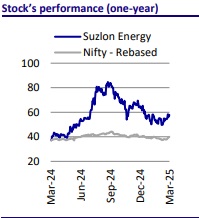

Buy Suzlon Energy Ltd For Target Rs. 70 by Motilal Oswal Financial Services Ltd

Riding the winds of growth

* Initiate with BUY and SOTP-based TP of INR70: We initiate coverage on Suzlon Energy (SUEL) with a BUY rating and a target price of INR70/share, implying 21% upside. SUEL is a global leader in wind energy with an installed capacity of ~20.9GW across 17 countries. It is India's top wind energy service provider with the highest installed capacity of ~15GW, operating with a vertically integrated structure, including in-house R&D and manufacturing facilities in India. SUEL's operations span wind turbine generator (WTG) sales, project execution, foundry and forging components, and operation and maintenance (O&M) services.

* Wind energy's critical role in India's renewable future: By 2030, wind energy is expected to account for ~20% of India’s renewable energy (RE) mix vs. 39% in the US and Germany, 33% in China, and 42% in the UK, highlighting the need for more focus on wind energy development. India’s relatively lower wind energy penetration offers significant room for growth. Though there are concerns that a combination of solar energy and storage solutions may replace wind energy, ReNew, a leading RE firm in India, estimates that adding wind energy to solar and storage solutions can reduce the levelized cost of energy (LCoE) by INR0.2- 0.3/kWh and lead to ~1% higher project IRR. Given these advantages, Firm and Dispatchable Renewable Energy (FDRE), which strategically integrates solar, wind, and battery storage, is expected to become the preferred procurement model, which will drive increased investments in wind energy.

* SUEL is a bellwether play on India’s wind energy potential: India's wind energy sector offers substantial growth potential, as the country aims to increase its installed wind capacity to 100GW by 2030 from 48GW currently (Dec’24). SUEL projects India’s new wind energy installations to reach ~4GW in FY25, 6GW in FY26, and 7-8GW annually from FY27 onward. This opportunity positions SUEL’s EPC and OMS businesses for strong growth. With ~15GW of installed capacity, SUEL towers over competitors like Siemens Gamesa (8.9GW), Vestas (3.4GW), and INOX (3.1GW). The company’s strong leadership in the O&M segment further strengthens its competitive edge. The acquisition of Renom Energy Services, a leading O&M company, expands SUEL’s service capabilities further, allowing it to cater to turbines from other OEMs.

* Domestic players well placed if NITI Aayog pushes for local content: In Mar’24, NITI Aayog, in its report, suggested granting approval to a revised list of models and manufacturers (RLMM) only if major components—such as nacelle (including gearboxes and generators), blades, towers, hubs, and controllers— are manufactured domestically. It also proposed introducing a mandatory requirement of sourcing at least 60% of content by value from India. This policy shift, if implemented, will present significant growth opportunities for Indian OEMs.

* Competition is rising but pie is big enough: Given the strong outlook, competitors are investing in the Indian wind equipment market, e.g., Envision Energy India's 1GW partnership with Juniper Green Energy and SANY India's 1.6GW contracts with JSW Group (1.3GW) and Sembcorp (0.3GW). Western players like GE, Gamesa and Vestas, despite their EPC capabilities, are avoiding the EPC segment due to low margins, while Chinese manufacturers are inactive in India’s EPC market. This creates a favorable environment for domestic manufacturers, particularly SUEL, to capitalize on the growing demand in the Indian wind energy sector due to its presence across the value chain. Assuming 8GW wind installation in India (in FY27), we estimate SUEL’s order book execution (or deliveries) to be 3.2GW in FY27. Assuming Inox Wind contributes an estimated 2GW in FY27 (FY24: 0.4GW), this still leaves an additional 2.8GW for other players, demonstrating the scale of opportunities in the sector.

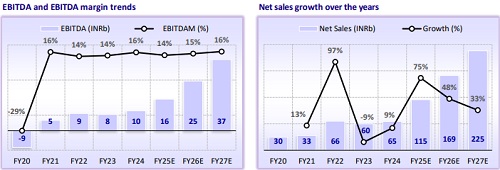

* Economies of scale to drive adj. PAT CAGR of 63% over FY24-27: The WTG segment currently has fixed costs of ~INR7b, breaking even at 700MW of deliveries. With an expanded order book, execution is set to scale from 710MW in FY24 to 1.5GW/2.3GW/3.2GW in FY25/FY26/FY27, reducing per-unit fixed costs and supporting margins. We expect WTG gross margins to increase from ~19.5% in FY24 to 22% in FY27, aided by the economies of scale. We estimate a CAGR of 51%/52%/63% in revenue/EBITDA/adjusted PAT over FY24-27.

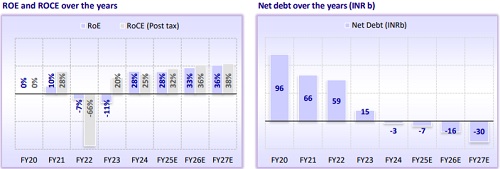

* EBITDA margin healthy; tax shield benefits until FY27: We estimate consol. EBITDA margins to remain healthy at ~14-16% in FY25/FY26/FY27. SUEL is also well positioned to benefit from its significant tax shield arising from unabsorbed depreciation and brought-forward losses (FY24: INR61b). A majority of these losses are set to expire between FY25 and FY32. We estimate SUEL not to have any tax liability until 1HFY27, enabling the company to conserve cash flows.

* Balance sheet well placed to fund future growth: SUEL’s net debt-to-EBITDA ratio has moved from 6.6x in FY22 to a net cash position in FY24. We expect the net cash position to rise further by FY27 given limited capex needs in the near term (~INR3.5-4b p.a. FY25 to FY27). Operating cash flows too are expected to rise strongly as the company executes its order book.

* Valuation and view: Adjusted for growth, SUEL reasonably priced vs. capital goods peers – We arrive at a target price of INR70 by applying a target P/E of 34x to Dec’26E EPS. This is at a slight premium to historical average 2-year fwd P/E of 27x given execution and earnings are just picking up for SUEL. While valuations across the capital goods space have come off, they remain elevated given a healthy earnings growth trajectory, a decent order book, improving cash flows, and a positive industry outlook. We think SUEL is reasonably priced, given an estimated EPS CAGR of 63% over FY24-27, significantly surpassing domestic capital goods peers ABB India (23%), Siemens (20%), Thermax (17%), and CG Power (26%) and global peers such as SANY (26%). On PEG ratio, SUEL is favorably trading at FY26E PEG ratio of 0.6x, below other domestic capital goods peers such as Thermax (2.5x), ABB India (6x), and CG Power (1.9x).

* Key risks: 1) Rising competition from Chinese and European players as wind installations pick up; 2) Potential pressure on realizations/ margins for wind turbine generators (WTGs); 3) Dependency on ISTS waiver for project economics; 4) Technological changes leading to product obsolescence; 5) Delays in project execution leading to slower-than-expected execution of order book; 6) Volatility in raw material prices, operational and overhead costs.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412