Hold IndusInd Bank Ltd For the Target Rs.1,029 by Choice Broking Ltd

Margins shrink, slow business traction, asset quality woes, but IndusInd bank recalibrates its future course in turbulent times.

IIB reported dismal performance in Q3FY25, failing short of market and our expectations. The bank reported slower business growth falling well short of high and mid teens guidance, converging spreads with upward drifting C/I ratio. IIB, another victim of micro finance, reported higher slippages with soft recoveries. IIB in Q3FY25 reported:

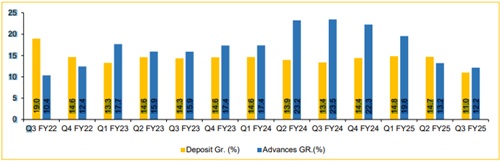

* Advances at INR 3,668 Bn (vs CEBPL est. INR 3,782), up 12.2% YoY while deposits grew 11% YoY to INR 4,094 Bn (vs CEBPL est. INR 4,192). CD ratio reported at 89.6% as advances grew 2.7% QoQ and deposits declined by 0.7% on QoQ basis.

* Asset quality deteriorates as GNPA/NNPA weakens by 33bps/14bps on YoY basis and 11bps/4bps on QoQ basis. GNPA was reported at INR 84 Bn(vs CEBPL est. INR 84 Bn).

* PAT for Q3FY25 reported at INR 14 Bn, (vs CEBPL est. 18 Bn) was down by 39.1% YoY but recovered 5.3% sequentially.

Balance sheet Calibration in turbulent times:

IIB cautiously curtailed non LCR deposits and focused on retail deposits. This strategy resulted in negative 1% QoQ growth in total deposits. IIB implemented calibrated loan growth strategy as microfinance and two wheelers disbursements were intentionally slowed down. We expect the IIB to shift its portfolio away from unsecured loans. To diversify its micro finance business, IIB announced launch of Bharat Vikas Banking segment in April 2025. With these recalibration steps we expect convergence in Loan and deposit growth. We forecast advances to grow by 12.2% and Deposits to grow by 12.1% in FY26

Deteriorating operating leverage adding fuel to fire:

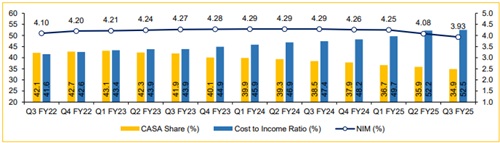

For the 5 th consecutive quarter cost to income ratio is in upward trend rising 507 bps YoY. NIM for the bank has contracted 36 bps YoY as cost of funds rose 14 bps YoY to 6.58% and Yield on advances fell 21 bps YoY to 12.21%. We expect this trend of double whammy to continue and forecast NIM at ~3.83% in FY26 and cost to income ratio at 53% in FY26, despite management efforts to curtail Opex costs.

Microfinance and two-wheeler segments weighing down the asset quality:

GNPA in microfinance and two wheeler segment remained at elevated levels, 7.05% and 8.73% respectively, rising 51 bps and 74 bps respectively on QoQ basis. The management has guided that slippages to remain elevated for another quarter in both the segments. While the overall GNPA stands at 2.28%, we expect it to rise to ~2.6% by FY26 fueled by higher slippage ratio. The troubled segments (MFI, Credit cards and 2-wheeler) combined stands at ~13.2% of the overall portfolio.

View and Valuation:

We revise our FY25/26 ABVPS estimates downwards by 5.2%/9.2% and reiterate our ‘HOLD’ rating. We revise our TP downwards to INR 1,029, valuing it at 1.10x FY26 P/ABPS. IIB is showing growth in core areas while navigating through challenges in its unsecured business. While the bank’s focus on retail deposit mobilization and digital and cost management initiatives will indeed translate into long term value creation, recalibration is a slow and steady process. Anticipated rate cut cycle will also put pressure on margins. We expect IIB to deliver ROE of 10.5% and 12.1% in FY25 and FY26

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131