Buy Kirloskar Oil Engines Ltd For Target Rs. 1,240 By JM Financial Services Ltd

Strong growth across segments; LGM transaction positive

Kirloskar Oil Engines (KOEL) quarterly performance was above JMFe and consensus estimates, driven by strong growth across segments. Volume normalisation, stable prices and higher HHP genset revenue resulted in strong growth in the powergen segment. As a strategic move, KOEL has transferred its B2C (Water Management Solutions) business to its wholly-owned subsidiary La-Gajjar Machineries Pvt Ltd (LGM), to create a simplified organisation structure, drive significant operational efficiencies by eliminating redundancies, streamlining go-to-market channels, and amplifying reach to its core customer base. We expect standalone EBITDA margins to improve 30-50bps by FY28 with completion of above transaction. Maintain Buy with revised SoTP of INR 1,240 valuing core business at 25x Sep’27E.

* Strong revenue growth across segments: Revenue grew at a healthy 34.3% YoY to INR 16bn (JMFe INR 12.9bn), crossing the INR 16bn mark for 1st time in a quarter. This was led by doubledigit growth across segments. Gross margin fell 210bps YoY to 34.7%. EBITDA grew 44.6% YoY to INR 2.1bn with EBITDA margin expanding 90bps YoY to 13.4%, due to operating leverage (JMfe 12.9%). Adj. PAT grew 50% YoY to INR 1.4bn, above JMFe of INR 1.1bn.

* Strong growth in powergen and exports segment revenue: Powergen segment reported robust revenue growth of 41% YoY to INR 6.8bn, led by volume recovery and growth in the HHP segment (from the real estate sector). Recently, the Optiprime range genset won orders for 1500KVA (two orders), 2000KVA and 2500KVA gensets from the real estate sector (residential and commercial). On the exports front, revenue grew 39% YoY to INR 1.7bn, with traction witnessed in Middle East and Africa, which account for 60% of export revenue. In North America, the company is still investing in product development, channel partners and expect growth in the near term to be negligible.

* Defence and Railways led the Industrial segment growth: Industrial segment revenue grew 47% YoY to INR 3.7bn, with growth witnessed in defence and railways. Defence growth was supported by execution of orders under emergency procurement (likely to continue in 3QFY26 as well). The company has submitted detailed design for the Indian Navy’s prestigious ‘Make 1’ initiative (6MW medium-speed marine diesel engine). Industrial segment outlook continues to remain healthy from defence, and railways, and the expected recovery in the construction sector.

* Strategic alignment of B2C segment: KOEL has transferred its B2C business (INR 6.3bn revenue in FY25) to its wholly-owned subsidiary La-Gajjar Machineries Private Limited (LGM) by way of slump sale. The key objective is to maintain dedicated focus on each segment and drive greater efficiency through structures best suited to their respective customer needs. Consequently, we have revised our standalone assumption in line with the restructuring. With this restructuring and consolidation of the Sanand facility we expect LGM margin to expand to 9% by FY28E from 4.2% in FY25 (low base- impact of facility consolidation).

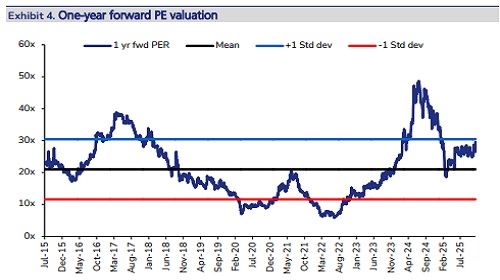

* Maintain BUY with TP of INR 1,240: We remain positive on the stock factoring in, market share gain in the HHP segment, new product launches in the high KVA segment, thrust on the aftermarket segment, push on exports, volume recovery in domestic powergen, and healthy industrial segment outlook. The company continues to invest in product enhancement, new product launches and capacity expansion to meet upcoming opportunities. With the transfer of the B2C business and product mix, we expect standalone EBITDA margin to expand c.30-50bps by FY28E (from 13.3% in 1HFY26). Maintain BUY rating on stock with a SoTP-based TP of INR 1,240 (INR 1,220 earlier), valuing core business at 25x Sep’27E (28x FY27E earlier).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361