Buy RBL Bank Ltd for the Target Rs.290 by Motilal Oswal Financial Services Ltd

NII in line; controlled provisions lead to earnings beat

Margins moderate 39bp QoQ

* RBL Bank (RBK) reported a 1QFY26 PAT of INR2b (42% beat, 46% YoY decline) amid lower-than-expected provisions.

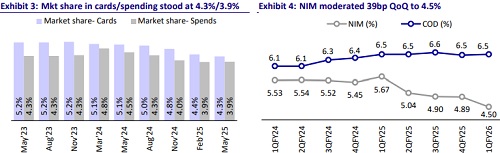

* NII declined 13% YoY (down 5.3% QoQ) to INR14.8b (inline). NIM moderated sharply by 39bp QoQ to 4.5% due to repricing of advances and change in mix.

* Opex grew 12% YoY to INR18.5b (6% higher than MOFSLe) due to higher collection costs in the cards business. The C/I ratio thus rose to 72.4%.

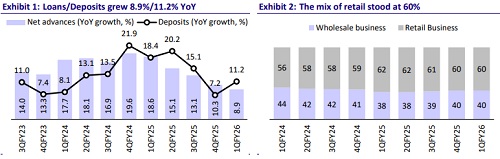

* Advances grew 8.9% YoY/2% QoQ, while deposits grew 11.2% YoY/1.6% QoQ. CASA mix moderated 170bp QoQ to 32.5%. The C/D ratio was 83.8%.

* Fresh slippages stood stable at INR10.6b. GNPA/NNPA ratios increased by 18bp/16bp QoQ to 2.78%/0.45%. PCR moderated to 84%.

* We fine-tune our EPS estimates and project an FY27E RoA/RoE of 1.07%/ 11.4%. Reiterate Buy with a TP of INR290 (premised on 1x FY27E BV).

Guides a mid-teen credit growth in FY26; RoA to improve steadily

* RBK reported a 1QFY26 PAT of INR2b (42% beat, 46% YoY decline) amid lower-than-expected provisions.

* NII declined 13% YoY (down 5.3% QoQ) to INR14.8b (in line). NIM moderated sharply by 39bp QoQ to 4.5% during the quarter.

* Other income grew 33% YoY/7% QoQ to INR10.7b (6% beat). Treasury gains stood at INR2.8b vs. INR300mn in 4QFY25. Total revenue thus grew 2% YoY (flat QoQ) to INR25.5b (in line). Opex rose 12% YoY to INR18.5b (6% higher than MOFSLe). The C/I ratio thus increased 600bp QoQ to 72.4%.

* PPoP declined 18% YoY/QoQ each to INR7b (8% miss). Provisions stood at INR4.4b (up 21% YoY, 23% lower than MOFSLe). The bank has reinstated 1% contingent provisions on JLG and provided INR540m towards this.

* Advances grew 9% YoY (up 2% QoQ) to INR944b. Retail book grew 5.4% YoY (1.6% QoQ), and wholesale grew 15% YoY (2.4% QoQ). Housing loans grew 1.6% QoQ, and business loans were up 4.4% QoQ. Personal loans declined 6% QoQ, and credit cards were flat QoQ, with the mix of cards standing at 18.2% of loans. JLG mix stood at 5.8% of advances.

* Deposits grew 11.2% YoY/1.6% QoQ. CASA mix moderated 170bp QoQ to 32.5%. The C/D ratio was 83.8%. Overall credit growth for FY26 is expected to be in the mid-teens, while the RoA trajectory is likely to improve steadily.

* Fresh slippages stood stable at INR10.6b. GNPA/NNPA ratios increased by 18bp/16bp QoQ to 2.78%/0.45%. PCR moderated to 84%. Restructured book declined to 0.22% (from 0.29% in 4QFY25).

* RBK’s credit costs for 1QFY26 came in at 50bp (including the 6bp contingent provision on JLG loans)

Highlights from the management commentary

* Yield on advances was lower by 48-49bp QoQ due to lower card balances and repo cut. RBK expects a 15-20bp decline in yield on advances in 2QFY26 (would likely bottom out).

* On 4QFY26 exit, NIM would be in the range of 4.8-4.9%. A 15-20bp drop in yield is expected in 2Q. This will be offset by a reduction in deposit rates, which will stabilize the NIM trajectory.

* The unsecured book would grow in single digits, while the secured book growth would be in the early-to-mid-20s.

* Going forward, provisions on JLG would be 25% of fresh slippages, unless there are some material issues. Thus, credit cost would be in the range of 50bp.

Valuation and view

RBK reported a beat on earnings, with margins sharply moderating due to the repo rate cuts. Deposits grew 2% QoQ, with the CASA ratio moderating to 32.5%. Advances also increased 2% QoQ, with the bank expecting it to grow in the mid-teens, with a mid-to-high teen growth in wholesale advances. In addition, the comfortable CD ratio will further support its credit growth. Asset quality ratios deteriorated slightly as slippages continued to remain at elevated levels. Management indicated that credit quality trends would improve going forward, primarily from 2H, which should keep RBK’s credit costs under control. Opex was high due to higher collection costs, as the bank is shifting the collections process in-house. This has resulted in the C/I ratio inching up to 72.4%. The operating leverage benefit would be reflected from 3QFY26 onwards, and the C/I ratio will start trending downwards. We fine-tune our EPS estimates and project an FY27E RoA/RoE of 1.07%/11.4%. Reiterate Buy with a TP of INR290 (premised on 1x FY27E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412