Neutral Bharti Hexacom Ltd for the Target Rs. 1,975 by Motilal Oswal Financial Services Ltd

Relatively weaker 2Q as subscriber base dips QoQ

* Bharti Hexacom (BHL) underperformed in 2QFY26, with customer wireless revenue growth of ~1.7% (vs. ~2.6% for Airtel) as its subscriber base declined. EBITDA (up 4% QoQ) was ~2% below our estimate as network opex remained high (up 11% YoY).

* Similar to Bharti, BHL’s capex also surged in 2QFY26, which led to moderation in FCF generation to INR4.4b (vs. INR8.9b QoQ). Net debt (excleases) was broadly stable QoQ at INR28b (with leverage at modest 0.64x).

* BHL provides a pure-play exposure to Bharti Airtel’s fast-growing India wireless and home broadband segments with slightly better growth prospects and lower capital misallocation concerns.

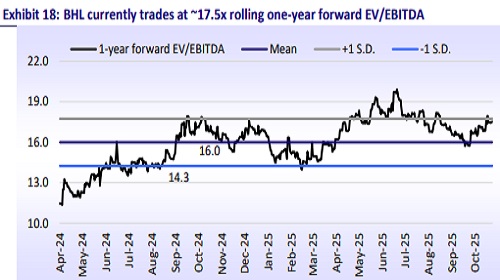

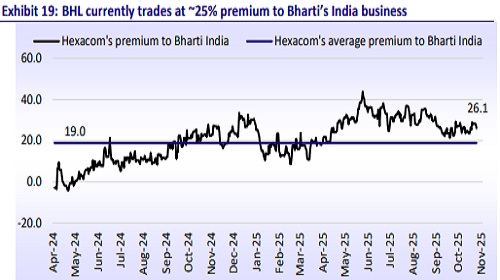

* However, since its listing, the stock has re-rated significantly and now trades at ~17.5x one-year forward EV/EBITDA (~25% premium to Bharti’s India business (ex-Indus). We believe such a sharp premium is unjustified.

* We cut our FY26-28E EBITDA by ~1-2% and model a CAGR of ~12%/20% in BHL’s revenue/EBITDA over FY25-28E, driven by ~15% tariff hike from Dec’25, ramp-up of FWA offerings and continued market share gains.

* We ascribe a DCF-based Dec’27E EV/EBITDA of 14.1x (~10% premium to our multiple for Bharti’s India wireless business) to BHL. Given its significant premium to Bharti for largely similar growth rates, we reiterate our Neutral rating on BHL with a revised TP of INR1,975.

Weaker 2Q as wireless subscriber base declines and network opex remains elevated

* BHL’s overall 2Q revenue at INR23.2b (+11% YoY) grew 2.4% QoQ, with customer revenue rising ~2% QoQ to INR22b.

* BHL’s underlying sequential wireless revenue growth at 2.1% was weaker (vs. ~3% QoQ for RJio, including FTTH and Airtel’s India wireless) driven by subscriber base decline (pronounced seasonality in BHL circles).

* Reported EBITDA at INR12.1b (+21% YoY, +4% QoQ) came in 2% below our estimate due to higher network opex (+11% YoY, 9% higher).

* Reported EBITDA margin expanded ~85bp QoQ to 52.1% (+435bp YoY, 140bp below our est.).

* PAT at INR4.2b increased 8% QoQ (up 66% YoY), but was 5% below our estimate due to lower EBITDA and higher D&A.

* Similar to Bharti, BHL’s overall capex surged QoQ to INR3.7b (still -18% YoY).

* BHL’s consolidated free cash flow (after leases and interest payments) moderated QoQ to INR4.4b (vs. INR8.9b QoQ) due to higher capex and actual interest outgo.

* BHL’s net debt (ex-leases) was broadly stable at ~INR28.2b, with leverage ratio moderating to 0.64x (vs. 0.65x QoQ and 1.32x for Bharti India).

* For 1HFY26, BHL’s revenue/EBITDA/adj. PAT grew 14%/26%/82%, driven by the full flow through of the Jun’24 tariff hikes.

* Based on our estimates, the implied revenue/EBITDA/adj. PAT growth run rate for 2HFY26 is 7%/16%/40%.

Wireless: Another quarter of weaker performance vs. Airtel

* BHL’s wireless ARPU grew 1.8% QoQ (vs. 2.3% QoQ for Airtel) to INR251 (+10% YoY, our est. INR250), driven by better subscriber mix and one extra day QoQ.

* Paying subscriber base declined by 110k (vs. +17k QoQ and our est. +140k), resulting in ~10bp QoQ decline in BHL’s share of Airtel’s subs to 7.6%.

* Reported wireless revenue grew 2.1% QoQ (lower vs. ~3% QoQ for RJio/Bharti) to INR22.4b (+10% YoY, vs. our est. INR22.3b) due to weaker net adds. Underlying customer revenue growth was weaker at ~1.7% QoQ (+13% YoY).

* Wireless EBITDA at INR12.3b (+20% YoY, 2% below our estimates) was up ~3% QoQ (+3.5%/+4.2% QoQ RJio, including FTTH/Airtel) due to high network opex.

* Wireless EBITDA margin improved by ~40bp QoQ to 54.8% (+450bp YoY) vs. +90bp QoQ improvement for Airtel’s India wireless business (60.3%).

* Incremental wireless EBITDA margins were robust at ~73% for BHL (vs. ~60%/94% for RJio/Bharti).

Key takeaways from the management interaction

* Subscriber base decline: BHL witnessed pronounced seasonality during the quarter, largely due to migration patterns and heavy monsoons across Rajasthan. This led to a marginal drop in customer base in 2Q. Management highlighted that the seasonality impact was a one-off event and 3Q has started on a strong note, with customer additions normalizing.

* ARPU: ARPU benefited from one additional day in the quarter and continued premiumization trends. The company continues to focus on data monetization and content-led packs, which are driving higher engagement.

* Home Broadband (HBB): HBB business sustained steady momentum, with record quarterly net additions. Management indicated that FWA plays a very important role in BHL circles and the share of customers sign-up for FWA remains high. HBB ARPU declined as newer customers signed up for low-end plans. However, increased preference for content-driven packs is leading to better customer acquisition as well as retention.

* Capex: The quarterly capex trends are impacted by seasonality and prioritization, but directionally capex should be trending downwards in FY26.

* SG&A expenses: There were certain one-offs in SG&A expenses and the trend going ahead should be similar to last two quarters’ average rather than 2Q.

Valuation and view

* BHL provides a pure-play exposure to Bharti Airtel’s fast-growing India wireless and home broadband segments with slightly better growth prospects and lower capital misallocation concerns.

* However, since its listing, the stock has re-rated significantly and now trades at ~17.5x one-year forward EV/EBITDA (~25% premium to Bharti’s India business (ex-Indus).

* We find such a sharp premium to Bharti’s more diversified business to be too steep and do not find the risk-reward attractive for BHL shareholders. We continue to prefer Bharti over BHL.

* We cut our FY26-28E EBITDA by ~1-2% as we model higher network and other opex. We model a CAGR of ~12%/20% in BHL’s revenue/EBITDA over FY25-28E, driven by ~15% tariff hike from Dec’25, ramp-up of FWA offerings and continued market share gains.

* We ascribe a DCF-based Dec’27E EV/EBITDA of 14.1x (~10% premium to our multiple for Bharti’s India wireless business) to BHL. Given its significant premium to Bharti for largely similar growth rates, we reiterate our Neutral rating on BHL with a revised TP of INR1,975.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412