Sell Fine Organic Industries Ltd for the Target Rs. 3,660 by Motilal Oswal Financial Services Ltd

Muted earnings outlook amid margin pressure

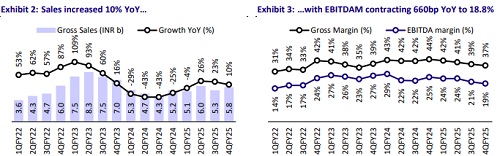

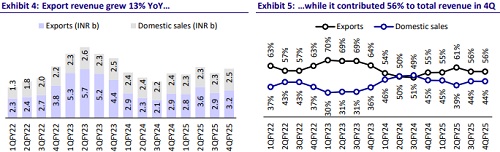

* Fine Organic Industries (FINEORG) reported revenue of INR5.8b in 4QFY25. EBITDA stood at INR1.1b (28% miss; down 18% YoY). EBITDAM contracted 660bp YoY to 18.8%, while gross margin dipped 640bp YoY to 37.2%. PAT was down 15% YoY to INR885m (our est. INR1.2b). In FY25, exports contributed 57%, and domestic sales formed 43% of revenue (56% and 44%, respectively, in 4QFY25).

* EBITDAM stood at 21.8% in FY25, hit by rising raw material and logistics costs due to global supply chain disruptions from 2QFY25. RM costs remained elevated but are expected to stabilize in the near future. The company maintained elevated inventory levels for both raw materials and finished goods to manage geopolitical risks and supply volatility, ensuring business continuity and readiness for demand spikes.

* All plants are running near full capacity, with Patalganga ramping up. FINEORG is setting up a wholly owned subsidiary in the UAE and plans to manufacture locally in the US, aiming to enhance supply chain efficiency and regulatory compliance. The company began trial production of new products, targeting segments like food, feed, cosmetics, and coatings, with phased expansion planned across the US, SEZ, and domestic plants.

* Despite global volatility, domestic demand remained robust across product categories, with continued focus on strengthening the India business. The company remains cautious on new contracts due to uncertainty around government policies such as import duties, which could impact pricing and margins. Regular maintenance spending was low in FY25, but some extra investment may be needed in the next six months, which is yet to be decided.

* We estimate a CAGR of 4%/-1%/-2% in revenue/EBITDA/PAT over FY25-27, with margin in the range of 19-20%. FINEORG is currently trading at ~34x FY27E EPS and ~26x FY27E EV/EBITDA. Valuations appear expensive for a company with no earnings growth during FY25-27. We reiterate our Sell rating on the stock with a TP of INR3,660.

Operating performance below est.; margin contracts YoY and QoQ

* Revenue was at INR5.8b (-4% from our est., +10% YoY). Gross margin contracted 640bp YoY to 37.2%, with EBITDAM at 18.8% (-660bp YoY).

* EBITDA stood at INR1.1b (est. of INR1.5b, -18% YoY). PAT stood at INR885m (est. of INR1.2b, -15% YoY).

* For FY25, revenue was at INR22b (+13% YoY), EBITDA was at INR4.8b (-1% YoY). PAT was INR3.9b (+6% YoY), while EBITDAM was 21.7% (-300bp YoY).

* The Board declared a final dividend of INR11 per equity share.

Valuation and view

* The long-term prospects for FINEORG remain robust, as the company operates within the oleochemicals industry and has consistently driven growth through R&D innovations over the years. However, we anticipate that its performance may be adversely affected in the near to medium term by the following factors: 1) longer-than-expected delays in the commissioning of new capacities for expansion; 2) existing plants operating at close to optimum utilization with no potential of debottlenecking; and 3) further delays in the ramp-up of the Thailand JV.

* We estimate a CAGR of 4%/-1%/-2% in revenue/EBITDA/PAT over FY25-27, with margin in the range of 19-20%. FINEORG is currently trading at ~34x FY27E EPS and ~26x FY27E EV/EBITDA. Valuations appear expensive for a company with no earnings growth during FY25-27. We reiterate our Sell rating on the stock with a TP of INR3,660.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)