Buy Gland Pharma Ltd for the Target Rs. 1,740 by Motilal Oswal Financial Services Ltd

Margins cushion revenue miss

Core weakness and Cenexi hurdles weigh on FY25; recovery path intact

* Gland Pharma (Gland) delivered marginally below-expected revenue (3% miss) in 4QFY25. However, it delivered better-than-expected EBITDA (17% beat), due to higher contribution from milestone income/profit share. A higher tax rate led to in-line earnings for the quarter.

* 4QFY25 is the second consecutive quarter to witness YoY decline in core market sales to INR11b.

* ROW markets (down 21% YoY to INR1.3b) also witnessed volume decline, affecting overall performance for 4QFY25.

* Cenexi’s production challenges at its Paris site and continuing normalcy at Belgium site moderated its YoY growth to 8% for 4QFY25.

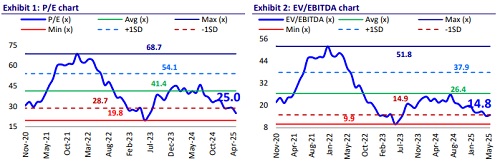

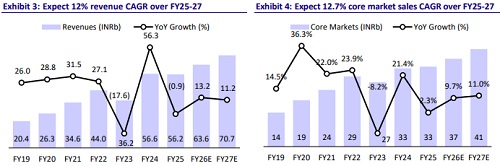

* We cut our estimates by 7%/8% for FY26/FY27, factoring in a) manufacturing disruption at Cenexi’s site, and b) gradual improvement in business of core markets. We value GLAND at 28x 12M forward earnings to arrive at a price target of INR1,740.

* GLAND has faced deterioration in earnings over past three years due to increased competition in its base products and operational losses at its Cenexi business. Having said this, a) largely steady price erosion in the base portfolio, b) new launches across key markets, and b) improving operating performance of Cenexi would drive 20% earnings CAGR over FY25-27. Maintain BUY.

Revenue drag was offset by higher share of milestone income/profit share on YoY basis

* Gland Pharma 4QFY25 revenues declined by 7.3% YoY to INR14.2b (our estimate: INR14.7b). The base business (ex-Cenexi) declined 12% YoY to INR10.3b for the quarter.

* Core markets sales declined 11% YoY to INR11.3b (80% of sales). RoW sales declined 14% YoY to INR2.4b (17% of sales). India sales remained flat YoY at INR525m (3% of sales).

* Gross margin (GM) grew 470bp YoY to 65.8% due to change in product mix in base business, coupled with expansion in GM of Cenexi business.

* EBITDA margin expanded by 110bp YoY to 24.4% (our estimate: 20.1%), led by lower RM costs and lower operating leverage (employee cost/other expenses up 330bp/30bp YoY as % of sales). On ex-Cenexi basis, the EBITDA margin was 38.3% (up 160bp YoY). The profit share/milestone income was 6%/15% of base business sales for the quarter.

* EBITDA declined 3.1% YoY to INR3.4b (our est: INR2.9b).

* Adj. PAT declined 2.7%YoY at INR1.8b (our estimate: INR1.8b).

* In FY25, revenue was largely stable YoY at INR56b. EBITDA/PAT declined by 6.1%/11% YoY to INR12.6b/INR6.9b.

Highlights from the management commentary

* While Gland ended FY25 with flat revenue YoY, it intends to grow the revenue by a mid-teens rate YoY in FY26.

* The revenue growth would be backed by biologics business (~INR1b), dry powder contract (~INR600-700m), business from GLP contracts and new launches in US/ROW markets.

* GLAND indicated Cenexi to achieve EBITDA break-even in 3QFY26. It aspires to achieve double-digit EBITDA margin by FY27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412