Neutral HDB Financial Services Ltd for the Target Rs. 800 by Motilal Oswal Financial Services Ltd

Poised for an improved 2H with receding asset-quality headwinds

Credit cost pressure to gradually ease; expect NIM expansion to continue in 2HFY26

* Over the past year, HDB Financial (HDB) has navigated a phase of consolidation, reflected in subdued disbursement momentum, modest AUM growth, and emerging asset-quality pressure across a few of its key product segments. The company management has prioritized stability over scale, reinforcing collections, tightening underwriting frameworks, and retaining a conservative stance toward unsecured lending. This approach has positioned HDB to recalibrate its growth engine with greater resilience as the operating environment normalizes.

* The softness in the company’s performance was shaped by multiple factors, including rising asset-quality stress in unsecured business loans and CV portfolios, prolonged monsoons that curtailed fleet utilization and increased vehicle idling, and a broader, muted macro environment. However, with early indicators of stabilization now emerging and the momentum seen after the GST rate cut expected to be sustained, we expect a measured recovery in both AUM growth and asset quality through 2HFY26, supported by improving collections and a normalizing operating backdrop.

* Growth momentum is set to improve in 2HFY26, aided by multiple tailwinds such as GST rate cuts, festive-season demand, and a healthy kharif harvest that will bolster rural cash flows. Demand across vehicle and consumerdurable segments began to firm up from the last week of Sep’25, with this positive traction sustaining through Oct’25 as well.

* As the monsoon-related disruptions subside and the macros improve, the asset quality pressure is expected to ease somewhat. Credit costs (which have been relatively elevated for the last few quarters) are expected to moderate as some of its stressed business segments, such as unsecured business loans and CV, stabilize. We model credit costs of 2.4%/2% in FY26E/FY27E.

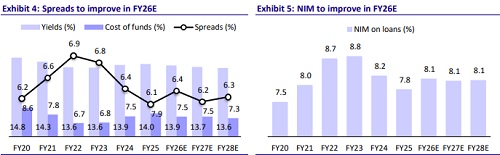

* HDB has benefited from the declining interest rate environment, with NIM expanding by ~40bp over 1HFY26. While much of the CoF advantage has already been realized, there still remains some potential for a NIM expansion in 2H since the borrowing costs will continue to ease modestly. We estimate NIM of 8.1% each in FY26E/FY27E.

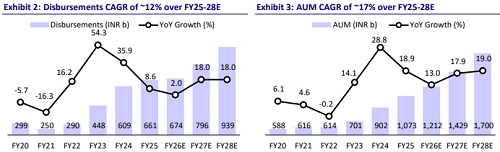

* HDB currently trades at 2.5x FY27E P/BV. We estimate a CAGR of 12%/17%/24% in disbursement/AUM/PAT over FY25-28, with RoA/RoE of ~2.5%/16% in FY28. We reiterate our Neutral rating with a TP of INR800 (premised on 2.5x Sep’27E BVPS). With valuations largely factoring in medium-term growth potential, we will look for clearer evidence of stronger execution on loan growth, the ability to better navigate industry/product cycles, and structural (not just cyclical) improvement in return ratios.

Growth to pick up in 2HFY26 driven by multiple tailwinds

* HDB’s loan growth has remained subdued over the past year, driven by muted disbursements as the company tightened credit filters amid elevated delinquencies in the unsecured MSME and CV segments. During this period, management prioritized stemming asset-quality weakness and reinforced its collections infrastructure and tempered loan growth to restore portfolio stability.

* However, the macro environment is now expected to turn more supportive, with early signs of stabilization in unsecured MSME loans, a healthy monsoon supporting rural incomes, and lower GST rates spurring consumption. We expect HDB’s loan growth momentum to revive in 2HFY26, led by stronger traction in auto finance, two-wheelers, and the consumer durable segment.

* While volumes and demand were healthy in October, aided by festive tailwinds and GST rate reductions, the key monitorable remains whether this momentum will sustain over the medium term or taper off within the next 4-6 months. We model loan growth of 13% in FY26 and expect it to pick up thereafter, with a loan CAGR of 17% over FY25-FY28E.

