Buy Angel One Ltd for the Target Rs.3,200 by Motilal Oswal Financial Services Ltd

Volume recovery and distribution boost revenue

* Angel One (ANGELONE) reported a total income of INR8.9b (+7% QoQ/- 20% YoY) in 1QFY26, in line with our estimate. Sequential growth was driven by a slight recovery in F&O activity, strong improvement in cash realization, and robust traction in credit distribution.

* Total operating expenses grew 23% QoQ (flattish YoY), driven by higherthan-expected employee costs. Excluding IPL costs (INR1,117m), the company’s admin expenses declined 10% QoQ, in line with the decline in customer additions during the quarter. PAT was in line at INR1.1b (-34% QoQ/-61% YoY) for the quarter.

* The number of orders grew 5% QoQ to 343m. The average MTF book witnessed 5% QoQ growth to INR42.1b. Loan distribution volumes surged to INR2.3b (INR1b in 4QFY25).

* A sequential revenue growth of ~8%, led by improvement in retail activity and scale-up on non-broking segments, will allow the company to clock margins of 40-45% in 4QFY26.

* We broadly retain our EPS estimates as the rise in distribution revenue and higher cash realization are offset by higher employee costs. Reiterate BUY with a one-year TP of INR3,200 (premised on 20x FY27E EPS).

Revenue growth led by F&O recovery and improved cash realization

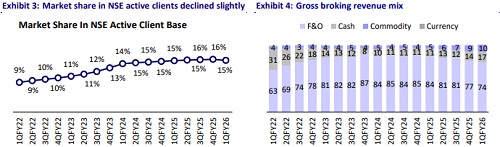

* Gross broking revenue at ~INR7.9b grew 7% QoQ (5% beat), driven by slight recovery in F&O activity (F&O brokerage up 5% QoQ and in-line with expectations), improvement in cash realization (cash brokerage up 29% QoQ and 23% above estimates), and strong growth in commodity activity (commodity brokerage up 20% QoQ and 9% above estimates).

* ANGELONE’s 4QFY25 was the first full quarter facing the F&O regulation impact, after which the F&O orders grew 5% QoQ to 241m in 1QFY26. Revenue per order inched up to INR21.3 (from INR21.2 in 4QFY25).

* A stable market environment led to flattish sequential performance for cash orders at 75m. However, revenue per order increased QoQ to INR15.2, driven by higher ticket sizes and strong MTF activity.

* Commodity orders grew 23% sequentially to 27m.

* Average client funding book grew 4% QoQ to INR42.1b (INR40.3b in 4QFY25), resulting in a 6% sequential growth in net interest income to INR2.7b (in line). Management expects the momentum to be sustained by various initiatives being taken towards MTF book growth. The exit MTF book stood at INR48b.

* Credit distribution was INR2.3b during the quarter vs. INR1b in 4QFY25 (INR7b cumulative as of Mar’25). This resulted in a 63% sequential growth in distribution income, taking other income to INR961m (+11% QoQ and 11% above our estimate).

* As of 30th Jun’25, the wealth platform had an AUM of INR50.6b across ~1,000 clients. Asset management AUM stood at INR3.4b spread across five products.

Rise in employee expenses and IPL costs leads to an elevated C/I ratio

* ANGELONE’s total operating expenses grew 23% QoQ, led by IPL costs of INR1,117m and 47% sequential growth in employee expenses in 1QFY26. On a QoQ basis, the CI ratio increased to 78.2% in 1QFY26 from 68.2% in 4QFY25.

* Employee costs included ESOP costs of INR465m (+38% QoQ) and employee benefit expenses of INR2,274m (+49% QoQ), resulting in 11% higher total employee expenses than our estimates.

* Admin and other expenses grew 12% QoQ to INR4.2b, owing to IPL costs of INR1,117m. Excluding IPL costs, other expenses declined sequentially, in line with a drop in client additions.

Highlights from the management commentary

* ESOP cost is expected to amount to INR2.1b for FY26, spread out over the remaining three quarters at ~INR550m per quarter.

* Excluding IPL-related marketing costs and the reversal of variable pay in 4QFY25, operating profit rose 30.5% sequentially, with operating margin at 34.3% for 1QFY26.

* MTF lending rates are not sensitive to RBI rate cuts. Borrowings are linked to MCLR, so the impact of rate cuts comes with a lag, providing potential for margin expansion in a declining interest rate environment.

Valuation and view

* While the near-term outlook is not encouraging for the broking segment, the structural story remains intact. The MTF book can aid the broking segment through higher ticket sizes in the cash segment and better NIMs as interest rates decline. ANGELONE’s strategy to diversify its revenue stream has started reflecting in revenue, especially credit distribution. In the medium term, wealth management and financial product distribution through the AP channel should start contributing meaningfully.

* We broadly retain our EPS estimates as the rise in distribution revenue and higher cash realization are offset by higher employee costs. Reiterate BUY with a one-year TP of INR3,200 (premised on 20x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)