Neutral Aditya Birla Lifestyle Brands Ltd for the Target Rs. 155 by Motilal Oswal Financial Services Ltd

Retail momentum continues; profitability improvement remains key trigger

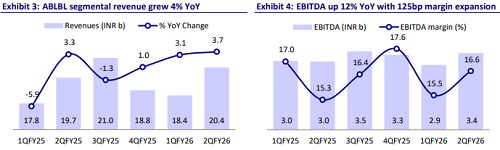

* ABLBL reported a modest 4% YoY revenue growth (vs. 11% for Arvind Fashion) in 2QFY26, as strong 12% LTL retail growth was offset by the adverse impact from recent store rationalization and GST-related transition on wholesale primary sales.

* EBITDA rose 12% YoY to INR3.2b, with margins expanding 125bp to 15.5%, driven by higher gross margin. However, pre-Ind AS EBITDA for 1H was flat at INR2.5b, with ~15bp margin contraction due to higher lease rental costs.

* Reebok and Van Heusen Innerwear showed strong consumer traction (10%+ and 20%+ LTL, respectively), but reported sales were muted due to inventory corrections in Reebok and GST-linked disruptions in wholesale channels.

* Management is targeting to double revenue (11%+ CAGR) over FY24-30 through sustained high-single-digit LTL growth and net store additions of 250+ annually (on a base of ~3,200+ stores).

* However, we believe that given the widespread presence of Lifestyle brands across EBOs, MBOs, LFS and online channels and rising competition from newage D2C brands, sustaining double-digit growth could prove challenging.

* Our FY26-28E EBITDA is broadly unchanged, though our FY26E PAT is cut by ~13% due to the front-loaded impact of lease rentals. We build in a CAGR of 9%/11%/26% in revenue/EBITDA/adj. PAT over FY25-28E.

* We ascribe a 12x Dec’27E EV/EBITDA multiple to Lifestyle brands and a ~1.2x EV/sales multiple to the emerging brands. We maintain a Neutral stance with a revised TP of INR155 (implies ~23x Dec’27E pre-INDAS EV/EBITDA).

Strong LTL growth across segments, but yet to translate into improved profitability

* Revenue at INR20.4b grew by a modest 4% YoY (vs. our estimate of 6% YoY, though 2QFY25 numbers have been restated), despite improvement for peers (+11% YoY for Arvind Fashions).

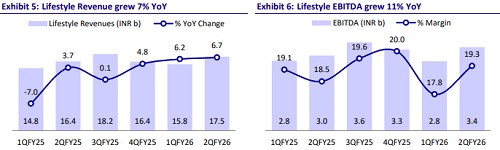

* Lifestyle Brands grew 7% YoY, driven by 12% retail LTL growth, while Emerging Brands delivered 11% LTL growth.

* Despite healthy LTL growth, ABLBL’s overall growth was adversely impacted by store rationalizations in past 12 months.

* Gross profit rose ~6% YoY to INR11.7b (4% miss) as gross margin expanded ~130bp YoY to 57.7%, likely driven by lower discounting.

* Other expenses spiked 12% YoY likely due to higher A&P spends, while employee and rental expenses fell 4% and 8% YoY, respectively.

* Reported EBITDA at INR3.2b grew by ~12% YoY (in line with our estimate) as EBITDA margin expanded by ~125bp YoY to 15.5%.

* Pre-IND AS EBITDA for 1HFY26 stood at INR2.5b, flat YoY, with margins at 6.4%, contracting 15bp YoY.

* Depreciation jumped ~20% YoY on front-loading of lease-related expenses, while interest cost declined ~10% YoY.

* Resultantly, PAT at INR232m declined ~41% YoY, significantly below our estimate of INR475m. Overall, 1HFY26 PAT stood at INR475m, down 30% YoY.

* Inventory levels increased by 16% compared to FY25, driven by festive-season stocking. This pushed core working capital up by 9% YoY, with core WC days rising to 67 from 61 in Mar’25.

* Pre-INDAS OCF outflow stood at INR1b in 1HFY26 (vs. ~INR2.1b YoY), driven by favorable WC movement. 1HFY26 FCF outflow stood at INR2.2b (vs. INR3.4b YoY) as capex moderated ~10% YoY to INR1.2b.

* For 1HFY26, revenue/EBITDA grew 7%/6%. Based on our estimates, the implied run rate for 2HFY26 for revenue/EBITDA stands at 10%/11%.

Key highlights from the management interaction

* Demand: Early festive and strong growth in small towns drove strong LTL growth in retail channels, but overall consumption remains muted due to weather and GST transition-related disruptions. Diwali sales were modest and the near-term outlook hinges on the recovery in the ongoing wedding season.

* Expansion: Network consolidation is largely complete, with ABLBL adding 75+ gross stores across formats (~26 on net basis). Management expects store additions to accelerate from 2HFY26.

* Inventory: Higher inventory levels reflect early festive stocking and precautionary winterwear sourcing amid sourcing uncertainty from Bangladesh. Working capital is elevated in the short term but is expected to normalize by year-end as sales accelerate.

Valuation and view

* ABLBL’s Lifestyle brands have achieved scale along with healthy profitability. The company is focused on scaling up its Emerging brands such as American Eagle (denim), Reebok (footwear) and Van Heusen Innerwear (innerwear and athleisure), providing a compelling retail play with a balanced growth and profitability profile with strong cash generation and robust return ratios.

* Management is targeting to double revenue (11%+ CAGR) over FY24-30 through sustained high-single-digit LTL growth and net store additions of 250+ annually (on a base of ~3,200+ stores).

* However, we believe that given the widespread presence of Lifestyle brands across EBOs, MBOs, LFS and online channels and rising competition from new-age D2C brands, sustaining double-digit growth could prove challenging.

* Our FY26-28E EBITDA is broadly unchanged, though our FY26E PAT is lowered by ~13% due to the front-loaded impact of lease rentals. We build in a CAGR of 9%/11%/26% in revenue/EBITDA/adj. PAT over FY25-28E.

* We ascribe a 12x Dec’27E EV/EBITDA multiple to the Lifestyle brands and a ~1.2x EV/Sales multiple to the Emerging brands. We maintain a Neutral stance with a revised TP of INR155 (implies ~23x Dec’27 pre-INDAS EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412