Neutral Bharat Dynamics Ltd for the Target Rs.1,900 by Motilal Oswal Financial Services Ltd

Lock, Load, Succeed!

Securing the skies, expanding the base

Bharat Dynamics (BDL) is a prominent player in missile technology within the defense sector and has established itself as a leading integrator for various missile platforms. With a focus on developing advanced guided missiles, underwater weapons, and airborne products, BDL currently holds an order book of ~INR227b and a prospect pipeline of INR500b. In recent years, BDL’s revenue has been adversely impacted by supply chain disruptions and difficulties in procuring essential components through imports from Russia and Israel. However, these issues are beginning to resolve, and we anticipate a rebound in revenue growth. Along with this, we also expect company to benefit from upcoming emergency procurement pipeline as well as large orders such as QRSAM. We estimate BDL’s revenue CAGR at 35% over FY25-28. With ongoing investments in backward integration and an improved share of indigenized products, we expect BDL’s EBITDA margin to remain strong at ~24-26%. This is anticipated to drive an EBITDA/PAT CAGR of 64%/51% over FY25-28. The stock currently trades at 70x/52x/38x P/E on FY26/FY27/FY28 estimates. We initiate coverage on the stock with a Neutral rating and a TP of INR1,900 based on 42x Sep’27E P/E. We like the business model of BDL and its ability to scale up its revenues and order book in current scenario , however, with fair valuations, we would look for lower price points to enter the stock.

Increased global spending augurs well for Indian defense sector

Nato’s recent announcement to increase defence spending of member countries from historic ~2% to 5% of GDP by CY35 will open up possibilities of 1) India too increasing the defence spend, and 2) export opportunities for defense players. Further, emergency procurement and recent DAC’s approval worth INR1t bodes well for opening up addressable market for players.

Positive industry tailwinds to benefit BDL

We expect BDL’s total addressable market size of ~INR500b. The growth of the missile market in India will be driven by several factors: 1) missile procurements for new naval, airborne, and army platforms such as Project 75I Submarines, LCA Tejas Mk1A, Su30-Mk1, LCH Prachand, ALH Dhruv, QRSAM, MRSAM, NAG, and VSHORAD; 2) ongoing contracted missile procurements, such as S-400 Triumf Advanced Air Defense Systems, Barak-8 Surface to Air Missiles (SAMs), and heavyweight torpedoes; 3) modernization and refurbishment of in-service systems; and 4) export demand, particularly for Akash missile systems.

Emerging as a leading integrator of missile platforms

BDL is a multi-product, multi-location organization that caters to the needs of the Army, Navy, and Air Force. It has evolved from being solely a missile manufacturer to a comprehensive weapon system integrator, working on various missile platforms. BDL is also expanding into new areas, including drone-delivered payloads such as bombs and missiles, as well as mines, guided bombs, warhead manufacturing, engines for cruise missiles, propellants, rockets, et al. The company is also pursuing partnerships with foreign OEMs for new weapons and potential Transfer of Technology (ToT), alongside its collaborations with DRDO programs.

Strong order book and easing supply chain issues to scale up revenue

BDL’s order book stood at ~INR227b at the end of FY25. It experienced remarkable growth, achieving a CAGR of 27% over FY20-24, primarily driven by large-sized order inflows related to the Akash missile, Konkur anti-tank missile, and exports in FY23. Despite maintaining a robust order book, BDL's revenue growth over the past two years was adversely affected by supply chain disruptions stemming from the RussiaUkraine conflict and issues related to Israel. However, based on our discussions with the management, these challenges have subsided to some extent. Consequently, we anticipate that the current order book will be executed over the next 4-5 years, driving a sharp revenue CAGR of 35% over FY25-28.

Focus remains on indigenization

BDL has, over time, reduced the proportion of imports in its overall raw material requirements. Simultaneously, the company is working on indigenizing several platforms, achieving indigenization levels of 80-90% across these platforms. This progress will enable the company to bid directly for projects. BDL is also a development partner with DRDO for nearly 40 products and will benefit product as development matures.

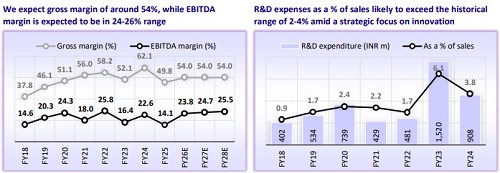

Continuous capacity expansion and investment in R&D to reduce import dependence

BDL is continuously expanding its capacities for backward integration and the development of new products. The company has established an integrated Radio Frequency (RF) Seeker Facility at its Kanchanbagh Unit for the production and testing of RF seekers. Additionally, BDL is increasing its capacity to manufacture Surface-to-Air Missiles (SAMs), including next-generation missiles, Very Short Range Air Defense (VSHORAD) rockets, and propellants for various Anti-Tank Guided Missiles (ATGMs). Over the past two years, the company has significantly increased its R&D expenditure. BDL is actively engaged in new product development and the enhancement of existing products to meet customer requirements. The company is also investing in R&D activities both in-house and in collaboration with DRDO for various development and production programs

Ramping up exports

With the Cabinet Committee on Security’s (CCS) approval for the export of the Akash Weapon System to nine countries, BDL is scaling up the export orders. The company has already secured export contracts from several allied nations, and already scaled up export revenues to INR12b in FY25 from INR1.6b in FY24. The company offers a range of products, including the Akash Weapon System (Surfaceto-Air Missile), Astra Weapon System (Air-to-Air Missile), Smart Anti-Airfield Weapon, Helina (Air-to-Surface Weapon), Lightweight and Heavyweight Torpedoes, Counter Measures Dispensing Systems, and Anti-Tank Guided Missiles such as Nag, Konkurs-M, and Milan-2T. BDL has successfully exported lightweight torpedoes and is attracting interest from multiple countries for its other offerings.

Financial outlook

We expect an overall revenue CAGR of 35% over FY25-28, primarily driven by a sharp scale-up in execution due to moderating supply chain issues. We expect BDL’s EBITDA margin to remain strong at 23.8%/24.7%/25.5% for FY26/FY27/FY28, fueled by the various indigenization efforts taken by the company as well as lower provisions. With an estimated annual capex of INR2.0b/2.5b/3.0b in FY26/FY27/ FY28 and comfortable working capital, we expect PAT to register a 51% CAGR over FY25-28. With improving revenue and stable margins, we expect its RoE/RoCE to remain comfortable, reaching 25.2%/25.6% by FY28.

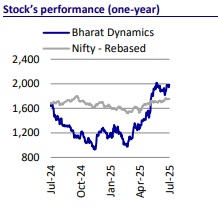

Valuation and recommendation

The stock currently trades at 70x/52x/38x P/E on FY26/27/FY28 estimates. We initiate coverage on the stock with a NEUTRAL rating and a TP of INR1900 based on 42x Sep’27E P/E. We like the business model of BDL and its ability to scale up its revenues and order book in current scenario, however, with fair valuations, we would look for lower price points to enter the stock.

Key risks and concerns

Key risks for the company include a decline or reprioritization of the Indian defense budget, termination of existing contracts or failure to succeed in tendering projects, changes in procurement rules and regulations of the MoD and the government, and supply-chain-related issues.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412