Buy Reliance Industries Ltd for the Target Rs.1,688 by PL Capital

Poised for multi-engine growt

Quick Pointers:

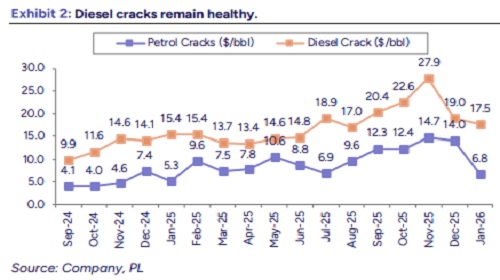

* Diesel cracks remain resilient

* Global capacity rationalization to support petrochemical margins

Reliance Industries’ (RELIANCE) O2C segment is expected to deliver steady performance, supported by healthy diesel cracks amid resilient transportation fuel demand. In the near term, petchem profitability is likely to remain under pressure, though long-term fundamentals should improve with global capacity rationalization. RJIL fcontinues to be a key value-unlocking lever, backed by improving operational performance and a strong growth outlook. Rising 5G and FWA subscriber additions, along with deep penetration across India, should further support earnings momentum. In the retail segment, in absence of a perfect peer, we compared RRVL with Titan and DMart. RRVL’s revenue and EBITDA/sqft trail Titan and DMart due to its higher exposure to low-margin grocery formats; however, the outlook remains constructive, supported by potential mix improvement from higher margin jewelry and fashion categories. The stock is trading at consol EV/EBITDA of 11.1x/9.9x of FY27E/FY28E. In the absence of quantitative disclosures, we assign a value of Rs111/share to the New Energy segment, valuing it at 2x the earlier announced capex of Rs750bn. Maintain ‘BUY’ rating with TP of Rs1,688.

* Energy business to improve: Transportation fuel crack spreads are expected to remain healthy, supported by resilient domestic demand. Opportunistic sourcing of discounted crude including direct license to source Venezuelan barrels and ongoing global capacity rationalization in petrochemicals should support margins and improve profitability. Standalone EBITDA is expected to rise from Rs581bn in FY25 to Rs636bn in FY28E, implying a CAGR of 3.1%.

* Growth momentum continues in RJIL: Reliance Jio Infocomm Ltd (RJIL) is expected to maintain market leadership, supported by its dense and extensive 5G network across urban and rural India. We model subscribers at 538mn and ARPU at Rs243 by FY28E, implying CAGR of 3.3% and 7.4%, respectively, over FY25–FY28E. Revenue is expected to exceed Rs1,500bn with EBITDA of Rs896bn in FY28E, driven by an improving subscriber mix and migration to higher value plans.

* RRVL EBITDA margin trajectory to remain steady: Reliance Retail Ventures Ltd (RRVL) operates the largest store network by count and total retail area in India. However, the pace of store addition remains slow as against its competitors such as DMart and Titan. Lower revenue and EBITDA/sqft reflect higher exposure to low-margin, mass-market grocery and value formats. We expect EBITDA margin to remain steady, at 8.0-8.2% by FY28. EBITDA CAGR is expected at 10.9% over FY25-28E supported by enhanced store count, with jewelry and fashion offering incremental profitability over time.

* New Energy projects remain on track: RELIANCE, through Reliance New Energy Ltd (RNEL), is developing an integrated new energy platform comprising 10GW solar manufacturing (scalable to 20GW) and a battery value chain from cells to ESS, with battery capacity of 40GWh expandable to 100GWh. The solar PV giga-factory is progressing as planned, with module and cell lines commissioned and ingot/wafer pilot operational, while polysilicon and solar glass units are targeted for commissioning within a year

Above views are of the author and not of the website kindly read disclaimer