Buy UTI AMC Ltd for the Target Rs.1,650 by Motilal Oswal Financial Services Ltd

Higher other income drives PAT beat

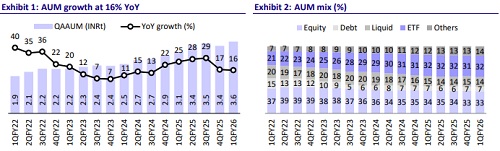

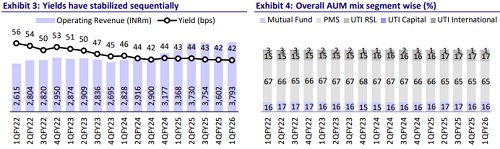

* UTI AMC’s 1QFY26 operating revenue stood at INR3.8b (in line), up 13% YoY/6% QoQ. Yield on management fees stood at 42bp in 1QFY26 vs. 43.4bp in 1QFY25 and 42.4bp in 4QFY25.

* Total opex was up 16% YoY to INR2.1b. As bp of QAAUM, it remained flat YoY at 22.9bp in 1Q (vs. 24.3bp in 4QFY25). EBITDA was up 9% YoY/12% QoQ at INR1.7b (8% miss on account of higher employee costs). EBITDA margins stood at 45.4% vs. 47.1% in 1QFY25 and 42.6% in 4QFY25.

* PAT declined 8% YoY to INR2.5b (15% beat), driven by better-than-expected other income.

* Higher employee costs were offset by other income.

* FY26/FY27 earnings estimates remain broadly unchanged. We expect UTI to report a CAGR of 15%/12%/15% in AUM/revenue/core PAT over FY25-27E. The stock trades at FY27E P/E of 18x and core P/E of 28x. We reiterate our BUY rating with a one-year TP of INR1,650 (based on 32x core FY27E EPS)

Steady growth in AUM led by SIP flows

* Total MF QAAUM was up 16% YoY/6% QoQ at INR3.6t, driven by 7%/18%/36%/21% YoY growth in Equity/ETFs/Index/Debt funds.

* Equity QAAUM contributed 26% to the mix in 1QFY26 vs. 29% in 1QFY25. Debt/Liquid schemes contributed 7%/14% to the mix in 1QFY26 (7%/15% in 1QFY25).

* Overall net inflows for UTI stood at INR99.2b vs. INR141.7b in 1QFY25 and INR6.7b in 4QFY25. Equity/ETFs & Index/Income/Liquid funds garnered inflows of INR5b/INR35b/INR36b/INR23b.

* Gross inflows mobilized through SIPs stood at INR22.6b in 1Q. SIP AUM stood at INR421.9b, up 17% YoY. Total live folios stood at 13.5m (as of Jun’25).

* The overall MF AAUM market share declined to 5% from 5.27% in Jun’24. UTI AMC’s market share in Passive/NPS AUM stood at 13.18%/24.67%.

* The market share in Equity/Hybrid/Index & ETFs/Cash & Arbitrage/Debt Funds stood at 3.01%/4.2%/13.18%/4.24%/3.27% in Jun’25 vs. 3.45%/4.17%/13.31%/4.75%/3.22% in Jun’24.

* The distribution mix in QAAUM remained largely stable in 1Q, with direct channel dominating the mix with 71% share, followed by MFDs at 21% and BND at 8%. However, with respect to equity AUM, MFDs contributed 54% to the distribution mix.

* Total expenses grew 16% YoY (flat QoQ) to INR2.1b (7% above est.), with employee costs up 14% YoY at INR1.3b (10% above est.) and other expenses up 21% YoY at INR770m (in line with est.). As a result, CIR stood at 54.6% vs. 52.9% in 1QFY25 and 57.4% in 4QFY25.

* Other income declined 14% YoY to INR1.7b.

* The number of digital transactions grew 30% to 4.9m in 1Q, showing a strong focus on growing SIP book digitally. Capitalizing on cross-selling and upselling opportunities has supported growth in online gross sales at 89.9%.

* Total investments as of Jun’25 stood at INR43.3b, with 70%/15%/8%/7% being segregated into MFs/Offshore/Venture Funds/G-Sec/Bonds.

Growth across non-MF segments

* Total group AUM stood at INR21.9t, up 13% YoY, of which MF AUM stood at INR3.6t, up 16%. Non-MF AUM, comprising PMS/UTI RSL, grew 11%/20% YoY to INR14.2t/NR3.8t, while UTI Capital/UTI International declined 4%/7% YoY to INR28b/INR274b.

* Yields on MF/PMS/RSL/International businesses largely remained stable YoY, while yields on capital business improved to 0.75% from 0.57% in 1QFY25.

* In the UTI International segment, the UTI India Innovation Fund, domiciled in Ireland, has AUM of USD59.232m as of Jun’25.

* UTI Pension Fund has crossed the milestone of INR3.8t in AUM and manages 24.67% of the NPS industry AUM as of Jun’25.

* In the Alternatives business, UTI AMC has gross commitments of USD200m in the IFSC GIFT City as of Jun’25.

Valuation and view:

* UTI AMC continues to deliver a steady and broad-based performance across its mutual fund, pension, and international businesses. The core AMC operations have seen consistent growth in AUM, supported by a diversified product mix with a strong tilt toward equity, healthy SIP inflows, and robust retail traction.

* Despite macro challenges, the company has maintained its operational momentum through strong digital adoption, wide distribution reach—especially in B30 markets—and a growing presence in passive and alternate assets. Improving fund performance and scaling up the non-MF business will improve profitability over the medium term.

* Higher employee costs were offset by other income, leading to FY26/FY27 earnings estimates broadly remaining unchanged. We expect UTI to report a CAGR of 15%/12%/15% in AUM/revenue/core PAT over FY25-27E. The stock trades at FY27E P/E of 18x and core P/E of 28x. We reiterate our BUY rating with a one-year TP of INR1,650 (based on 32x core FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)