NIM could remain range-bound but with an upward bias

* HDB’s blended yields are well-supported by a diversified product mix, with higher-yield unsecured loans offsetting the lower-yield secured book. About 77% of HDB’s loan book is on a fixed rate, which will support yields in a declining interest rate environment. Also, the company’s emphasis on direct origination, efforts to pivot the loan mix towards higher-yield products, and deeper presence in underserved markets should further strengthen its pricing power.

* About 33% of HDB’s liabilities are on floating rates, within which ~90-95% of its bank borrowings are linked to EBLR and have been repriced already in line with market/external benchmarks. The company will continue to benefit from HDFC Bank’s strong parentage and AAA credit rating.

* HDB has seen a meaningful expansion in NIM, which has risen by ~40bp over the last two quarters, largely supported by a benefit in its cost of borrowings (CoB). Although most of the CoB benefit from its floating-rate borrowings has already been realized, there is still room for incremental NIM improvement as borrowing costs continue to gradually decline. We model NIMs of ~8.1% each in FY26/FY27E (vs. 7.8% in FY25).

Operating efficiencies to drive improvement in cost ratios

* HDB has made substantial investments in building its physical infrastructure, including a wide branch network and employee base, over the past few years. These investments have contributed to elevated operating expense ratios (opex/avg. assets) and a relatively high cost-to-income ratio.

* HDB’s expanding scale, increasing digital origination, and centralized processing framework are expected to drive continued operating leverage over the medium term. This will be driven by enhanced productivity, increased process automation, and better cost absorption across the expanding branch network, collectively providing a structural boost to profitability. We model a ~15bp decline in opex-to-average assets to 3.6% by FY28E.

Asset quality pressure to ebb, and credit costs set to moderate in 2H

* Over the past year, HDB’s credit costs have remained elevated, primarily due to stress in the unsecured business loans and CV segment. Further, in 1HFY26, the company also reported higher stress in CV segments primarily due to monsoon/ flood-related disruptions, which resulted in higher vehicle idling and led to higher slippages.

* Asset quality trends have now started to exhibit signs of stabilization. The business loans segment, which started improving in 1Q, continued to normalize through 2QFY26. The CV segment will also start recovering now as seasonal disruptions abate. There is a sequential improvement in the portfolio delinquencies, and recent incremental disbursements reflect improved underwriting and risk discipline.

* We expect credit costs to begin moderating from 3QFY26 as stress in the unsecured segment has largely peaked, with early signs of stabilization visible. With monsoon-related disruptions now behind and a favorable outlook on improvement in rural cash flows, asset quality should exhibit improvement in 2H. We estimate credit costs at ~2.4%/2.0% for FY26E/FY27E.

Valuation and view

* HDBFIN has spent the past year in consolidation mode – strengthening portfolio quality, tightening underwriting, and stabilizing operations. Focused efforts on improving collections and reinforcing risk controls are now yielding results. Asset quality has stabilized, disbursements are improving, and early signs of revival are visible across key retail segments. With operating efficiencies improving and credit costs normalizing, HDB is positioned to shift from consolidation to steady, profitable growth in the coming quarters.

* HDB currently trades at 2.5x FY27E P/BV. We estimate a CAGR of 12%/17%/24% in disbursement/AUM/PAT over FY25-28, with RoA/RoE of ~2.7%/16% in FY28E. Reiterate Neutral with a TP of INR800 (premised on 2.5x Sep’27E BVPS). With valuations largely factoring in medium-term financial performance, we will look for clearer evidence of stronger execution on loan growth, the ability to better navigate industry/product cycles, and structural (not just cyclical) improvement in return ratios.

* Key risks: 1) HDBFIN’s focus on low- to middle-income and self-employed segments exposes it to higher credit sensitivity during economic slowdowns, despite its secured portfolio mix; 2) execution risk remains in translating scale into sustained profitability, as operating efficiency metrics currently lag peers; 3) rising competition in semi-urban and rural lending and potential yield compression.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412