Buy Indian Hotels Ltd for the Target Rs. 880 by Motilal Oswal Financial Services Ltd

Steady performance amid a high base and extreme weather conditions

Operating performance in line with our estimate

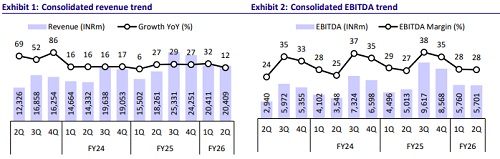

* Indian Hotels (IH) reported steady consolidated revenue growth of 12% YoY in 2QFY26, led by healthy growth in subsidiaries (up 24% YoY), while standalone revenue rose only 2% on the back of renovations, a high base (high-profile weddings in the base quarter), and extreme weather conditions. RevPAR/ARR/OR remained largely flat YoY for its standalone business.

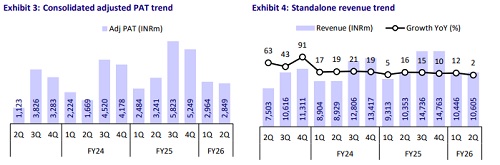

* IH maintained its double-digit revenue guidance for FY26, supported by strong MICE activity in 2H, favorable demand-supply dynamics, and the reavailability of renovated rooms in 2H. We expect IH’s performance to continue its uptrend, with revenue/EBITDA/adj. PAT CAGR of 13%/16%/15% over FY25-28, largely led by room additions and ARR growth, while OR is likely to inch up marginally.

* We broadly maintain our FY26/FY27/FY28 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR880.

Flattish RevPAR growth but consistent margin expansion

* 2Q consolidated revenue/EBITDA grew 12%/14% YoY to INR20.4b/INR5.7b, while Adj. PAT declined 12% YoY to INR2.9b (all in line with estimates). The decline in Adj. PAT was due to the one-time fair value adjustment (gain) of INR3b during the integration of TajSATS. Excluding this, Adj. PAT grew 15% YoY.

* Standalone revenue marginally rose ~2% to INR10.6b, led by flattish RevPAR growth YoY amid a high base and unavailability of rooms due to renovations. EBITDA grew 8% YoY to INR3.7b, with margins expanding 170bp to ~35%, led by continued cost optimization measures. F&B/other services/management fees grew 2%/9%/24% YoY.

* For subsidiaries (consol. less standalone; including TajSATS), sales/EBITDA grew 24%/27% YoY to INR9.8/INR2b. TajSATS revenue/EBITDA grew ~14%/10% YoY.

* International hotels performed better this quarter, with UOH/St. James’ revenue growing 12%/23% YoY. EBITDA for St. James rose 18% YoY, while UOH saw a reduction in losses to INR40m vs INR100m in 2QFY25.

* IH’s new business verticals, comprising Ginger, Qmin, and amã Stays & Trails, grew 22% YoY to INR3.2b in 1HFY26 and aim to grow at 30% in 2HFY26.

* 1HFY26 consolidated Revenue/EBITDA/Adj. PAT grew 21%/21%/2% to INR40.8b/INR11.5b/INR5.8b. For 2HFY26, implied Revenue/EBITDA/Adj. PAT growth is 15%/18%/14%.

* RevPAR/ARR grew 5% each for standalone in 1HFY26, while OR remained flat. Enterprise RevPAR/ARR rose 9%/8%, while OR was marginally higher.

Highlights from the management commentary

* Portfolio: IH inaugurated two Greenfield hotels in Ekta Nagar- Ginger hotel (151 keys) and Vivanta (127 keys), and opened its 250th Hotel Gateway in Goa, Palolem. It also received all approvals for its Taj Bandstand hotel, with excavation work having started a few days ago

* Outlook and demand: IH remains confident of maintaining double-digit growth guidance for FY26, driven by favorable demand-supply dynamics, high-profile diplomatic visits, and the busy wedding season in 2HFY26. The company maintained its capex guidance of INR10-12b for FY26 (spent INR4.8b in 1HFY26), and expects a similar outflow in FY27.

* Renovations and upgrades: In 1HFY26, IH incurred renovation and upgraderelated expenses of ~INR2.5b. Positive benefits from renovations and upgrades on ARR and OR are partially expected in 3QFY26 and fully from 4QFY26 onwards. Major renovation work has been completed as of Oct’25.

Valuation and view

* The outlook continues to remain healthy for IH, led by continued traction in both the core business and new and reimagined businesses.

* We expect the growth momentum to continue in the medium term, led by: 1) a strong room addition pipeline in owned/management hotels (~4,000/18,000 rooms), 2) continued favorable demand-supply dynamics, and 3) increasing MICE activities in India.

* We broadly maintain our FY26/FY27/FY28 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR880.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412