Neutral Havells India Ltd for the Target Rs. 1,640 by Motilal Oswal Financial Services Ltd

Weak Lloyd performance; Cable segment maintains growth

Short summer and high channel inventory weigh on Lloyd’s performance

* Havells India’s (HAVL) 2QFY26 earnings were in line with estimates. Revenue increased ~5% YoY to INR47.8b. EBITDA grew ~17% YoY to INR4.4b. OPM expanded 90bp YoY to 9.2% (vs. our estimate of 9.5%). However, (Ex-Llyod) segment margin expanded 2.3pp YoY to 12.2% (+1.2pp vs. our estimate). PAT grew ~19% YoY to INR3.2b (+5% vs. estimates led by higher other income).

* Management indicated weak performance in RAC, Fans, and Cooler due to a short summer season and higher channel inventory. The company is collaborating with channel partners to boost consumer offtake and anticipates channel inventory to normalize by the end of 3QFY26. It expects a recovery in the ECD and RAC segments in 2HFY26, led by positive consumer sentiments. The Cable segment continued to witness steady growth, supported by strong growth in power cables. The company’s cable expansion plan is on track, and it has acquired a land parcel of 39 acres adjacent to the existing manufacturing facility.

* We largely maintained our earnings estimates for FY26-28E. HAVL’s trades at 48x/40x FY27E/FY28E EPS. We reiterate our Neutral rating with a TP of INR1,640 (based on 50x Dec’27E EPS).

OPM expands 90bp to ~9.2% ; C&W margin expands 5.1pp to ~14%

* HAVL’s consolidated revenue/EBITDA/PAT stood at INR47.8b/INR4.4b/INR3.2b (+5%/+17%/+19% YoY and in line vs. our estimates). Gross margin stood at ~35% (+1.2pp YoY). OPM expanded 90bp YoY to ~9.2%. OPM (Ex-Llyod) stood at ~12.2% (up 2.3pp YOY; 1.2pp above estimates). Ad spends stood at 2.8% of revenue vs. 2.9%/2.6% 2QFY25/1QFY26.

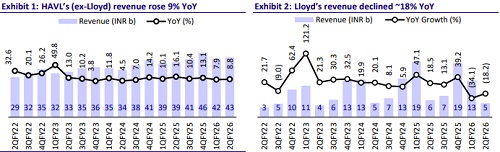

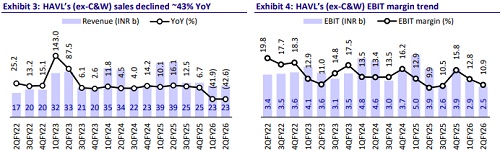

* Segmental highlights: 1) HAVL’s revenue (excl. Lloyd) increased ~9% YoY to INR43.0b. C&W’s revenue grew ~12% YoY to INR20.3b, and EBIT margin expanded 5.1pp YoY to ~14%. Switchgear’s revenue rose ~8% YoY to INR6.0b, while EBIT margin expanded 1.5pp YoY to ~22%. The Lighting revenue increased ~8% YoY to INR4.3b, while EBIT margin remained flat YoY at ~13%. ECD’s revenue declined ~2% YoY to INR8.4b, and EBIT margin contracted 1.9pp YoY to ~6%. 2) Lloyd’s revenue declined ~18% YoY to INR4.8b. Operating loss stood at INR1.1b vs a loss of INR243m in 2QFY25.

* In 1HFY26, Revenue/EBITDA/PAT stood at INR INR102.3b/INR9.5b/INR6.7b (- 1%/+1%/-1% YoY). OPM expanded 20bps YoY to ~9.3% in H1FY26. Operating cash outflow stood at INR3.8b vs operating cash inflow of INR7.6b in 1HYF25. Capex stood at INR6.3b vs INR3.5b in 1HFY25. Net cash outflow stood at INR10.1b vs net cash inflow of INR4.0b in 1HYF25.

Key highlights from the management commentary

* The quarter was marked by a weaker summer, leading to subdued sales in cooling products. Elevated channel inventory carried over from 1Q further weighed on primary sales. Management indicated that inventory liquidation is underway and should normalize by the end of 3QFY26.

* The C&W segment maintained its steady growth momentum, led by strong traction in power cables and sustained B2B demand from real estate, infrastructure, and industrial projects.

* FY26 capex is guided at around INR14b, with FY27 estimated at INR10b, primarily allocated toward capacity expansion in Cables, Lloyd, and Automation.

Valuation and view

* HAVL’s 2QFY26 performance was in line with our estimates, as weakness in Lloyd offset the strong performance of other segments. We believe demand momentum after the GST reduction will be a key monitorable for the near term, along with a reduction in channel inventory.

* We expect HAVL to report a revenue/EBITDA/ PAT CAGR of 11%/17%/17% over FY25-28. We estimate OPM to expand to ~11% by FY27-28 vs. ~10% in FY26E. The company’s RoIC is expected to improve to ~28% by FY28 from ~21% in FY26, and RoE is likely to be ~19% in FY28 vs. ~16% in FY26E.

* HAVL trades at 48x/40x FY27E/FY28E EPS, and we reiterate our Neutral rating with a TP of INR1,640 based on 50x Dec’27E EPS

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412