Neutral Bandhan Bank Ltd for the Target Rs. 170 by Motilal Oswal Financial Services Ltd

Modest quarter; high provisions dent earnings

MFI mix moderated to 41%

* Bandhan Bank (BANDHAN) reported 4QFY25 PAT of INR3.2b (up 480% YoY), 29% below our estimate due to lower other income and higher provisions.

* NII declined 4% YoY/3% QoQ to INR27.6b (in line). Margins contracted 21bp QoQ to 6.7% due to a change in the product mix toward secured advances and higher slippages/interest reversals.

* Opex grew 9.4% YoY to INR18.8b (in line). C/I ratio thus rose to 54.5%.

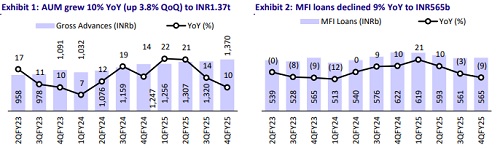

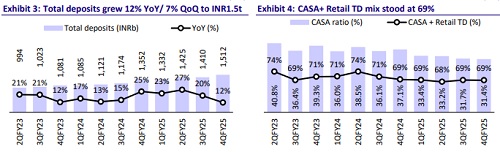

* Net advances grew 9% YoY/4% QoQ, while deposits grew 12% YoY/7.2% QoQ. CASA mix stood at 31.4%. CD ratio improved to 87%.

* GNPA ratio increased 3bp QoQ to 4.7%, while NNPA stood flat at 1.3%. Slippages increased to INR17.5b vs. INR16.2b in 3QFY25 due to continued stress in MFI. SMA book declined 50bp QoQ to 3.3%.

* We cut our earnings estimates by 10%/7% for FY26/FY27 and expect FY27E RoA/RoE of 1.7%/14.3%. Reiterate Neutral with a TP of INR170 (1.0x FY27E ABV).

Asset quality remains under pressure; NIM down 21bp QoQ

* Bandhan reported 4QFY25 PAT of INR3.2b (480% YoY growth, 29% miss), led by lower other income and higher provisions. In FY25, earnings grew 23% YoY to INR27b.

* NII declined 4% YoY/3% QoQ to INR27.6b (in line). Margins declined 21bp QoQ to 6.7%.

* Other income was flat YoY/down 36% QoQ at INR7b (15% miss), resulting in 3% YoY decline in total revenue (5% miss). Opex grew 9.4% YoY to INR18.8b (in line). C/I ratio thus increased to 54.5%. PPoP declined 15% YoY to INR15.7b (8% miss).

* Gross advances grew 9.8% YoY/3.8% QoQ. EEB book declined 9.2% YoY (flat QoQ), whereas non-micro credit book rose 29% YoY (6% QoQ). Mix of EEB moderated to 41%.

* Deposit grew 12% YoY/7.2% QoQ. CASA ratio moderated 36bp QoQ to 31.4%.

* GNPA ratio increased 3bp QoQ to 4.7%, while NNPA remained flat at 1.3%. PCR stood at 73.7%. Slippages increased to INR17.5b from INR16.2b in 3QFY25 due to continued stress in MFI. SMA book declined 50bp QoQ to 3.3%.

Highlights from the management commentary

* The bank aims to expand its asset book with secured advances mix expected at ~55% of total advances by FY27.

* Advances growth is expected at ~15-17% CAGR over the next three years. Deposits are expected to grow more than advances with lower reliance on bulk deposits.

* Bandhan will continue to invest and expects its opex-to-avg asset ratio to increase ~10-20bp over the coming quarters.

* Management suggested credit cost to remain elevated in 1HFY26 and expects 1.5-1.6% over the next 2-3 years. RoA is expected to be ~1.8-1.9% over 2-3 years.

Valuation and view

BANDHAN reported a weak quarter as margins contracted significantly and provisions remained elevated. Loan growth was suppressed as MFI book declined with the segment mix reducing to 41%. The reduction in repo rate and the mix of unsecured/MFI loans will affect margins. Deposit growth was higher than advances growth, though CASA ratio moderated further. Asset quality deteriorated as slippages continued to rise by 72% YoY amid rise in stress in MFI book. We cut our earnings estimates by 10%/7% for FY26/ FY27 and expect FY27E RoA/RoE of 1.7%/14.3%. Reiterate Neutral with a TP of INR170 (1.0x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412