Neutral GSK Pharma Ltd for the Target Rs. 3,040 by Motilal Oswal Financial Services Ltd

Niche products and cost efficiency drive a beat on margins

Efforts ongoing to enhance awareness of differentiated products

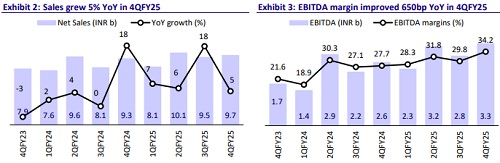

* GlaxoSmithKline Pharmaceuticals (GLXO) reported in-line sales for the quarter. However, it delivered a beat on EBITDA/PAT due to a superior product mix and controlled costs.

* While priority brands in the general medicines category outperformed the industry, muted performance in certain products within the anti-infectives and pain categories hit overall revenue growth for GLXO.

* GSK is driving healthy execution in the vaccines segment through superior products as well as enhanced marketing efforts. The comprehensive plan is paving the way for improved off-take of Shingrix.

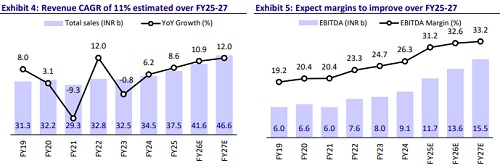

* We raise our earnings estimates by 5% each for FY26/FY27, factoring in 1) the higher benefit of marketing efforts in the vaccines segment and 2) the reorganization of operational costs

* We value GLXO at 44x 12M forward earnings to arrive at our TP of INR3,040. Considering a 15% earnings CAGR over FY25-27 and priced-in valuation (45x FY26E/39x FY27E earnings), we reiterate our Neutral rating on the stock.

Product mix and improved productivity boost margins YoY

* GLXO’s revenue grew 4.8% YoY to INR9.7b (est: INR9.7b).

* Gross margin (GM) expanded 340bp YoY to 63.9%, due to a change in the product mix.

* EBITDA margin expanded 650bp YoY to 34.2% (our est: 28.7%) due to better product mix and improved operating leverage (employee expenses/other expenses down 290bp/20bpp YoY as % of sales).

* EBITDA grew 29.5% YoY to INR3.3b (vs. our est. of INR2.7b).

* PAT grew 36.8% YoY to INR2.6b for the quarter (our est. INR2.1b).

* For FY25, revenue/EBITDA/PAT grew by 9%/29%/25% YoY to INR37.4b/ INR11.6b/INR9.1b.

Key highlights from the management commentary

* GLXO has aligned an operational plan for Shingrix with a focus on areas of resourcing. Accordingly, it has witnessed more patient activations at the point of vaccination.

* Notably, it has been able to surpass the 10K sell-in barrier for the first time in Mar’25 since launch month.

* Softening of raw material prices and reorganization efforts have led to lower operational costs for the quarter.

* GLXO has been driving higher off-take of Nucala/Trelegy through redefining goals for clinical outcomes and pushing science-led differentiation.

* Certain brands like Augmentin, Ceftum, and T-Bact have been gaining market share compared to peers in their respective categories.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412