Buy Kalyan Jewellers Ltd for the Target Rs. 675 by Motilal Oswal Financial Services Ltd

Growth trajectory sustains; healthy festive season fuels growth further

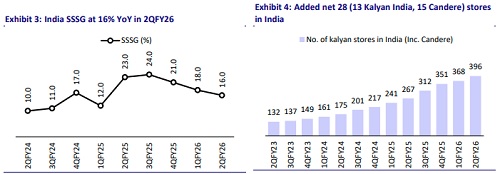

* Kalyan Jewellers (KALYANKJ)’s consolidated revenue grew 30% YoY to INR78.6b (in line). India business achieved 31% YoY revenue growth, driven by store additions (added a net of 13 Kalyan Indian stores and 15 Candere stores) and 16% SSSG (14% in the South, 17% in the non-South).

* Management said that demand momentum on the ground remained healthy, with Navratri witnessing robust offtakes. During the 30 days leading up to Diwali, KALYANKJ reported LFL growth of over 30%, indicating sustained festive momentum.

* KALYANKJ’s studded share remained stable at 31% in 2QFY26 vs 30% in 2QFY25. Studded revenue surged 36% YoY.

* Gross margin for the Indian business contracted 100bp YoY to 12.5%. The margin contraction was largely due to the rising mix from franchised stores (~49% revenue mix in 2QFY26). EBITDA margin for the India business remained flat YoY to 6.3%. Lower advertising costs were offset by higher employee and other expenses. PBT margin expanded 60bp YoY to 5.1%, while PBT jumped 49% YoY, fueled by interest savings on debt reduction.

* KALYANKJ repaid INR1.3b of non-GML debt during the quarter, reducing debt to INR5.5b. It further plans to lower non-GML debt by ¬INR1.5b in 2HFY26, targeting INR4b by Mar’26, with the aim to become debt-free by FY27.

* The Middle East business delivered 8% revenue growth driven by 7% SSSG. Studded share was 18%. There were two new store additions in 2QFY26.

* KALYANKJ plans to launch a new regional jewelry brand in 4QFY26 with an initial investment of INR3b, primarily towards inventory. It will begin with five pilot COCO stores and further expansion to be franchisee-led. We look forward to more clarity on this initiative and remain watchful of its progress.

* With the successful scale-up of its new franchise businesses (>45% revenue contribution) and stable success in non-Southern markets, the company has established itself as a leading brand in the industry. KALYANKJ is further establishing a region-specific store format to combat increasing competition from the unorganized players. We model a 25%/22%/30% revenue/EBITDA/PAT CAGR during FY25-28E. We reiterate our BUY rating with a TP of INR675 (based on 45x Sep’27 P/E).

India outperformance sustains; store roll-outs remain healthy

India business

* Strong revenue growth with double-digit SSSG: India revenue grew 31% YoY to INR68.4b (est. of INR66.7b), and same-store sales increased 16% YoY. SSSG was 14% in the South regions and 17% in the non-South regions. South revenue growth was 19%, and non-South was 44% YoY. Non-South markets showed promising growth, with revenue contribution increasing to 54%. Studded share remained stable at 30.9% in 2QFY26 vs 29.7% in 2QFY25. Studded revenue grew 37% YoY.

* Stellar growth in profitability: EBITDA grew 30% YoY to INR4.3b. PBT grew by 49% YoY to INR3.5b, and APAT jumped 52% YoY to 2.6b.

* Rapid store expansion: The company added a net of 13 Kalyan stores in India, reaching a total of 300 stores. Candere added 15 stores, reaching a total of 96 stores. Total stores in India stood at 396. ‘My Kalyan’ grassroots stores reached 1,092 in 2QFY26, contributing ~13% to revenue from operations in India and over 28% to enrolment in advance purchase schemes in India.

* In 1HFY26, its revenue/EBITDA/PAT grew 31%/34%/54%.

Middle East

* Sales grew 8% YoY to INR8.7b, driven by SSSG of 7%.

* Gross margin contracted 60bp YoY to 13.7%, and EBITDA margin contracted 30bp YoY to 7.1%. EBITDA grew 4% YoY to INR613m. PAT grew 9% YoY to INR151m.

* There were two new store additions during the quarter. The studded share stood at 18% vs 19%.

* In 1HFY26, its revenue/EBITDA/PAT grew 18%/11%/15%.

Consolidated performance

* KALYANKJ’s consolidated revenue grew 30% YoY to INR78.6b (est. INR76.4).

* Gross margin contracted ~80bp YoY to 12.9% (est. 13.3%).

* EBITDA margin contracted 20bp YoY to 6.3%. (est. 6.7%). EBITDA grew 25% YoY to INR5.0b (est. INR5.1b). PBT rose 42% YoY to INR3.5b, and APAT grew 43% YoY to INR2.6b.

Key takeaways from the management commentary

* Momentum on the ground remained healthy, with Navratri witnessing robust offtakes, and the strong demand trend continued into the festive period. During the 30 days leading up to Diwali, KALYANKJ reported LFL growth of over 30%, indicating sustained festive momentum.

* The company will launch a new regional jewelry brand store in 4QFY26, with an initial investment of INR3b (primarily in inventory). It will open five pilot COCO stores, after which expansion will follow a FOCO.

* Of the planned 84 Kalyan India stores, 40 have already opened; internationally, six stores are planned (three already operational – two in the Middle East and one in the US). For Candere, 30 stores are open out of the 80 planned for FY26.

* The company has restarted debt repayment after getting approval from its lead bank to release real estate kept as collateral. It repaid INR1,300m during the quarter, bringing non-GML debt down to INR5,500m as of Sep’25. KALYANKJ plans to further reduce its non-GML debt by about INR1,500m in 2HFY26 to reach INR4,000m by Mar’26 and aims to be debt-free by FY27.

Valuation and view

* We raise our EPS estimates by 5% for FY26 and FY27.

* With the successful scale-up of its new franchise businesses (>45% revenue contribution) and continued success in non-Southern markets, the company has established itself as a leading brand in the industry. Its non-South expansion has improved the studded jewelry mix, while the asset-light expansion supports healthy cash flow generation for debt repayment and enhances profitability by reducing interest costs. It is also gaining momentum in the Middle East and the US.

* We model 25%/22%/30% revenue/EBITDA/PAT CAGR during FY25-28E. We reiterate our BUY rating with a TP of INR675 (based on 45x Sep’27 P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412