to 0.36% of loans.

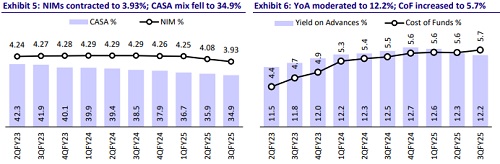

NIMs to remain under pressure; expect some relief in 2HFY26

IIB has witnessed a 36bp NIM compression over the past one year (15bp QoQ NIM decline in 3QFY25). We expect near-term margins to remain soft, affected by high slippages and a decline in the mix of high-yielding MFI business. The reversal in the repo rate cycle by the RBI will further impact lending yields. However, with the majority of the book being fixed-rate and higher linkage to MCLR within the floating rate loan book, we expect IIB to report a stable/positive margin trajectory from 2HFY26 onward. This, coupled with a gradual moderation in the credit cost, will support return ratios over the coming years. We, thus, expect RoA to recover to 1.3%/1.4% over FY26E/FY27E after bottoming out at 1.1% in FY25E.

RBI has approved a one-year term amid heightened speculation

The RBI’s extension for a one-year term to incumbent MD & CEO will keep uncertainties lingering around the potential leadership transition. On the other hand, this gives the bank adequate time to regain normalcy in operations, work on management succession, and address the gaps with the regulator in a planned manner without disrupting the operating performance of the bank.

Valuation and view: Near-term negativity remains; retain BUY on inexpensive valuations

* IIB has reported a muted performance over the past few quarters, led by a combination of factors, including a slowdown in loan growth, high slippages and provisions, and subdued margin performance, all of which have resulted in the stock price declining by 39.4%/3.6% over FY25YTD/CY25YTD. Additionally, the speculation regarding the MD’s term extension has contributed to further de-rating in the stock price.

* We cut our FY26E/FY27E earnings by 9.3%/10% and estimate IIB to deliver RoA of 1.3%/1.4% over FY26E/FY27E.

* We believe that at the current valuations, IIB is already pricing in most of these uncertainties, and notwithstanding near-term negativity, we believe the current valuations are inexpensive in context to the potential earnings and growth outlook. We maintain BUY with a revised TP of INR1,100 (1.1x Sep’26E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412