Buy Ajanta Pharma Ltd For Target Rs.3,220 by Motilal Oswal Financial Services Ltd

India/Asia drive earnings

Adding growth levers through newer therapies in the Branded Generics market

* Ajanta Pharma (AJP) delivered a marginally better-than-expected performance in 3QFY25. It has continued to outperform in the Domestic Formulation (DF) market during this quarter. The US generics business remains on a moderate growth trajectory, which impacted 3QFY25 performance to some extent. AJP has ventured into two new therapies in the DF market and plans to introduce additional therapies in the international market as well.

* We largely maintain our estimates for FY25/FY26/FY27. We value AJP at 35x 12M forward earnings to arrive at a TP of INR3,220.

* In addition to gaining market share in existing therapies, AJP is working to add newer therapies and expand its field force to support marketing activities. The company also has sufficient momentum from new launches in the international branded generics market, positioning it for sustained midteens growth over the next three years. Accordingly, almost 70% of the business is derived from the branded generics segment. AJP continues to build a healthy product pipeline for the US market as well. We build a 16% earnings CAGR over FY25-27, driven largely by its diversified portfolio and multiple geographies. Reiterate BUY.

Segment mix benefit substantially offset by higher opex

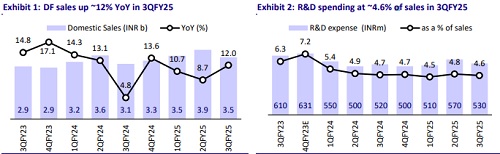

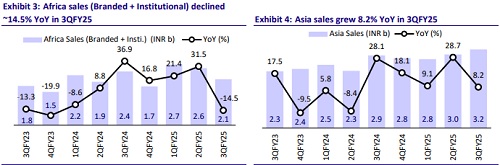

* AJP 3QFY25 revenues grew 3.7% to INR11.5b (our est: INR11.1b), led by growth across all key businesses. DF sale was up 12% YoY to INR3.5b (30% of sales). US generic sales grew 4.4% YoY to INR2.6b (23% of sales). Asia branded generics sales were up 8.2% YoY to INR3.2b (28% of sales). Africa branded generics and institutional sales declined 14.5% YoY to INR2b (18% of sales).

* Gross margin expanded 410bp YoY to 77.5% due to a reduction in raw material costs.

* EBITDA margin contracted ~110bp YoY to 28% (our est. 27.5%) as higher gross margins were offset by an increase in employee costs/other expenses (up 220bp/300bp YoY as % of sales).

* Consequently, EBITDA was flat YoY at INR3.2b (our est. INR3b).

* Adjusting for the Forex gain impact of INR176m, Adj. PAT grew 3.3% YoY to INR2.2b (our est. INR2b).

* During 9MFY25, revenue/EBITDA/PAT grew 10%/14%/20% YoY to INR34.8b/INR10.2b/INR7.2b.

Highlights from the management commentary

* AJP has forayed into new therapies, Gynaecology and Nephrology.

* The company has added 200 MRs in the Gynae and Nephrology segments during the quarter.

* Moreover, it has launched 12 new products in the Gynae and Nephrology segments during the quarter.

* The company launched 26 new products during the 9MFY25, of which eight were first-time launches in India.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)