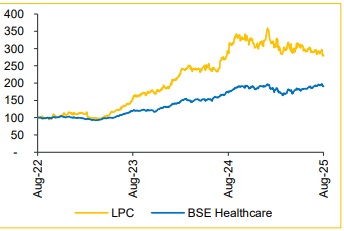

Buy Lupin Ltd For Target Rs. 2,375- Choice Broking Ltd

Steady Growth Ahead, Backed by Pipeline and Margin Gains

We expect LPC to sustain its growth momentum, supported by a strong pipeline in its key markets—North America and India. High-impact launches such as Liraglutide and Glucagon are likely to drive meaningful revenue contribution, with overall revenues projected to grow in double digits in FY26 and low double digits in FY27. While margins may face temporary slowdown in FY26 due to elevated R&D spends—particularly on the GLP-1 portfolio—normalization is expected by FY27 as scale benefits kick in. Additionally, the company has achieved procedural credibility in the Mirabegron litigation, and management remains confident about its relaunch prospects. We forecast revenue/EBITDA/PAT to grow at a CAGR of 12%/14%/12% over FY25–28E. We value the stock at 25x (unchanged) FY27–28E average EPS and revise our target price to INR 2,375 (from INR 2,270) and upgrade our rating to BUY.

Strong Beat Across Metrics; Margins and PAT Impress

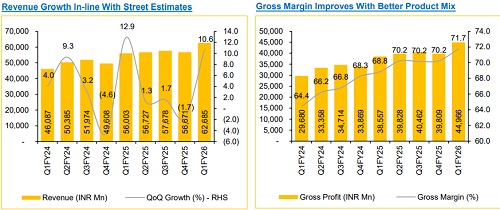

* Revenue grew 11.9% YoY / 10.6% QoQ to INR 62.7 Bn (vs. CIE estimate: INR 61.6 Bn).

* EBITDA rose 27.6% YoY / 27.0% QoQ to INR 16.4 Bn; margins expanded 540 bps YoY / 424 bps QoQ to 27.6% (vs. CIE: 23.0%).

* PAT delivered robust growth of 52.1% YoY / 57.8% QoQ to INR 12.2 Bn (vs. CIE estimate: INR 9.5 Bn).

New Wave of US Launches: Liraglutide, Glucagon to Anchor Growth

North America has continued to deliver strong growth, supported by recent launches such as Tolvaptan, where management anticipates a longer exclusivity tail. While Albuterol faced some pressure from a new market entrant, the company has managed to retain its position. Looking ahead, we believe FY26 is poised for robust growth driven by a string of high-potential launches, including Glucagon (launched in July), Liraglutide (expected in October), and Risperdal Consta (September). These much-anticipated products are expected to contribute meaningfully to revenue. Management has guided for double-digit revenue growth in FY26E, underpinned by this launch momentum.

India Business Steady; GLP-1 Launches to Drive Acceleration

India continues to perform in line with the broader domestic market, with therapies like Cardiac, Gastrointestinal, and VMS delivering above-market growth. The company has a strong pipeline, with 80+ launches planned over the next five years. Near-term growth is expected to be driven by its GLP-1 portfolio—injectables via a partnered launch targeted for end-FY26 and an inhouse oral GLP-1 launch expected in FY27. We believe the India business will continue to outperform the market, supported by strong execution, a focused pipeline, and early entry into high-growth therapeutic categories.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131