Buy HDFC Life Insurance Ltd For Target Rs. 850 by Motilal Oswal Financial Services Ltd

VNB margin beats estimate; APE growth weak

HDFC Life Insurance (HDFCLIFE) reported APE of INR51.9b (in line) in 4QFY25, up 10% YoY, driven by 9%/13% YoY growth in individual/group APE. For FY25, APE grew 16% YoY to INR154.8b.

* VNB grew 12% YoY to INR13.8b (in line) in 4QFY25, resulting in 13% YoY growth in FY25 VNB to INR39.6b. VNB margin for 4QFY25 came in 30bp above our estimate at 26.5% vs. 26.1% in 3QFY25/4QFY24, driven by higher rider attachment in ULIPs and sales of longer-term policies. For FY25, VNB margin was at 25.6% (vs. 26.3% in FY24).

* PAT increased 16% YoY to INR4.8b (15% miss) in 4QFY25. For FY25, PAT grew 15% YoY to INR18b, driven by back-book surplus.

* APE growth is expected to moderate in FY26 to mid-teens. VNB margins will remain range-bound as the company continues to invest the surplus in agent productivity enhancement and technology transformation.

* We have trimmed our VNB margin assumptions by 20bp/30bp in FY26/27, keeping our APE and EV estimates unchanged. We estimate HDFCLIFE to deliver a 19% VNB CAGR over FY25-FY27E and margins to gradually trend higher going ahead. Reiterate BUY with a TP of INR850 (based on 2.4x FY27E EV).

VNB margin expands as product-level margins improve

* For 4QFY25, HDFCLIFE reported 15% YoY growth in gross premium to INR240b (in line), driven by 9%/15% YoY growth in first-year/ renewal premium. For FY25, gross premium grew 13% YoY to INR710b.

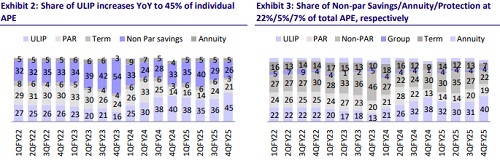

* Overall APE growth of 8% YoY was driven by strong growth of 270%/63% YoY in group/par business, while ULIP/annuity maintained stable momentum (+15%/31% YoY). This was offset by 18% YoY decline in non-par APE.

* Individual APE growth was 14% YoY, led by 22%/59% YoY growth in ULIP/Par segment. Share of ULIPs was 40% in overall APE and 45% in individual APE vs. 31%/36% in 3QFY25.

* While the share of ULIP remained higher in 4QFY25, VNB margin improved 40bp YoY on account of persistency improvement, a higher level of protection in ULIPs, and an increase in sales of long-term products.

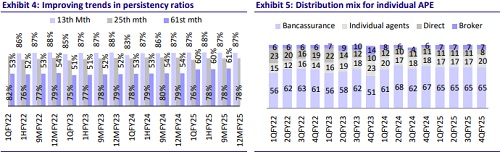

* The overall channel mix between banca/agents/direct/broker has remained largely steady at 65%/20%/8%/7%, with the agency channel’s contribution rising on account of branch expansion, strong agent addition and improved agent efficiency.

* For FY25, the persistency ratio for 13th month was stable, while for 61st month improved 1,000bp to 63.5%.

* Total AUM as of Mar’25 increased by 15% YoY to INR3.3t, with AUM mix for Debt: Equity at 69:31 as of 12MFY25.

* Embedded Value (EV) grew 17% YoY to INR554.2b at the end of FY25, reflecting RoEV of 16.7%. Solvency ratio improved to 194% on account of sub-debt raise of INR20b

Highlights from the management commentary

* Management expects traditional products to perform well, aided by lower interest rates and equity market uncertainty in FY26.

* Apart from the HDFC Bank channel’s support in the sales of higher-margin ULIPs, multiple levers are available for VNB margin improvement, with pricing discipline as the most important aspect. The company also has cost-control measures and cost-efficiency opportunities through process automation.

* The company is undergoing a technology transformation by building real-time service capabilities, which will result in a temporary rise in costs, but customer experience will be elevated and long-term digital leadership will be achieved.

Valuation and view

* HDFCLIFE aims to maintain a balanced product mix and enhance sum assured of ULIPs, along with higher rider attachment to achieve improvement in underlying margins. While product innovation, improved agent productivity and enhanced customer experience through tech transformation will have a short-term impact on profitability, it will boost market share with respect to the number of policies in the long term.

* We have trimmed our VNB margin assumptions by 20bp/30bp in FY26/27, keeping our APE and EV estimates unchanged. We estimate HDFCLIFE to deliver a 19% VNB CAGR over FY25-FY27E and margins to gradually trend higher going ahead. Reiterate BUY with a TP of INR850 (based on 2.4x FY27E EV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412