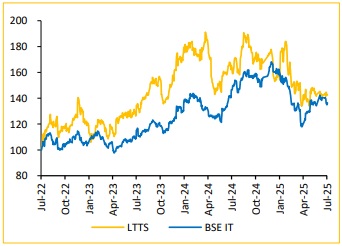

Add L&T Technology Services Ltd For Target Rs. 4,850 By Choice Broking Ltd

LTTS reported Q1FY26 performance in-line with consensus estimates

• Revenue for Q1FY26 came at INR 28.6Bn, up 13.6% YoY but down 2.8% QoQ (vs Consensus est. at INR 29.1Bn).

• EBIT for Q1FY26 came at INR 3.8Bn, down 0.6% YoY and 3.2% QoQ (vs Consensus est. at INR 3.9Bn). EBIT margin was down 228bps YoY but up 10bps QoQ to 13.3% (vs Consensus est. at 13.4%).

• PAT for Q1FY26 stood at INR 3.1Bn, up 0.7% YoY and 1.5% QoQ (vs Consensus est. at INR 3.1Bn).

Mixed Q1; Strong deal wins & Sustainability segment to drive H2 recovery: In Q1FY26, LTTS reported revenue of USD 335.3Mn, decline of 2.9% QoQ but an increase of 13.6% YoY in USD terms. In CC terms, growth was down 4.2% QoQ, highlighting short-term execution headwinds & weakness in Mobility & Technology vertical partially offset by strong performance in Sustainability segment. Deal wins remained strong; with company crossing USD 200Mn in Large deal TCV for the third consecutive quarter. Overall, the company reported a mixed Q1FY26 performance, with SWC declining sequentially due to seasonality, while Sustainability remained a standout, crossing USD 100Mn quarterly run-rate driven by high-margin large deals. Technology segment saw contributions from Intelliswift but faced margin pressure; Mobility stayed soft amid EV-related caution & pricing pressure, though a USD 50Mn deal win last quarter & Software Development Vehicle (SDV) demand offer modest upside. Despite near-term headwinds, we remain constructive on the medium-term outlook, supported by strong multivertical portfolio, rising AI-led demand, & robust deal momentum. H2FY26 is expected to drive recovery in revenue and profitability, backed by sustained USD 200M+ quarterly TCVs, deal ramp-ups, and Intelliswift integration.

EBITM target of mid-16% by Q4FY27E remains intact: In Q1FY26, EBIT margin stood at 13.3%, up 10 bps sequentially, despite headwinds from revenue decline, SWC seasonality, & Intelliswift integration costs. Management expects H2FY26 margins to improve, driven by broad-based growth, high-margin deal ramp-ups (especially in Sustainability), and SG&A leverage. LTTS reiterated its medium-term target of achieving mid-16% EBIT margin by Q4FY27. However, we anticipate a conservative margin expansion to 15.7% by FY27E.

View & Valuation: LTTS is well-positioned for a recovery in H2FY26, driven by strong large-deal wins, robust growth in the Sustainability vertical, and an improving margin trajectory. Continued execution on the Intelliswift integration and operating leverage from SG&A rationalization are expected to support further margin expansion. Moreover, a healthy pipeline and consistent large-deal TCVs enhance growth visibility. While revenue visibility & margin outlook have significantly improved, future growth depends on execution capabilities, we revise our PE multiple to 28x (from 30x earlier) to align with sector peers & have rolled forward our estimates to FY28E. We expect Revenue/EBIT/PAT to grow at a CAGR of 13.4%/16.5%/16.3% over FY25–28E. Consequently, we revise our rating to ADD, maintaining our Target Price of INR 4,850, based on the average of FY27E & FY28E EPS of INR 173.2.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131