Buy CAMS Ltd for the Target Rs. 4,300 by Motilal Oswal Financial Services Ltd

Yield pressures likely; non-MF growth to remain strong

* CAMS reported operating revenue of INR3.6b in 4QFY25 (7% beat), up 15% YoY. For FY25, operating revenue grew 25% YoY to ~INR14.2b.

* Total operating expenses grew 18% YoY to INR1.97b. Employee expenses/other expenses rose 12%/27% YoY to ~INR1.2b/INR790m. EBITDA increased 11% YoY to INR1.6b, reflecting EBITDA margin of 44.7% (vs. 46.2% in 4QFY24 and our est. of 40.7%). For FY25, EBITDA grew 29% YoY to INR6.5b.

* PAT grew 10% YoY to INR1.1b (15% beat) in 4QFY25, driven by strong topline growth. For FY25, PAT rose 32% YoY to INR4.6b.

* The non-MF business recorded a revenue run rate of ~INR2b in FY25, with management projecting 25% growth in FY26, driven mainly by CAMSPay, AIF, and KRA, which would add around INR500m. EBITDA margins for Non MF were around 10-15% in FY25 and are expected to rise to ~20% in FY26.

* We have cut our earnings estimates by 5% each for FY26/FY27 to factor in: 1) lower assumption in AUM growth, given market sentiment, and 2) the decline in yields as guided by the management. We expect revenue/PAT to post a CAGR of 12%/13% over FY25-27E. We reiterate a BUY rating on the stock with a one-year TP of INR4,300, premised at a P/E multiple of 35x on FY27E earnings.

CAMSPay, CAMS Alternatives, and CAMSKRA driving non-MF growth

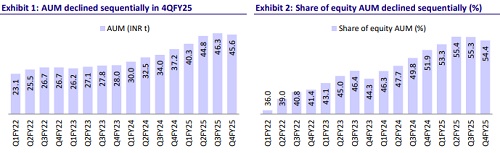

* QAUM grew 23% YoY but declined 2% QoQ to INR45.6t in 4QFY25. The share of Equity AUM grew to 54.4% in 4QFY25 from 51.9% in 4QFY24 but declined from 55.3% in 3QFY25. Equity AUM rose 28% YoY to INR24.8t.

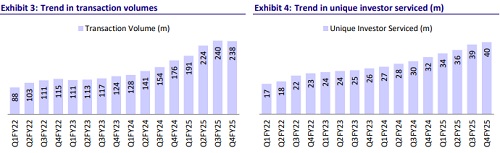

* Transaction volumes increased 36% YoY to 238m, with SIP transactions up 42% YoY to 197.4m. Live folios grew 30% YoY to 94.2m.

* MF segment’s revenue grew 14% YoY to INR3.1b, contributing ~86.3% to total revenue. MF asset-based contributions accounted for ~72.6% of total MF revenue, while non-asset contributions made up ~13.7%.

* CAMS alternatives continued to scale up thanks to strong signings (56 new mandates in 4Q), bringing the total to more than 200. GIFT City saw good traction, with CAMS serving more than 30 clients with assets nearing USD1.2b.

* CAMSPay registered stellar revenue growth of 85% YoY, driven by a surge in digital payments and growing traction from new segments. Currently 55% of revenue comes from MF segment. With a stronger growth in non-MF segment, the share of MF segment is expected to reduce to 40% in FY26.

* CAMS KRA revenue grew 31% YoY despite a decline in new account openings. Recently, the company signed three leading brokerage clients and over 20 new FIs and fintechs.

* CAMSRep witnessed strong momentum in policy additions, with the annual run rate doubling from 1-1.5m per year. Integration with LIC is expected to further boost the momentum. It holds ~40% of market share servicing more than 11m e-policies.

* Other income came in at INR134m vs. INR149m in 4QFY24.

* Total expenses came in at INR2b vs. INR1.7b in 4QFY25. 4Q CIR stood at 55.3% vs. 53.8% in 4QFY24 and 53.3% in 3QFY25.

* Employee costs/other expenses rose 12%/27% YoY (in line) to INR1.2b/INR790m. Management guided for employee costs to remain at ~33% of total revenue (due to slowdown in the hirings and some rationalization of manpower in the core business) and other operating expenses to remain stable.

Key takeaways from the management commentary

* For FY26, management expects EBITDA margins to decline to ~44%, driven by a muted AUM growth outlook of ~11-12%, translating into ~8-9% revenue growth. However, they do not foresee a further drop in margins, citing a stable MF segment, controlled costs, and continued contributions from the non-MF side.

* AUM contraction and a lower share of equity assets in the mix sequentially led to yield compression. Management has guided for yields to drop to 2.14bp by 4QFY26.

* Regarding capex spends, for FY26, management plans to spend ~INR1b on platform re-architecture and an additional INR700m on other capex items.

Valuation and view

* Empirically, CAMS has traded at a premium to listed AMCs in terms of one-year forward P/E. This premium is well deserved, given: 1) the duopoly nature of the industry and high entry barriers, 2) the relatively low risk of market share loss, and 3) higher customer ownership compared to AMCs.

* Despite weak market sentiment in 4QFY25, SIP flows for the industry have been healthy. With a recovery in markets, the momentum should improve. Non-MF businesses continue to gain strong traction for CAMS, which will offset the relatively weak performance of core business.

* We have cut our earnings estimates by 5% each for FY26/FY27 to factor in: 1) lower assumption in AUM growth, given market sentiment, and 2) the decline in yields as guided by management. We expect revenue/PAT to post a CAGR of 12%/13% over FY25-27E. We reiterate a BUY rating on the stock with a one-year TP of INR4,300, premised at a P/E multiple of 35x on FY27E earnings.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412