Buy Suzlon Energy Ltd for the Target Rs. 83 by Motilal Oswal Financial Services Ltd

Strong 4QFY25; outlook upbeat

Suzlon Energy (Suzlon) delivered a strong set of results, with deliveries and EBITDA coming in ~15%/38% ahead of our expectations. Management maintained its positive outlook and guided at least 60% YoY improvement in deliveries, revenue, EBITDA, and adjusted PAT for FY26. This guidance is broadly in line with our/street estimates and highlights management’s confidence in the sector.

* While FY27 guidance was not provided, management expects India-level wind installations to improve to 6/7-8/9GW in FY26/FY27/FY28 (FY25: 4.2GW). Following the earnings call, we largely maintain our FY26/27 earnings estimates but raise our TP to INR83. The early implementation of local content-related draft notification can be a strong catalyst for the stock.

* Reiterate BUY; our TP implies a 27% upside potential.

Strong beat driven by robust WTG deliveries and margin expansion

Financial performance:

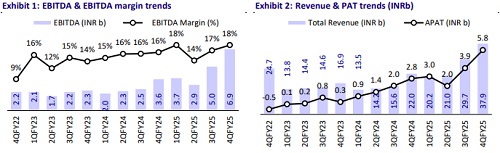

* Suzlon’s consolidated revenue came in at INR38b (+73% YoY, +27% QoQ), exceeding our estimates by 6% on account of higher-than-expected WTG deliveries (~15% higher than our estimate).

* EBITDA was 38% above our estimates at INR6.9b (+94% YoY, +39% QoQ), driven by a higher-than-expected gross margin.

* APAT exceeded our estimates by 44% and stood at INR5.8b (+108% YoY, +49% QoQ).

* Suzlon’s reported PAT was INR11.8b, which includes a deferred tax asset creation of ~INR6b during the quarter.

* Its 4QFY25 WTG revenue grew 105% YoY to INR31.4b, EBIT surged 537% YoY to INR4.2b, and EBIT margin improved 500bp to 13%.

* FY25 revenue stood at INR109b (+67% YoY). EBITDA/APAT rose 81%/106% YoY to INR18.5b/INR14.7b as WTG deliveries more than doubled YoY.

Operational performance:

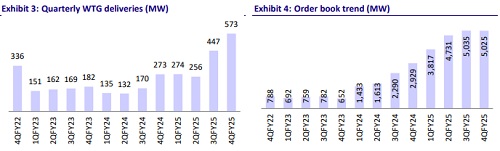

* WTG order book stood at 5,555MW as of May’25.

* The segment mix comprised 55% C&I/Captive, 19% Auctions, and 26% PSU.

* Scope Mix stood at 76% non-EPC and 24% EPC.

* WTG deliveries stood at 573MW for 4QFY25, taking total FY25 deliveries to 1,550MW (up 118% YoY).

* WTG's contribution margin exceeded 23%, reflecting 360bp YoY expansion.

* A total of 95MW of WTGs were installed during the quarter, bringing FY25 installations to 336MW. An additional 371MW has been erected and is ready for commissioning.

Highlights of the 4QFY25 performance

* Order book & deliveries: WTG order book exceeded 5.5GW as of May 2025, including 1.5GW from NTPC. FY25 deliveries stood at 1,550MW (+118% YoY), with 573MW delivered in 4QFY25.

* 4QFY25 financials: Revenue came in at INR37.8b; EBITDA was INR6.9b (+95% YoY, +39% QoQ); and EBITDA margin expanded to 18.4% (+200 bps QoQ).

* FY25 performance: Revenue rose 67% YoY to INR109b; EBITDA and adjusted PAT grew 81% and 106% YoY to INR18.5b and INR14.7b, respectively. WTG EBITDA surged 392% YoY, and the contribution margin stood at 23.6%.

* Balance sheet strength: Net worth came in at INR61b; net cash position improved to INR19.4b.

* FY26 outlook: Management guided for at least 60% YoY growth across all key metrics. EPC pipeline expected to expand; export readiness in place, though current focus remains on domestic execution.

Valuation and view

* We arrive at our TP of INR83 by applying a target P/E of 35x to FY27E EPS. This is at a slight premium to its historical average two-year fwd P/E of 27x, given execution and earnings are just picking up for Suzlon.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)