Buy Vishal Mega Mart Ltd for the Target Rs. 180 by Motilal Oswal Financial Services Ltd

Another superlative quarter on all fronts

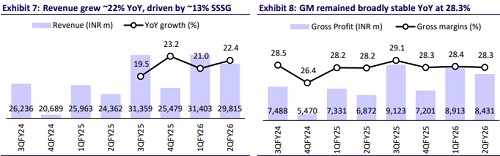

* Vishal Mega Mart (VMM) delivered another strong quarter, with ~22% YoY revenue growth, led by 25 net store additions (+15% YoY) and robust ~12.8% adjusted SSSG, benefiting from an early festive season.

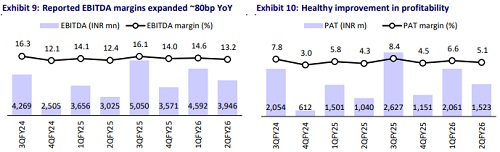

* Gross/EBITDA/pre-IndAS EBITDA margins expanded 5bp/80bp/100bp YoY, driven by operating leverage and robust cost controls.

* Management estimated the SSSG boost of ~150-200bp from the shift in the festive season. However, it remains optimistic about improvement in consumer sentiment, following the recent policy measures. The company reiterated its focus on maintain gross margins and investing the surplus to improve product proposition and drive growth, while operating leverage should aid EBITDA margin expansion.

* We believe that VMM’s unique business model, characterized by: 1) its wide presence in Tier 2+ cities (742 stores in 493 cities), 2) well-diversified exposure to key consumption baskets, 3) a strong and affordable own brands portfolio (~75% revenue share), and 4) one of the lowest cost structures, provides it with strong moats against competition.

* We raise our FY26-28E EBITDA and PAT by ~1-4%, driven by higher operating leverage. We model a CAGR of 20%/23%/30% in revenue/EBITDA/PAT over FY25-28E, driven by ~13% CAGR in store additions and double-digit SSSG.

* We reiterate our BUY rating with a revised TP of INR180, premised on DCF implied ~43x Dec’27E pre-Ind AS 116 EV/EBITDA (implying ~31x Dec’27E reported EBITDA and ~65x Dec’27E P/E).

Yet another strong quarter with 20%+ growth and margin expansion

* 2QFY26 consolidated revenue at INR29.8b grew 22% YoY (our est. +21% YoY), driven by ~12.8% adj. SSSG (vs. 11.4% in 1Q).

* Among key categories, Apparel revenue grew 25% YoY, followed by 23%/18% YoY growth in GM/FMCG.

* Revenue from private labels grew ~26% YoY, while third-party brands revenue grew ~14% YoY.

* Driven by the shift in Pujo to 2Q, east markets significantly outperformed, with salience rising to ~32% (vs. 25% contribution to VMM’s store count).

* VMM added 25 net new stores (28 openings, 3 closures) in 2Q, bringing the total store count to 742 in 493 cities (19/33 cities added in 2Q/1H) with total retail areas of ~12.8m sqft (up ~11% YoY).

* Store addition was skewed toward South with 15 net store additions in 2Q.

* Gross profit at INR8.4b grew ~23% YoY as gross margin expanded ~5bp YoY to 28.3%, driven by a higher share of higher-margin Apparel (up ~95bp YoY, FMCG down ~105bp YoY) and increase in private label mix (up 200bp YoY to 73.5%).

* Employee/other expenses increased 16%/17% YoY.

* Reported EBITDA rose ~32% YoY to INR3.95b (~5% beat) as reported EBITDA margin expanded ~80bp YoY to 13.2%, driven by operating leverage.

* Pre-IndAS 116 EBITDA grew ~40% YoY to INR2.4b, with EBITDA margin expanding ~100bp YoY to 8.1%.

* Reported PAT at INR1.5b (8% beat) rose ~47% YoY, driven primarily by higher EBITDA.

