Buy Avenue Supermarts Ltd for the Target Rs. 4,350 by Motilal Oswal Financial Services Ltd

Intensified competition and rising COR lead to the miss

* Avenue Supermarts (DMART) posted weak results in 4QFY25 as standalone EBITDA inched up 4% YoY (9% miss) due to weaker gross margin (GM; -25bp YoY) and higher cost of retailing (CoR; opex up 12% YoY on a per sqft basis).

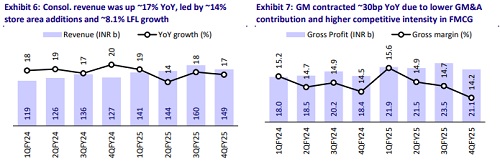

* DMART’s 4QFY25/FY25 standalone revenue grew ~17% YoY, driven by ~14% store area addition and like-for-like (LFL) growth for over two-year-old stores at 8.1%/8.4% in 4QFY25/FY25 (vs. ~10.3%/9.9% in 4QFY24/FY24).

* DMART added 28 stores in 4QFY25 (50 in FY25). As the majority of store additions happened towards the end of Mar’25, the full benefit is likely to reflect in the coming quarters. Acceleration in the pace of store additions continues to be the primary growth driver for DMART.

* DMART’s GM contracted ~25bp YoY to 13.5% (~35bp miss) in 4QFY25 due to ~50bp decline in the share of the higher margin GM&A category and heightened competition in the FMCG category. Management expects GM in mature metro markets to remain soft in the near term.

* A surge in wages of entry-level positions due to a supply/demand mismatch and continued investments in improving service levels led to ~27-28% rise in employee & other expenses, translating into ~12% YoY uptick in CoR/sqft.

* With the entry of large offline/online retailers into Quick-Commerce (QC), we expect pricing competition to remain intense over the near term, which could weigh on both growth as well as margins for DMART in the interim. However, we believe DMART’s superior store economics would ensure its competitiveness and relevance to customers over the longer term.

* We cut our FY26-27E EBITDA by ~5% each due to heightened competitive intensity and rising CoR, while our FY26-27E EPS is cut by ~6-8%. We reiterate our BUY rating with a revised TP of INR4,350 (vs. INR4,650 earlier).

4Q EBITDA inched up 4% YoY (9% miss) due to lower GM and high COR

* Standalone 4Q revenue was up ~17% YoY to INR145b (in line) driven by 14% area additions and 8.1% LFL (vs. 8.3% in 3Q/10.3% YoY).

* The company added 28 stores/1.1m sqft area to reach 415 stores and 17.2m sqft. This implies addition of an average of 39k sqft stores in 4QFY25 (vs. an average store size of 41.5k sqft).

* The store count was up ~14% YoY, with annualized revenue/store rising ~3% YoY to INR1.4b and annualized revenue/sqft up ~3% YoY to INR34.7k.

* Standalone gross profit (GP) came in at INR19.5b (up ~15% YoY, 2% below) as gross margin contracted 25bp YoY to 13.5% (~35bp miss).

* Share of higher margin GM&A category dipped ~50bp YoY to 20.1%, while the Foods category share was up ~150bp YoY to 59.9%

* Management indicated that increased competitive intensity in the FMCG space affected the gross margins.

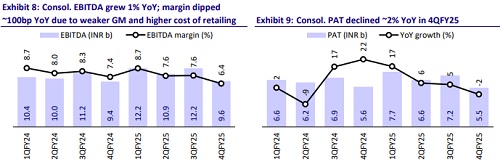

* Standalone EBITDA at INR9.8b (~9% miss), was up by a modest ~4% YoY, as margins contracted 80bp YoY (-115bp QoQ) to 6.8% (~70bp miss) due to weaker GM and ~12% YoY increase in CoR per sq. ft.

* The surge in wages of entry-level positions due to a supply/demand mismatch of skilled workers led to ~28% YoY jump in employee costs.

* Further, continued investments in improving service levels led to ~27% YoY increase in other expenses.

* Standalone PAT at INR6.2b (7% miss) inched up ~3% YoY, with PAT margin moderating 60bp YoY (~75bp QoQ) to 4.3%.

* DMART’s 4Q consolidated GP grew 15% YoY to INR21.1b as margins contracted ~30bp YoY to 14.2% (~45bp miss).

* Consolidated EBITDA was up by a modest 1% YoY to INR9.6b (11% miss) in 4QFY25 as margin contracted ~100bp YoY to 6.4% due to weaker standalone performance and higher operating losses in subsidiaries (EBITDA margin of - 6.4% vs. -4.4% QoQ and +1% YoY).

* DMART’s 4Q consolidated PAT declined 2% YoY to INR5.5b (9% miss).

Significant increase in CoR impacts FY25 performance

* FY25 standalone revenue grew ~17% YoY (vs. ~18% in FY24) to INR578b, driven by ~14% YoY store area additions and ~8.4% LFL growth (vs. 9.9% YoY).

* The company added 50 stores in FY25 (vs. 41 in FY24), with revenue/store rising ~3% YoY to ~INR1.5b and revenue/sqft growing 3% YoY to INR35.7k.

* FY25 standalone GP grew 17% YoY to INR81.7b, with GM stable YoY at 14.1%.

* FY25 standalone EBITDA rose 11% YoY to INR45b as the margin contracted ~40bp YoY to 7.85%, primarily due to an 11% YoY increase in CoR/sqft.

* FY25 standalone PAT grew 9% YoY to INR29.3b, while consolidated PAT inched up ~7% YoY.

Competitive intensity remains high; GM to remain soft in the near term

* Business outlook: The overall business remains resilient in metros. However, non-metro towns are doing significantly better. Further, the LFL growth in metro towns with lesser DMART store density has been relatively better. Management expects gross margins in the matured metros to remain soft in the near term.

* Bill cuts and ABV: Total bill cuts for 4QFY25 at 90m rose ~17% YoY (16.4% YoY in 9MFY25), while 4QFY25 average basket value (ABV) was stable YoY at INR1,607 (though lower vs. 1,647 in 9MFY25).

* DMART Ready: DMART Ready grew well in metros. Management believes its ability to serve the discerning value shoppers will only strengthen over time, though profitability in the online segment could still be some time away.

* Leadership transition: The CEO designate, Mr. Anshul Asawa, joined DMART in mid-Mar’25 and is expected to take charge of all operational aspects of the retail business in another 4-5 months, while the current CEO, Mr. Neville Noronha, will dedicate more time to store-opening acceleration, e-commerce capacity build-up, and other non-retail aspects of the business

Valuation and view

* Given the recent fundraising by the top 3 QC players and the entry of large offline/online retailers into quick commerce, the competitive intensity is likely to remain elevated in the near term.

* We believe DMART’s value-focused model and superior store economics would ensure its competitiveness and customer relevance despite QC’s convenience- focused model over the longer term. However, rising competition on pricing could weigh on DMART’s growth and margins at least in the near term.

* We cut our FY26-27E EBITDA by ~5% each due to heightened competitive intensity and rising CoR, while our FY26-27E EPS is cut by ~6-8%. We build in a CAGR of 17%/17%/15% in DMART’s consol. revenue/EBITDA/PAT over FY25-27E.

* We assign a ~46x FY27 EV/EBITDA multiple (implying ~79x FY27 P/E) to arrive at our revised TP of INR4,350. We reiterate our BUY rating on DMART.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412