Neutral Muthoot Finance Ltd for the Target Rs.4,500 by Motilal Oswal Financial Services Ltd

Sustained momentum; NPA recoveries drive earnings beat

Stellar gold loan growth of ~50% YoY; calc. NIM stable QoQ

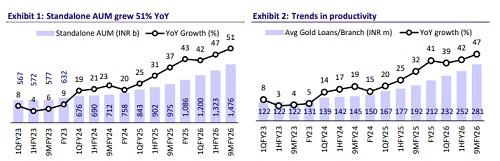

* Muthoot Finance’s (MUTH) strong operating performance in 3QFY26 was driven by: 1) robust gold loan growth of ~50% YoY to ~INR1.4t, 2) ~65bp QoQ improvement in GS3 to 1.6%, aided by NPA recoveries, and 3) spread expansion of 5bp QoQ to 11.85% as yields rose owing to NPA recoveries.

* PAT grew 95% YoY and 13% QoQ to ~INR26.6b (~23% beat). This included one-off interest income of ~INR6.5b – INR5b of interest on legacy NPA accounts, INR1.2b from gold loan auctions and INR240m from ARC sale. The yield improvement was mainly driven by the one-off item in interest income. Adjusted yields stood at 18.8% (vs. calculated yields of 20.7%). Reported RoA/RoE remained strong at 7.6%/32%.

* Net total income grew 66% YoY to ~INR46.2b (~16% beat). Opex grew ~28% YoY to INR9.2b (in line), resulting in a cost-to-income ratio of ~20% (PY: 26% and PQ: 21.3%). This included one-time impact of provisions of INR480m made on account of the new labor codes. PPOP grew 79% YoY to ~INR37b (~21% beat).

* Provisions stood at ~INR1.1b and translated into annualized credit costs of ~32bp in 3QFY26 [PY: ~90bp and PQ: ~35bp].

* Gold tonnage declined ~2% QoQ and grew ~1.5% YoY to 205 tons. The customer base declined ~0.6% QoQ to ~6.53m. Gold loan LTV declined ~75pp QoQ to ~55.8%.

* Management shared that gold loan growth is driven by customer need for liquidity rather than gold price movements. Additionally, with unsecured and MFI credit tightening, borrowers are increasingly shifting to goldbacked loans as a dependable source of funding.

* We believe gold loan growth will remain strong over the next few quarters, supported by elevated gold prices and continued tightening in unsecured credit, which is pushing borrowers toward secured, gold-backed financing. As the market leader among NBFCs, MUTH is well placed to capture a disproportionate share of this incremental demand and should continue to outpace peers. While the operating outlook remains favorable, volatility in gold prices remains a key monitorable, as sharp movements could influence customer behavior, collateral cover and short-term disbursement trends.

* We raise our FY26/FY27/FY28 EPS estimates by ~12%/9%/7% to factor in higher loan growth and stable recoveries from the NPA pool. We model a standalone AUM/PAT CAGR of ~18%/14% over FY26E-28E. We model RoA/RoE of 5.4%/24% by FY28E.

* MUTH now trades at 3.5x FY27E P/BV and 14x P/E and, in our view, has benefited from the tailwinds of: 1) a sharp rise in gold prices, and 2) an improvement in gold loan demand due to the industry-wide rationing in unsecured credit. With its ability to deliver industry-leading gold loan growth and best-in-class profitability, MUTH is one of the best franchises for gold loans in the country. Maintain our Neutral rating with a revised TP of INR4,500 (based on 3.3x Dec’27E P/BV).

Belstar: AUM up 2.5% QoQ; GNPA rises ~35bp QoQ

* MUTH’s MFI subsidiary (Belstar) AUM declined 9% YoY and grew ~2.5% QoQ to ~INR79b. Belstar reported PAT of ~INR510m during the quarter (vs. a loss of INR316m in 2QFY26).

* GS3 in Belstar rose ~35bp QoQ to ~4.95% (PQ: 4.6%). The company opened 39 new gold loan branches in 9MFY26 to diversify the portfolio.

Highlights from the management commentary

* The RBI’s draft proposal to eliminate the requirement for prior approval for branch openings is significantly positive. The company currently operates around 5k branches under Muthoot Finance and 1k under Muthoot Money, and plans to pursue calibrated network expansion based on business conditions.

* The company follows a customer-friendly approach and does not aggressively auction gold, often giving customers time to repay before triggering auction.

* Opex has risen due to higher employee costs, variable pay linked to business growth, rent increases, regulatory compliance costs, advertising and external consulting expenses.

Valuation and view

* MUTH reported a strong operating performance for the quarter, driven by sustained momentum in gold loan growth and higher-than-expected earnings supported by recoveries from the NPA pool and gold loan auctions. Excluding recoveries from the NPA pool, earnings were broadly in line during the quarter. Asset quality improved due to auctions and old NPA customers repaying their gold loans. NIMs and spreads were broadly stable in the quarter.

* With a favorable demand outlook for gold loans, driven by the limited availability of unsecured credit, the company is well-positioned to maintain its healthy loan growth momentum. Maintain our Neutral rating with a revised TP of INR4,500 (based on 3.3x Dec’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412