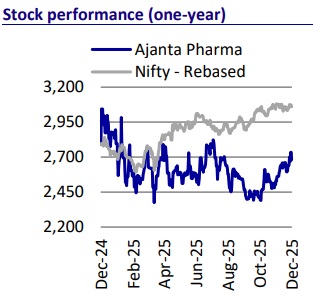

Buy Ajanta Pharma Ltd for the Target Rs. 3,145 by Motilal Oswal Financial Services Ltd

Branded generics playbook fires; semaglutide adds a new growth leg

We recently met the management of Ajanta Pharma (AJP) to gain deeper insights into the company’s business prospects. The key takeaways are as follows:

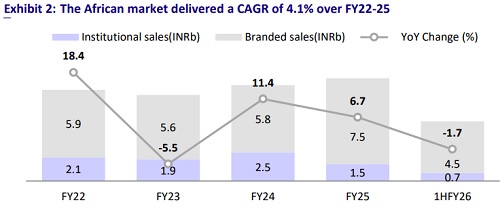

* AJP is implementing multiple strategic initiatives across focus branded generics markets of India, Asia, and Africa to sustain robust industry outperformance.

* In emerging markets across Africa and Asia, AJP has not only expanded its therapy coverage but has also shifted toward chronic indications, which should support more sustainable growth.

* AJP is also working on the following two levers: 1) adding geographies with larger market sizes to further widen its presence and 2) enhancing its product offerings within existing markets.

* The partnership with Biocon to source semaglutide for 23 target countries marks a meaningful step toward introducing newer therapies in these markets. Interestingly, the innovator’s limited reach paves the way for AJP to participate in market formation and gain market share.

* In India, incremental therapies supported by the medical representative (MR) footprint continue to drive 25-30% outperformance vs. the industry. While certain therapies, such as Ophthalmology, have faced pressure due to adverse seasonality and heightened competition, AJP has still managed to outperform the Indian Pharmaceutical Market (IPM) by 100-200bp over the past 12 months.

* The company’s surplus cash position provides enough cushion to acquire products that complement its branded generics portfolio. In fact, AJP has meaningfully scaled its acquired brands over the past 12 months.

* The company has earmarked INR10b for inorganic opportunities to plug gaps in select therapy areas, sharpening its growth focus across India/EM. Notably, Derma/Pain/Nephro/Gynaec shall remain the key focus areas with an emphasis on brand and portfolio acquisitions.

* AJP files around 150-200 product registrations annually, translating into 120- 150 approvals across India and Emerging Markets.

* On an overall basis, management remains confident of delivering double-digit YoY revenue growth in FY26.

* We expect a revenue/EBITDA/PAT CAGR of 11%/15%/16% to reach INR65b/ INR19b/INR14b over FY26-28. We estimate potential annualized sales from the semaglutide opportunity in Asia and Africa at USD25–30m from 2HFY28 onwards. Assuming a gross margin of ~70% and limited incremental operating costs, the EBITDA margin for this product should be healthy at 50–55%, driving incremental profitability for AJP.

* We value AJP at 30x 12M forward earnings to arrive at our TP of INR3,145. Reiterate BUY.

AJP’s positioning in GLP1: building the next growth engine via tie-ups

* In emerging markets, AJP is pursuing an asset-light, marketing-led model and will source semaglutide from Biocon under an in-licensing arrangement. The company has exclusive or semi-exclusive marketing rights across 23 countries in Africa and three countries in the Middle East and Central Asia. With patents expiring in Mar’26 and approvals expected between late 2026 and early 2027, this structure enables AJP to capture upside without assuming manufacturing risk.

* Given the innovator’s limited presence, AJP’s established footprint in these markets, and limited generic competition, management remains confident of strong traction for semaglutide injections across the 23 plus three countries post-regulatory approvals, supported by intensified marketing efforts.

* While AJP has a separate tie-up for sourcing Semaglutide in the Indian market, it is gearing up to participate in the first wave of market formation domestically.

EM: Broadening footprint into higher-TAM geographies and chronic-led portfolio aided by incremental MR addition

* Emerging markets are being developed into a scalable growth platform, driven by a steady cadence of new launches, adding therapies, a calibrated expansion of the field force, and exploring newer and bigger TAM markets.

* AJP is scaling its execution bandwidth via 5-6% annual MR addition on its strong base of 2,000, while also entering newer and structurally larger geographies to support the next phase of growth.

* In parallel, the portfolio is being transitioned from an acute-led portfolio to a more chronic-centric franchise, improving revenue durability, visibility, and thereby structurally upgrading the quality of growth

DF: Growth funnel expanded through entry into gynaec, nephro, and acquisitions

* AJP is re-engineering its DF engine by layering new chronic growth drivers on top of a scaled legacy base, with FY25 marking entry into two new therapies: gynaec and nephro.

* Gynaec is witnessing higher traction and is expected to become a meaningful contributor in 2-3 years, while nephro is building more gradually due to intense competition, where growth is a bit slow.

* This is being reinforced by sustained outperformance in core therapies, with derma/pain likely to grow 500-600/300-400bp ahead of the market.

* Ophthal is likely to continue growing 100–200bp faster than IPM despite industry headwinds from seasonality, competition, and NLEM inclusion.

* Cardiac therapy delivered 7.4% YoY growth over the last three months (Sep’25 to Nov’25) according to IQVIA. Management indicated that AJP’s growth in the covered market is in line with IPM. In 1HFY26, AJP is confident of achieving 11- 12% YoY growth vis-à-vis 4.7% YoY growth as per IQVIA.

* The portfolio reset is supported by time-bound front-end investments, including the addition of 750 MR in FY25 (around 200 for new therapies, with nephrology accounting for 40-45%, and 550 for existing therapies) and another 150 in 1HFY26. Meaningful benefits from the MR addition is expected to be reflected from 2HFY27 onwards.

* In parallel, three brands acquired in Nov-24 for INR400m are experiencing healthy traction, signaling early success in integration. ? Taken together, these initiatives reposition the DF business into a structurally higher-quality growth platform, moving it away from a narrow, cyclical volume engine.

Regulated market: New product launches/expansion into new geographies

* Expansion into newer geographies should structurally improve the sustainability of margins by diversifying the revenue base.

* Deeper penetration into existing therapies through new product launches should continue to drive incremental growth.

Valuation and view

* After posting a strong 23% earnings CAGR over FY23-25, AJP has entered a consolidation phase in FY26 due to incremental investments in MRs for both base and newer therapies. We, thus, expect earnings growth to moderate to 11% YoY in FY26.

* That said, the benefits of initiatives undertaken in FY26 should begin to accrue meaningfully in FY27, driving 20% YoY earnings growth. We have not yet factored in any semaglutide-related upside in FY28 earnings. Given the considerable scope of demand expansion and AJP’s robust franchise, the sales traction can be decent despite generics-led price erosion in Semaglutide across markets post-patent expiry.

* We estimate AJP’s potential sales from this opportunity in Asia and Africa at USD25-30m on an annualized basis in 2HFY28. Assuming a gross margin of 70% and limited additional operating costs, the EBITDA margin of this product should be healthy at 50-55%, driving additional EBITDA for AJP.

* We value AJP at 30x 12M forward earnings to arrive at our TP of INR3,145. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)