Neutral IndusInd Bank Ltd for the Target Rs.830 by Motilal Oswal Financial Services Ltd

Operating metrics regaining stability after 4Q reset

Asset quality deteriorates; Adjusted NIM declines 12bp QoQ

* IndusInd Bank (IIB) reported a 1QFY26 PAT of ~INR6b (72% YoY decline, 6% beat) led by better NII. Due to several one-offs in 4QFY25, the bank reported a loss; however, it has now returned to profitability.

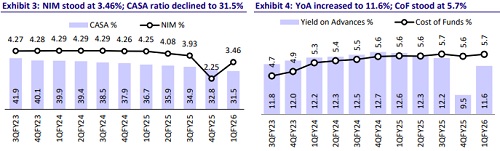

* NII declined 14% YoY to INR46.4b (12% beat), as reported NIMs stood at 3.46% (down 79bp YoY/ and up 121bp QoQ). Adjusted for one-offs, NIM contracted by 12bp QoQ.

* IIB’s other income declined 12% YoY (up 204% QoQ) to INR21.6b (11% miss). Operating expenses were up 8.5% YoY/flat QoQ at INR42.3b (in line). The C/I ratio stood at 62.2% for the quarter.

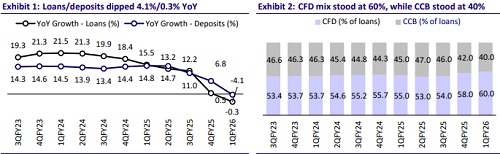

* Loan book declined 3.3% QoQ (down 4.1% YoY), while deposits also declined 3.3% QoQ (flat YoY). The CD ratio thus stood at 84%.

* Fresh slippages were INR25.7b vs. INR50b in 4QFY25 (due to one-offs) and INR15.4b in 1QFY25. Asset quality deteriorated, with the GNPA/NNPA ratio rising 51bp/17bp QoQ to 3.64%/1.12%. The PCR stood stable at 70.2%.

* We marginally raise our earnings estimates by 2.6%/2.3% for FY26/FY27 and project IIB’s RoA/RoE at 0.7%/6.4% for FY27. Reiterate NEUTRAL with a TP of INR830 (premised on 0.9x FY27E BV).

Business growth muted; retail mix rises to 60%

* IIB returned to profitability in 1QFY26, with a PAT of INR6b (72% YoY decline, 6% beat). NII declined 14% YoY to INR46.4b (12% beat). Adjusted for one-offs, NIM contracted 12bp QoQ. The bank delivered 11bp of positive impact on NIM due to the one-offs from interest reversal on IT refund and interest recovery in one account.

* Other income dipped 12% YoY to INR21.6b (11% miss) amid lower fee income. Treasury income stood at INR6.3b vs INR3.6b in 4QFY25. Operating expenses were up 8.5% YoY/flat QoQ at INR42.3b (in line). The C/I ratio stood at 62.2%. The PPoP thus stood at INR25.7b (35% YoY decline; 13% above MOFSLe).

* On the business front, IIB’s loans declined 4% YoY (down 3.3% QoQ), due to a sharp drop in the corporate and commercial books (down 16% YoY/7.7% QoQ), as the bank has run down certain corporate assets. Meanwhile, the consumer book remained flat QoQ, despite the MFI book declining 8% QoQ. Within the consumer business, the VF business grew 7.3% YoY/0.8% QoQ, while the cards business remained flat sequentially.

* Deposits declined 3.3% QoQ (flat YoY), while the CASA book declined 14.5% YoY/ 7.3% QoQ. IIB’s CASA ratio declined 133bp QoQ to 31.5%. Retail deposits as per LCR increased to 46% for the quarter.

* Fresh slippages stood elevated at INR25.7b vs INR50b in 4QFY25 (due to oneoffs) and INR15.4b in 1QFY25. Asset quality deteriorated, with the GNPA/NNPA ratio rising 51bp/17bp QoQ to 3.64% / 1.12%. The PCR stood stable at 70.2%. During the quarter, IIB’s restructured book declined 2bp QoQ to 0.10%.

Highlights from the management commentary

* The Board is focused on five key priorities: 1) The profitability-first approach (reduced deposit rates), 2) stringent cost management (implemented by all business units), working on containing opex to single digits, 3) heightened focus on recoveries, 4) building the One IndusInd franchise, and 5) effective engagement with stakeholders.

* IIB exited bulk and CD funding, resulting in higher retail and granular deposits.

* Bank book mix: Fixed stood at 55-58%, EBLR at 27%, and MCLR at 13%.

* MFI will take six months to stabilize and has come down to INR9b of slippages, although it is still elevated. Other slippages, ex-MFI, were quite stable.

Valuation and view

IIB returned to profitability in 1QFY26 after reporting a loss in previous quarters due to several one-offs. Other income was hit by lower fee income, but treasury gains and NII led to a slight beat on earnings. Adj. NIM contracted 12bp QoQ.. The advances book declined as the bank strategically reduced its corporate lending. Management expects vehicle finance demand to remain subdued. Deposit growth remained muted as the bank exited bulk and CD funding, though the CD ratio remained comfortable at 84%. The asset quality deteriorated primarily due to MFI, and management expects it to take six months to stabilize. We slightly raise our earnings estimates by 2.6%/2.3% for FY26/27 as the bank is focusing on containing costs and is adopting a profitability-first approach. We estimate an RoA/RoE of 0.7%/6.4% for FY27. Reiterate NEUTRAL with a TP of INR830 (premised on 0.9x FY27E BV). The appointment of a new CEO and the pace of business recovery will be the key near-term monitorables.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412