1HFY26 results: Healthy 20%+ growth with margin expansion

* Consolidated revenue at INR61.2b grew ~22% YoY, driven by ~12.1% adj. SSSG and ~11% store area additions.

* Revenue from private labels grew 25% YoY, while third-party brands’ revenue was up ~14% YoY.

* Among key categories, GM revenue grew ~23% YoY, followed by 22%/19% growth for Apparel/ FMCG.

* VMM added 46 net new stores (51 opened, 5 closures) in 1H.

* Gross profit at INR17.3b grew ~22% YoY as gross margin expanded 10bp YoY to 28.3%.

* Share of apparel inched up ~25bp YoY to 44.9%, while GM rose ~35bp YoY to 28.2%.

* Revenue contribution from own brands increased ~185bp YoY to ~74.7%.

* Reported EBITDA at INR8.5b was up ~28% YoY as margin expanded ~67bp YoY to 13.9%, driven by operating leverage.

* Pre-IndAS 116 EBITDA grew ~36% YoY to INR5.5b, with EBITDA margin expanding ~95bp YoY to 9%.

* Reported PAT surged 41% YoY, driven by robust EBITDA growth and higher other income (up 78% YoY).

* Based on our estimates, the implied run-rate for revenue/EBITDA/PAT growth for 2HFY26 is 21%/22%/30%.

FCF generation moderated YoY primarily due to reduction in payables

* Core working capital days inched up to ~5 (vs. -6 YoY), driven largely by a reduction in payable days to 62 (vs. ~75 YoY).

* OCF (post leases and interest) declined to INR4.9b (vs. INR7.3b YoY), due to unfavorable working capital movements.

* Capex stood at ~INR1.4b (vs. INR1.17b YoY), leading to lower FCF generation of INR3.5b (vs. INR6b YoY).

Highlights from the management commentary

* Demand trends: 2Q benefitted from the shift in Durga Puja (from 3Q last year) and, to some extent, Chhath. However, this was offset by weather disruptions and five-day closure in Assam. Management estimated that the early festive season could have boosted SSSG by ~150-200bp, though weather-related seasonality (winters if festive season is later) also plays a part.

* Demand outlook: The company remains optimistic about an improvement in consumer demand, led by higher disposable income after GST rationalization, income tax rate cuts and good monsoons.

* Margins: Management reiterated its endeavor to keep gross margin broadly stable, with any surplus likely to be reinvested in the business to drive growth. However, EBITDA margin is likely to inevitably expand, primarily driven by operating leverage.

* Store additions: While management has not given any explicit guidance, accelerated store additions remain high on the agenda. VMM’s initial forays in Kerala and pilots in Gujarat have seen encouraging response, prompting the company to increase its store addition plans in these states.

* Quick commerce (QC): VMM offers hyperlocal delivery in 695 stores across 460 cities and has ~11m registered customers on its QC platform (with ~20% of QC customers are new to VMM). Management indicated that QC contribution varies from 1.5% to 9.5% of store sales, depending on the presence of other QC players in any city. Further, FMCG accounts for ~75% of the typical basket in QC orders (vs. its ~27-28% contribution to in-store sales).

Valuation and view

* We believe the company’s diversified category mix, ownership of opening price points, significant contribution from its own brands, and lean cost structure provide it with a strong moat against intense competition from both offline and online value retailers. Refer to our recent Initiating Coverage note for our detailed thesis on VMM.

* We raise our FY26-28E EBITDA and PAT by ~1-4%, driven by higher operating leverage. We model a CAGR of 20%/23%/30% in revenue/EBITDA/PAT over FY25-28E, driven by ~13% CAGR in store additions and double-digit SSSG.

* We reiterate our BUY rating with a revised TP of INR180, premised on DCF implied ~43x Dec’27E pre-IND AS 116 EV/EBITDA (implying ~31x Dec’27E reported EBITDA and ~65x Dec’27E P/E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412