Add Hindustan Unilever Ltd For Target Rs.2,460 by Centrum Broking Ltd

Muted urban demand, flat volume cut Q3 growth

HUVR’s Q3FY25 print was in-line with our estimates; Revenue grew 1.4% YoY, led by flat volume growth. The slowdown in urban consumption along with gradual recovery in rural led to muted Q3. Growth in small packs has been higher, reflecting the current macroeconomic situation while premiumization trend remains resilient. Home Care and Beauty & Well-being outperformed in the segment while the Personal Care business declined due to inflation and a delayed winter. Separately, HUL has acquired a 90% stake in Minimalist for Rs29.5bn (5.9x Price to Sales) to tap the fast growing beauty space (TAM - Rs680bn). The management expects low single-digit price hikes (based on current commodity prices) while growth would continue to be muted. EBITDA margin is expected to be 23-24% despite higher A&P on Beauty and Food. We remain cautiously optimistic as the near term operating environment continuesto be competitive. Post 9MFY25E numbers, we have tweaked earnings and have maintained ADD rating, with a revised DCF-based target of Rs2,460 (implying 46.3x FY27E EPS).

Q3FY25 revenue grew 1.4%; Home Care +5.4%, Beauty +1.4%, F&R +0.3%, P.Care -3.0%

HUVR’s domestic business grew 1.4% YoY on account of pricing growth while volume was flat. Segmental growth: Home Care grew +5.4% with HSD volume growth, Beauty and Wellbeing grew +1.4%, led by LSD volume growth, P/Care declined 3.0% due to mid-single-digit drop in volume, F&R improved marginally by 0.3% YoY despite mid-single-digit drop in volume. Alternative channel grew in double digit while muted growth was observed in GT. Given the high food inflation impacting mass consumption, the management alluded to moderating demand in urban while rural continues to recover gradually. The management has launched Rin Bar with superior formula (polymer technology) along with a new dishwash liquid brand (Sun) at Rs99/ltr. It expects low single-digit price hikes (based on current commodity prices) while growth would continue to be muted

Operating environment remains tough; margin would be 23-24%

In Q3FY25, gross margin declined 83bps to 50.7% YoY due to rising competitive intensity in alternate channel and promotion activity in GT. Despite lower ad-spends (-8.0%), higher staff cost/other expenses (+5.4%/2.4%) led to EBITDA growth of 0.8%, settling EBITDA margin at 23.2% YoY (-14bps). To mitigate inflation, the management is expected to take low singledigit price hikes based on current commodity prices. Home Care, Food and Personal Care margins remain healthy while Beauty could see contraction due to higher A&P support.

HUL acquires 90% stake in Minimalist for Rs29.5bn (5.9x P/S) –premium beauty space

HUL has acquired 90% stake in Minimalist (ARR Rs5bn+) for Rs29.5bn (5.9x P/S) to tap the premium beauty (TAM - Rs680bn) and expects strong growth to continue. M&A synergies: (1) strong brand in fast-growing affluent beauty market (2) strong online presence (3) utilizing supply-chain network (4) penetration through GT and (5) international penetration.

Valuation and risks

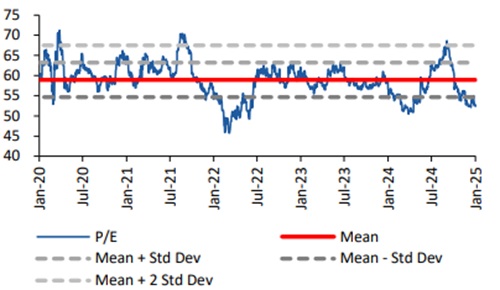

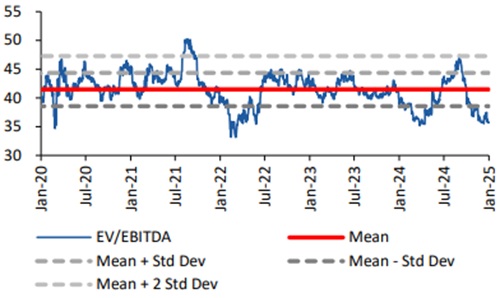

We expect a gradual recovery in discretionary spends and inherent distribution strength to drive Personal Care and GSK-CH business. Mass Beauty is expected to be come back while Home Care would continue to outperform. Although margins could remain in tight band, given the inflationary cycle and high ad-spends, HUVR expects premium mix and operating leverage to provide cushion. Considering the tepid 9MFY25 numbers, we have downgraded earnings by 6-7% for FY25-FY26E while maintaining ADD rating, with a revised DCF-based target of Rs2,460 (implying 46.3x FY27E EPS). Risks: significant acceleration in volume/price, decrease in ad-spends leading to margin expansion & lower competitive intensity.

Valuation

We expect a gradual recovery in discretionary spends and inherent distribution strength to drive Personal Care and GSK-CH business. Mass Beauty is expected to be come back while Home Care would continue to outperform. Although margins could remain in tight band, given the inflationary cycle and high ad-spends, HUVR expects premium mix and operating leverage to provide cushion. Considering the tepid 9MFY25 numbers, we have downgraded earnings by 6-7% for FY25-FY26E while maintaining ADD rating, with a revised DCF-based target of Rs2,460 (implying 46.3x FY27E EPS). Risks: significant acceleration in volume/price, decrease in ad-spends leading to margin expansion & lower competitive intensity.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331