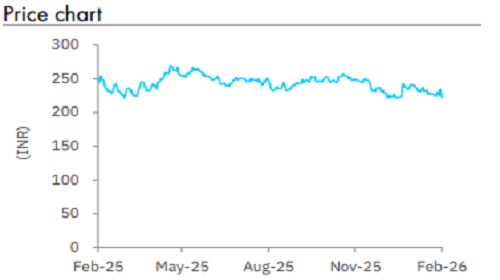

Accumulate Kansai Nerolac Paints Ltd For Target Rs 240 By Elara Capital

Subdued Q3, lacking growth catalysts

Kansai Nerolac Paints ( KNPL IN) posted a muted Q3 , with revenue missing estimates by 2.5% due to a subdued decorative segment, though the industrial segment registered good growth driven by the auto segment . The extended monsoon at the start of the quarter and a shorter festiv al season due to early Diwali impacted overall demand, alongside geopolitical conflicts, tariff wars, and rupee depreciation. In absence of any growth catalyst, we reiterate Accumulate, reducing our TP to INR 240 (from INR 272) , based on 25x FY28E P/E as we roll forward.

Shorter festival season and extended monsoons had a bearing on growth: KNPL posted a growth of 3.5% YoY in Q3 net sales to INR 19.1bn, missing estimates by 2.5% due to extended monsoon and shorter festiv al season. Decorative demand was subdued though internal initiatives drove good growth across projects, distribution, waterproofing and construction chemicals. Paint+ products now contribute >10% to decorative business, while painting services grew steadily, contributing >5%. New product launches supported premiumization and maintained stable contributions. Dealer network expanded by 3,500 YTD , with specialty stores (Nerolac NXTGEN and Nerolac Plus) exceeding 600 stores . The industrial coatings segment registered strong growth, led by automotive (fueled by GST 2.0 cuts ). Performance coatings saw healthy demand in general industrial , driven by construction equipment and pre -engineered buildings . Powder coatings and auto -refinish both saw stable demand in Q3 . Management indicated market share gains in industrial coatings, while decorative market share broadly remained stable, with a near -zero value -volume gap ,reflecting improved mix discipline.

Expectations of improved performance in Q4, competitive intensity persists: Management noted a recovery in decorative momentum in Nov ember and Dec ember after a muted Oct ober, with good growth expected to continue into Q4. KNPL expect s growth in decorative to touch mid -single digit in Q4 from flat -to-marginally negative growth in Q3. Industrial is anticipated to maintain strong momentum, supported by sustained construction activity, ongoing automotive demand, and infrastructure growth , which will drive demand for high -end coatings. KNPL is investing heavily in manpower, feet -on-street, influencer programs, CCD machine deployments (nearing 85% target), and dealer openings to protect and grow market share. Although c ompetitive intensity is high, with the JSW -Akzo merger potentially increasing investments in royalty pull -backs for influencers, the impact is yet to be seen.

Margin guidance of 13-14% reiterated: EBITDA was flat YoY at INR 2,473mn, missing estimates by 4.9%, with margins declining 44bps YoY to 13.0% (trailing estimates by 32bps) due to muted topline growth . Gross margins improved 24bps YoY to 35.5% (beating estimates by 54bps), aided by stable raw material costs. However, management retains its EBITDA margin guidance of 13 -14% for FY26, emphasizing caution amid high competition .

Reiterate Accumulate with a lower TP of INR 240: We slash our earnings estimate by 1.2%/3.8% for FY27 E /28E to factor in lower topline growth. With high competitiveness across dealer incentive, KNPL is focused on premiumization and mix improvement. However with no short - term trigger for growth and a subdued demand, we reiterate Accumulate with a lower TP of INR 240 from INR 272 on 25x FY28E P/E (from 30x FY27E) as we roll forward.

Please refer disclaimer at Report

SEBI Registration number is INH000000933