Buy Indian Bank Ltd for the Target Rs. 900 by Motilal Oswal Financial Services Ltd

Steady quarter; asset quality remains robust

Well on track to bridge ECL provisioning gap in Year 1 itself

* Indian Bank (INBK) reported 2QFY26 PAT of INR30.2b (up 11.5% YoY/1.5% QoQ, 3% beat), aided by steady margins and lower provisions.

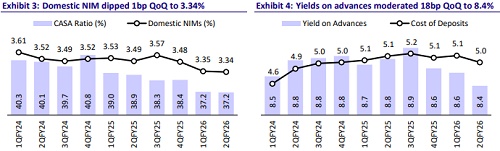

* NII was up 5.8% YoY/3% QoQ at INR65.5b (3% beat). Reported NIMs stood flat QoQ at 3.23%.

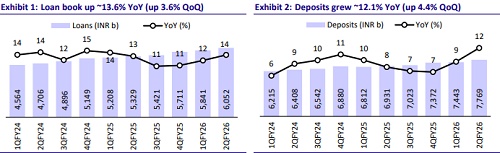

* Business growth was healthy, with net advances growing 13.6% YoY/3.6% QoQ and deposits up 12.1% YoY/4.4% QoQ. Consequently, the C/D ratio decreased 59bp QoQ to 77.9%. CASA ratio was flat at 37.2%, with domestic CASA ratio at 38.9%.

* Fresh slippages improved to INR11.6b vs. INR13.8b in 1QFY26 and INR14.3b in 4QFY25. GNPA/NNPA ratios continued to improve by 41bp/2bp QoQ to 2.6%/0.16%. PCR stood at 93.9%. The bank has commenced accelerated provisioning on SMA-1 and SMA-2 exposures and aims to bridge the entire provisioning gap within the first year of the ECL transition against a prescribed timeline of five years even as it maintains a similar PCR.

* We increase our earnings estimates marginally by 2.3%/1% for FY26/FY27 and anticipate the bank to deliver FY27E RoA/RoE of 1.31%/17.0%. Reiterate BUY with a TP of INR900 (premised on 1.4x FY27E BV).

NIMs stood flat; Bank makes SMA-1 provisioning of INR4b

* INBK reported 2QFY26 PAT of INR30.2b (up 11.5% YoY/1.5% QoQ), aided by steady NII and lower-than-expected provisions.

* NII increased 5.8% YoY/3% QoQ to INR65.5b. NIM stood flat QoQ at 3.23%. With 40% of the MCLR-linked book due for repricing in 3Q, the bank expects NIMs to bottom out in 3Q, followed by an improvement in 4Q.

* Other income grew 2.7% YoY (up 2% QoQ) to INR24.9b (in line), resulting in 4.9% YoY growth (2.7% QoQ) in total revenue (in line). Treasury income declined to INR1.4b vs. INR3.8b in 1QFY26.

* Opex grew 8.1% YoY (up 4.3% QoQ, largely in line). As a result, C/I ratio inched up to 46.5% from 45.8% in 1QFY26. PPoP grew ~2.3% YoY (up 1.4% QoQ) to INR48.4b (in line).

* Advances grew by a healthy 13.6% YoY/3.6% QoQ to ~INR6.05t, led by retail and MSME loans. Retail loans grew 18.6% YoY/5.5% QoQ. Within retail, housing grew 4.7% QoQ and VF rose 12.2% QoQ. Agri advances grew 1.4% QoQ, while corporate grew by 2.7% QoQ.

* Deposits grew 12.1% YoY (4.4% QoQ), with CASA growth at 7.2% YoY/4.2% QoQ. Domestic CASA ratio was largely flat at 38.9% (down 10bp QoQ). C/D ratio moderated 59bp QoQ to 77.9%.

* Fresh slippages improved to INR11.6b vs. INR13.8b in 1QFY26 and INR14.3b in 4QFY25. GNPA/NNPA ratios continued to improve by 41bp/2bp QoQ to 2.6%/0.16%. PCR stood at 93.9%.

* SMA-2 book declined to INR14.5b. The restructured portfolio fell to INR43.5b or 0.72% of loans (vs. 0.78% in 1QFY26).

Highlights from the management commentary

* Around 40% of the MCLR-linked book will reprice in 3Q, but the overall impact is expected to be limited.

* Approximately 50-60% of the book has already undergone repricing, with the remaining one-year MCLR loans set to reprice in 3Q.

* The bank has started making provisions of 5% on SMA-1 and 10% on SMA-2 exposures. It has thus provided INR4b during 2QFY26.

Valuation and view

INBK reported steady performance, driven by stable margins and lower-thanexpected provisions. With 40% of MCLR book to be repriced, the bank expects NIMs to bottom out in 3Q, with improvement starting to show up from 4Q onward. Business growth was healthy, with good traction in both advances and deposits. The bank has commenced accelerated provisioning on SMA-1 and SMA-2 exposures and aims to bridge the entire provisioning gap within the first year of the ECL transition against a prescribed timeline of five years even as it maintains a similar PCR. Asset quality ratios improved, with INBK maintaining the best-in-class coverage ratio and lower slippages, which provides comfort on incremental credit costs. We increase our earnings estimates marginally by 2.3%/1% for FY26/FY27 and anticipate the bank to deliver FY27E RoA/RoE of 1.31%/17.0%. Reiterate BUY with a revised TP of INR900 (premised on 1.4x FY27E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412