Neutral Repco Home Finance Ltd for the Target Rs. 465 by Motilal Oswal Financial Services Ltd

Disbursements gain momentum; loan growth to gain traction

Asset quality improves, but a sharp decline in Stage 3 PCR due to write-offs

* Repco Home Finance’s (Repco) 2QFY26 PAT declined 5% YoY to INR1.07b (in line). NII in 2QFY26 grew ~14% YoY to ~INR1.9b (in line). Other income declined ~46% YoY to INR123m (vs. our est. of INR200m). Opex rose ~17% YoY to INR603m (in line).

* PPOP grew ~3% YoY to INR1.4b (in line). Provision writebacks stood at INR15m, translating into 2QFY26 annualized credit costs of -4bp (PY: -46bp and PQ: -7bp). Repco reported an RoA/RoE of 2.9%/14% in 2QFY26.

* Management highlighted that the disbursement momentum improved in the quarter, supported by sustained traction in the housing finance segment. The company guided for the loan book to scale up to ~INR162b by Mar’26, with disbursements targeted at INR11–11.5b in 3Q and at INR13.5–14.0b in 4QFY26. Further, the management has also set an ambitious target of scaling up its loan book of ~INR250b by FY28, including some portfolio purchases.

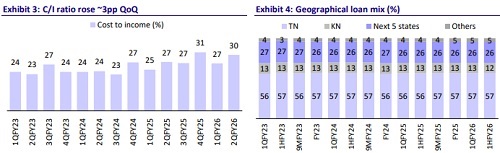

* The rise in opex was attributed to several factors, including: 1) realignment of the incentive policy, 2) elevation of employees to higher positions, 3) recruitment of experienced personnel in sales and collections, 4) Silver Jubilee celebrations leading to some one-time expenses, and 5) branch expansion over the last 3 years, resulting in higher employee costs.

* GNPA declined ~15bp QoQ to ~3.15%, while NNPA rose ~35bp QoQ to ~1.55%. The company reduced the PCR on S3 loans by ~12pp QoQ to ~53%. For the new book (originated post Apr’22), GS2 stood at 5% (vs. 8.8% for the overall book) and GS3 stood at 1.1% (vs. 3.3% for the overall book).

* Capital adequacy ratio (CRAR) was ~37%. Management shared that it has instituted a dedicated special team to monitor recoveries and targets an additional INR80–90m in recoveries in 2HFY26. Further, Repco did not have a concentrated exposure to the textile sector, and it maintained a welldiversified portfolio across TN. This mitigated the risk from sector-specific tariff issues.

* Repco’s valuations remain attractive, but we maintain a cautious stance due to concerns over the company’s ability to sustain the disbursement momentum and potential risks surrounding the quality of customer loans that may be added through inorganic growth initiatives.

* We broadly retain our earnings estimates and model a loan/PAT CAGR of ~12%/6% over FY25-FY28E. For an RoA/RoE of 2.7%/12% in FY28E, we reiterate our Neutral rating on the stock with a revised TP of INR465 (based on 0.7x Sep’27E BVPS).

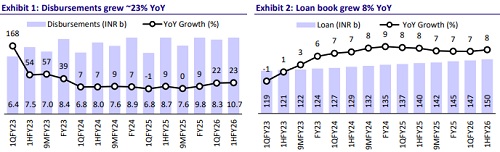

Disbursements rise ~23% YoY; momentum to remain strong in 2HFY26

* Disbursements grew ~23% YoY to INR10.7b in 2QFY26. The loan book grew ~8% YoY to ~INR150b. Run-offs were higher, with repayment rates increasing ~2pp YoY to ~19.8% (PY: ~17.6%).

* The disbursements also benefited from the branch expansions over the last two years, with 30-32 new branches contributing meaningfully to growth. Additionally, the management has guided for disbursements between INR11– 11.5b in 3Q and INR13.5–14b in 4QFY26, reflecting continued business momentum.

* As of Sep’25, the proportion of non-salaried customers remained broadly stable at ~53%, while loans for the salaried segment accounted for a 47% share. Housing loans accounted for 71% of the loan book, while home equity accounted for 29%.

Yields improve ~10bp QoQ; diversification of funds to optimize costs

* Reported yields improved ~10bp QoQ to ~12.1%, whereas CoB declined 10bp QoQ to ~8.6%. This led to spreads improving ~10bp QoQ to ~3.4%. Reported NIM improved ~10bp QoQ to 5.5%.

* The cost-to-income ratio improved ~3pp QoQ to ~30.0%. (PY: ~27.4% and PQ: ~26.9%).

* Repco lowered its benchmark lending rate (PLR) by ~10bp, effective 1st Jul’25. Repco has also initiated diversification of its borrowing profile and continues to engage with its banking partners to secure more favorable interest rates.

Key highlights from the management commentary

* Systematic measures have been implemented to reduce GNPA, including appointing general managers exclusively for TN branches and for branches outside TN, strengthening the recovery review mechanism, and conducting focused meetings on NPA recovery.

* Underwriting standards have improved substantially over the last 6–7 quarters, with a dedicated credit review cell ensuring proper checks.

* DSA sourcing has contributed to growth momentum, and an internal team is being built to complement this channel. DSA accounts for ~48% of sourcing, with the remaining ~52% from other channels.

Valuation and view

* Repco’s quarterly performance was hit by subdued loan growth, despite a healthy growth in disbursements. The asset quality continued to strengthen, underscoring the company’s commitment to building a high-quality portfolio.

* We will continue to focus on management’s ability to deliver on the guided metrics of disbursement growth and profitability. Similar to the previousfiscal year, we expect credit costs to remain benign due to recoveries from NPA and the written-off pool in 2HFY26.

* Although the risk-reward appears favorable at the current valuation of ~0.6x FY27E P/BV, we believe the company will have to start delivering stronger and sustained loan growth to command higher valuations. We reiterate our Neutral rating with a TP of INR465 (based on 0.7x Sep’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)